Deep Dive: Fever-Tree ($FEVR)

Fever-Tree x Molson Coors: When a Mixer Becomes a Royalty Stream

The U.S. market was always a paradox for Fever-Tree: the biggest revenue driver, the biggest opportunity, but also the biggest missed potential. For a company that built one of the most recognizable premium beverage brands in Europe, its American ambitions never quite translated into similar economics. The problem wasn’t product or price. It was everything in between – freight costs, fragmented distribution, and a marketing model too lean for a country that demands physical presence on every shelf.

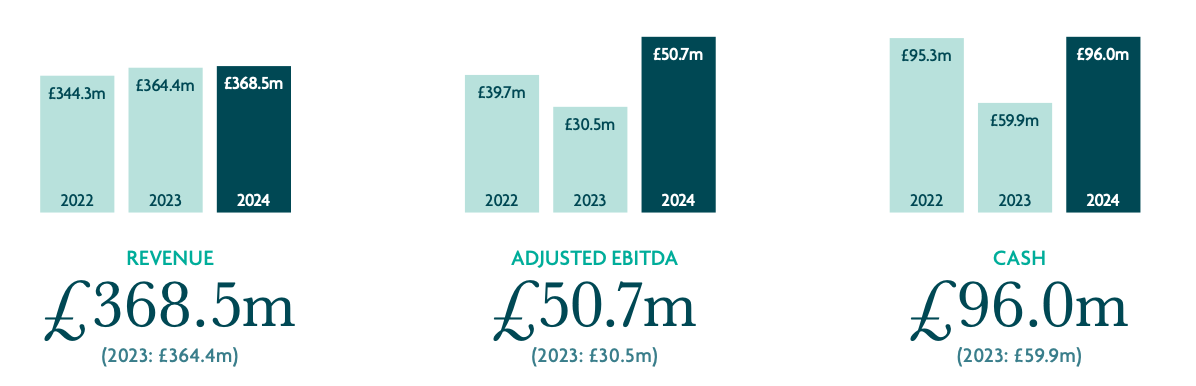

The result was a U.S. business that looked promising on the surface (£128 million in revenue in FY24) but felt structurally constrained underneath (roughly 1/3 of the margins posted in the rest of the group).

That bottleneck is now being blown open. In 2024, Fever-Tree announced what I’d call a transformational partnership with Molson Coors – one that doesn’t just tweak logistics but fundamentally changes a) how the company monetizes its award-winning brand and b) its ambitions on the North American continent.

On paper, it’s a distribution deal. In reality, it’s a transformational business model shift: Fever-Tree will no longer sell finished goods in the U.S. but instead license its brand to Molson Coors, collecting royalties on every bottle sold. Licensing is one of the most attractive business models in the world. And Fever-Tree’s royalty income even comes with guaranteed minimum payments through 2030, which effectively de-risks most of the profit contribution from Fever-Tree’s most important market.

The deal goes beyond money changing hands. Molson Coors will handle production, sales, and marketing in the U.S., giving Fever-Tree access to a distribution network that touches half a million accounts, runs 30,000 daily deliveries, and employs thousands of merchandisers. In return, Molson Coors takes an 8.5 % equity stake in Fever-Tree and acquires the company’s U.S. subsidiary for around $24 million – a sign that this isn’t a short-term tactical move but a structural partnership built to last.

It’s hard to overstate how significant this is. For the first time, Fever-Tree’s U.S. business will have scale, reach, and execution capabilities that match its brand equity. For shareholders, the implications are even more striking: a capital-light, high-margin, royalty-driven revenue stream that converts nearly all of its revenue (under the new model) into profits.

I’ve followed Fever-Tree for years, it always seemed too expensive, but the stock is also down significantly over the last five years (-60%) and this new partnership feels like the deal the company should have done long ago. It finally aligns incentives across the value chain and fixes what’s long been the company’s Achilles’ heel – distribution and “true” local presence.

More importantly, it turns Fever-Tree into something that looks less like a beverage manufacturer and more like a branded consumer IP business. It completely changes the economics. And who knows, maybe other geographic markets will follow (to be discussed below).

So in this post, I’ll dig into why this partnership redefines Fever-Tree’s economics, what the royalty model means for margins and justified valuation, and how parallels to other beverage success stories – like Celsius, Monster, or even Brown-Forman’s ready-to-drink partnership with Coca-Cola – help frame the opportunity. I’ll also unpack the U.S. guarantees through 2030, estimate what the royalty fee might realistically look like, and explore why the market might be underappreciating the stability this structure introduces.

Here’s a detailed breakdown of what’s covered in this post (roughly 12,000 words):

A full breakdown of the Molson Coors × Fever-Tree partnership – how it works, what changes operationally, and why it marks a structural turning point in the company’s business model.

An analysis of what Molson Coors gets vs. what Fever-Tree keeps – including exclusive rights, local production, and royalty economics that approach IP-like margins.

The mechanics behind the “partnership P&L”

A detailed exploration of the onshoring of U.S. production – how this resolves years of freight, glass, and logistics headwinds that weighed on margins.

The economic transformation of Fever-Tree’s U.S. business – moving from a low-margin importer to a high-margin royalty collector with guaranteed minimum profits through 2030.

A deep dive into royalty-based business models across consumer brands – what makes them so cash-efficient, how they compare to licensing plays in food and beverages, and what investors often miss when they just look at initial top-line declines.

Quantitative scenario modeling of the royalty income potential – including realistic bear/base/bull cases, back-solved from 2028 U.S. EBITDA guarantees.

A nuanced look at distribution as a moat

A detailed relative valuation analysis using peers showing where Fever-Tree fits on the growth/quality spectrum and why a rerating is plausible.

Exploration of strategic optionality beyond the U.S.: How the same royalty model could expand into Europe and RoW, unlocking similar margin structures without new capital & Why the Ready-to-Drink (RTD) category offers natural adjacency.

A balanced risk analysis covering both macro and execution aspects

The full analysis starts here:

The rest of this post covers the structure of the brokerage business. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more) and powerful investing frameworks. is just a click away. Upgrade your subscription, support my work, and keep learning.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.