Everyone Is Underweight AI!

Are We Still Underestimating the Biggest Shift of Our Time?

Note: The voiceover above is a custom-made, slightly adapted version of the blog post, edited for a smoother and more engaging listening experience. It’s one of the perks available to paid subscribers, as I’m always focused on adding as much value to my subscribers as possible. Enjoy!

“AI is growing faster and will be larger than any platform shift before, including the Internet, mobile, and cloud.” That’s what Nvidia CEO Jensen Huang said. Now, you never ask a barber if you need a haircut – but in this case, I think he might be right.

I've spent the last few months reading, listening, observing, and rethinking how AI might reshape the investment landscape. Not just in the obvious ways, but in the less visible ones too. And the more time I spend on it, the more convinced I become of a single idea:

Everyone is underweight AI.

That may sound like hyperbole. After all, hasn’t AI dominated every headline for over a year now? Don’t we already live in an era where Nvidia has joined the trillion-dollar club, where every software company has a “Copilot,” where self-driving cars are starting to scale across the U.S. – fast –, and where GPTs are pushing the limits of what machines can do?

Yes, on the surface, AI is everywhere. But when you look closer – at actual portfolio positioning – many investors are arguably still dramatically underexposed to the magnitude and velocity of this transformation.

It’s not just that the AI wave is massive. It’s that it’s accelerating. What’s unfolding isn’t a gradual trend, but a compounding force moving at a pace that’s hard to model, let alone price. Advances that once took a decade now show up in just one quarter. CapEx curves have gone vertical. Use cases are evolving in real time.

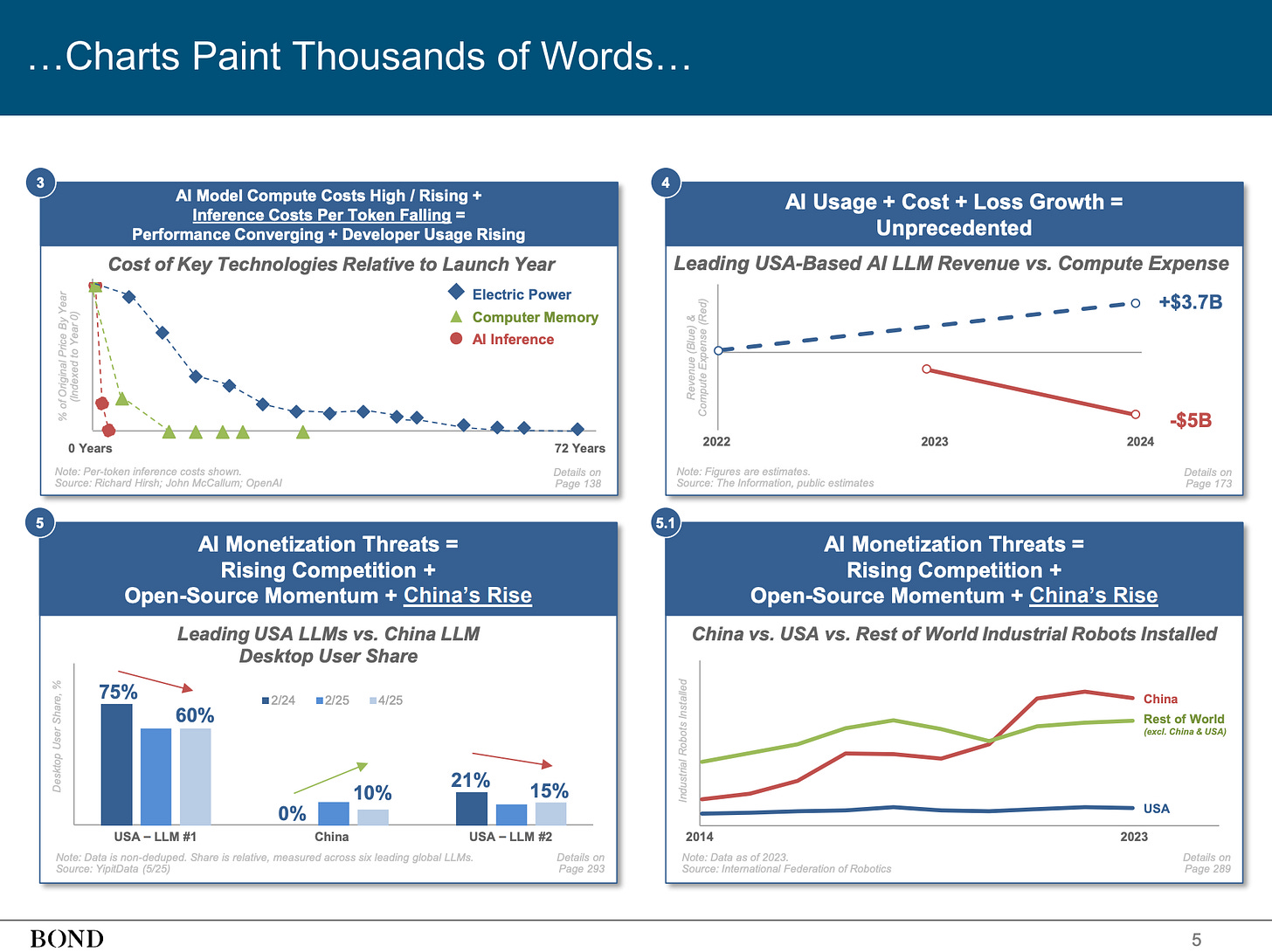

“Seem Like Change Happening Faster Than Ever? Yes, It Is”

from a report titled “Trends – Artificial Intelligence (AI)" by BOND

And yet, most portfolios still reflect a mental model from 2020 or earlier.

This post is my attempt to wrestle with what that means. Not just at a narrative level, but through the lens of capital allocation, disruption, and long-term investing strategy.

I’m not interested in hype cycles or clickbait predictions. I want to explore this with the mindset of a rational investor: Where are the risks? Where is the opportunity? How do you balance both?

And above all: How do you not get left behind?

Here’s what I’ll cover:

Why AI may be bigger than the internet, cloud, or mobile – and what the data says about adoption speed, infrastructure demand, and platform-level shifts

Why the speed of change matters more than most investors realize – and how it challenges traditional valuation, forecasting, and moat analysis

The macroeconomic and societal implications – from productivity gains to labor displacement to the potential arrival of post-scarcity economics

Two opposing investment mindsets – avoiding AI because of disruption risk vs embracing it for potential index outperformance, and how both can be valid

Why the physical world still matters – and how AI could amplify, rather than replace, legacy industries that are hard to digitize

How to express intelligent AI exposure in your portfolio – from first-order beneficiaries like chips and infrastructure to second-order plays in software and logistics

Why valuation discipline is more important than ever – and how to avoid the “electricity trap” or a 1999-style blow-up even when the underlying tech is real

How to think clearly when the future arrives too fast – and how mental models like the Lindy Effect, second-order thinking, and durability can help you navigate the noise

There’s a lot to unpack. So let’s dive in.

Before we dive back in, a quick note…

Want to invest in the one edge that compounds forever? Join hundreds of investors sharpening their thinking, avoiding mistakes, and discovering quality before the crowd. Subscribe to CompoundWithRene and become a better investor over time.

1. Something Bigger Than the Internet?

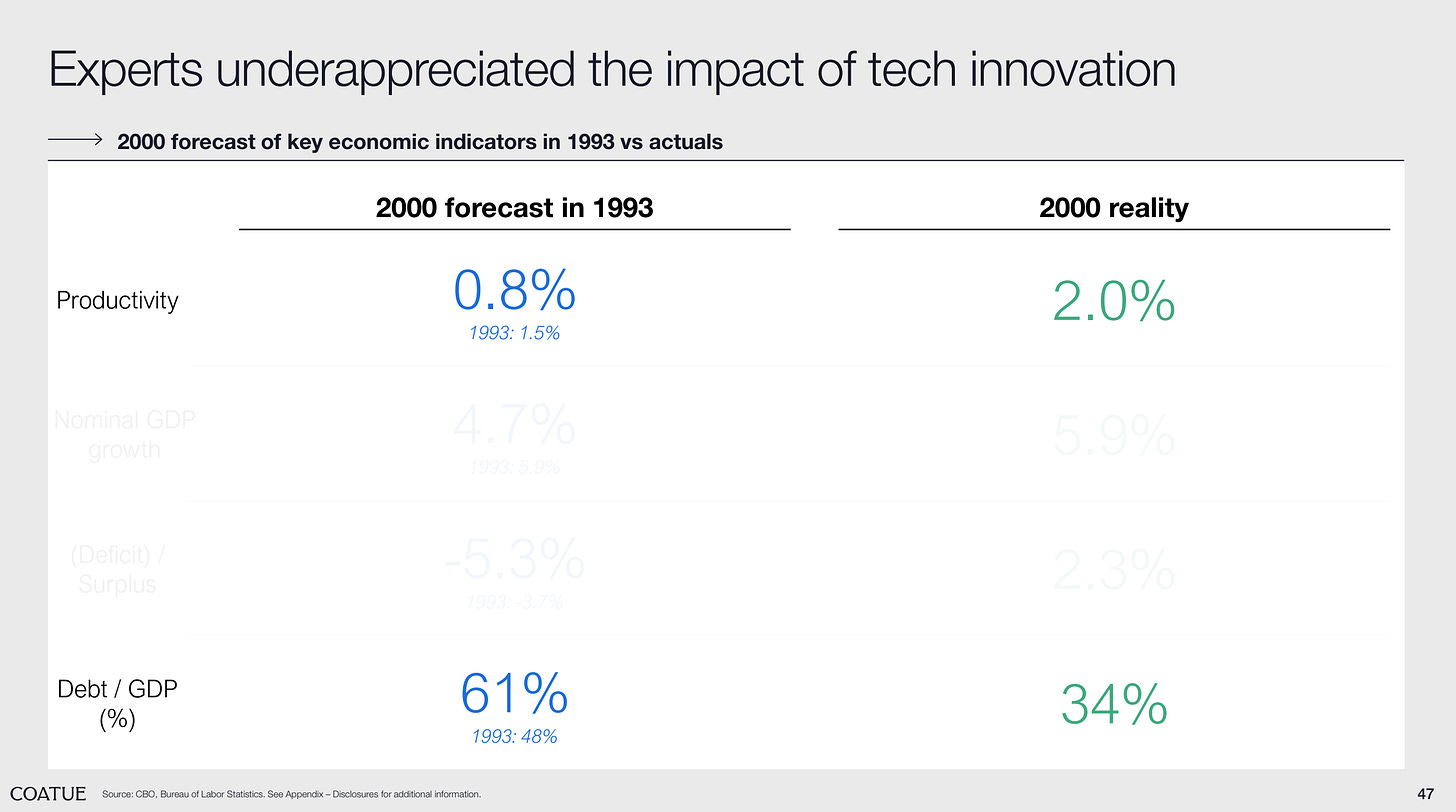

Every generation gets its big platform shift. In the 90s, it was the internet. In the 2000s, mobile. Then came the cloud. Each wave seemed unthinkably big in its time — and each one ended up even bigger than expected.

But when people say AI might be bigger than all of those combined, I don’t think they’re being hyperbolic.

Coatue, one of the more forward-thinking tech investment firms in public and private markets, asked a bold question in a recent investor deck: Will AI reach 75%+ of total US market cap?

They believe this isn’t just another wave – it’s a new technology supercycle, one that could completely reorder sector weights and reshape how capital is allocated across the market.

The signs are already here.

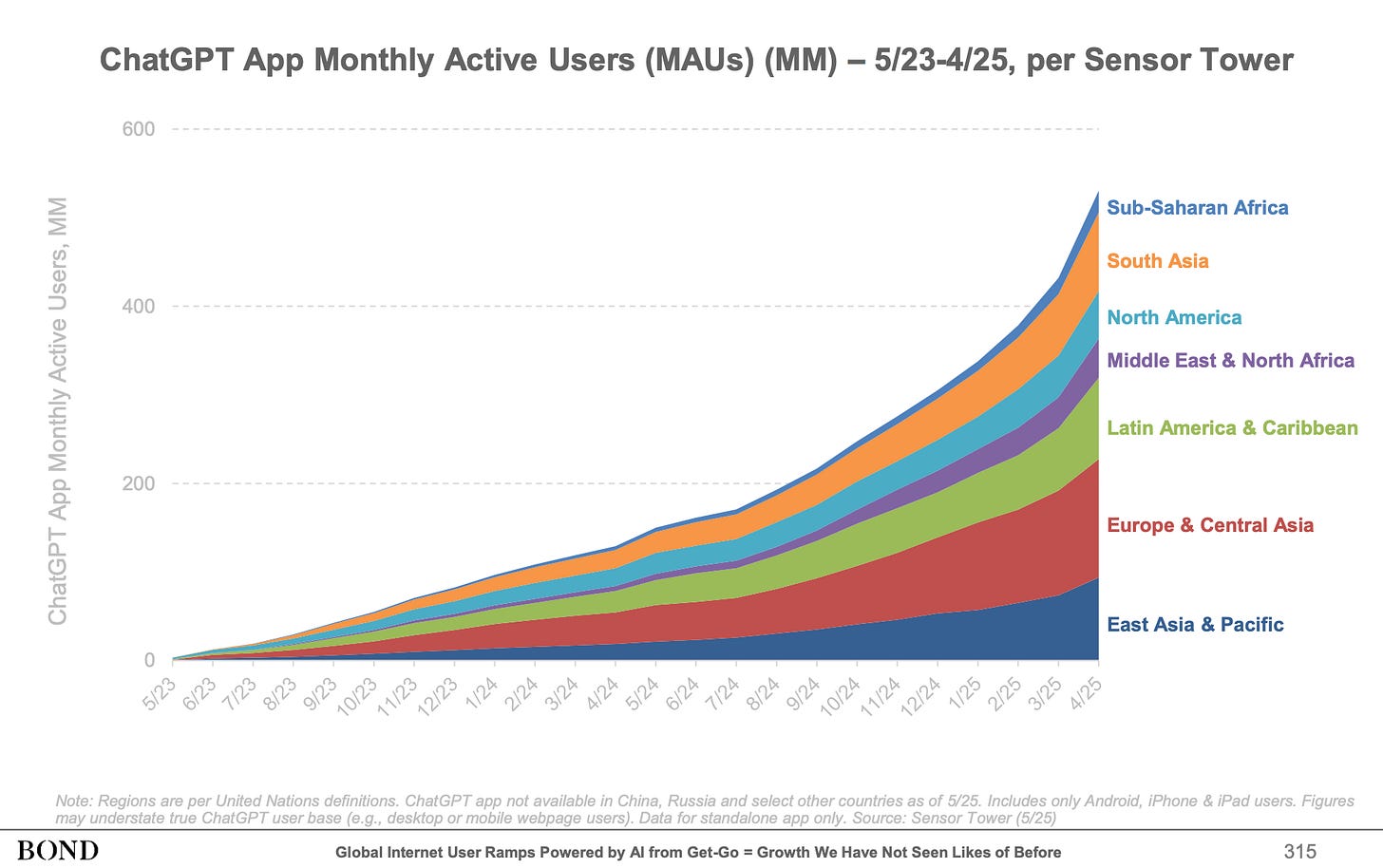

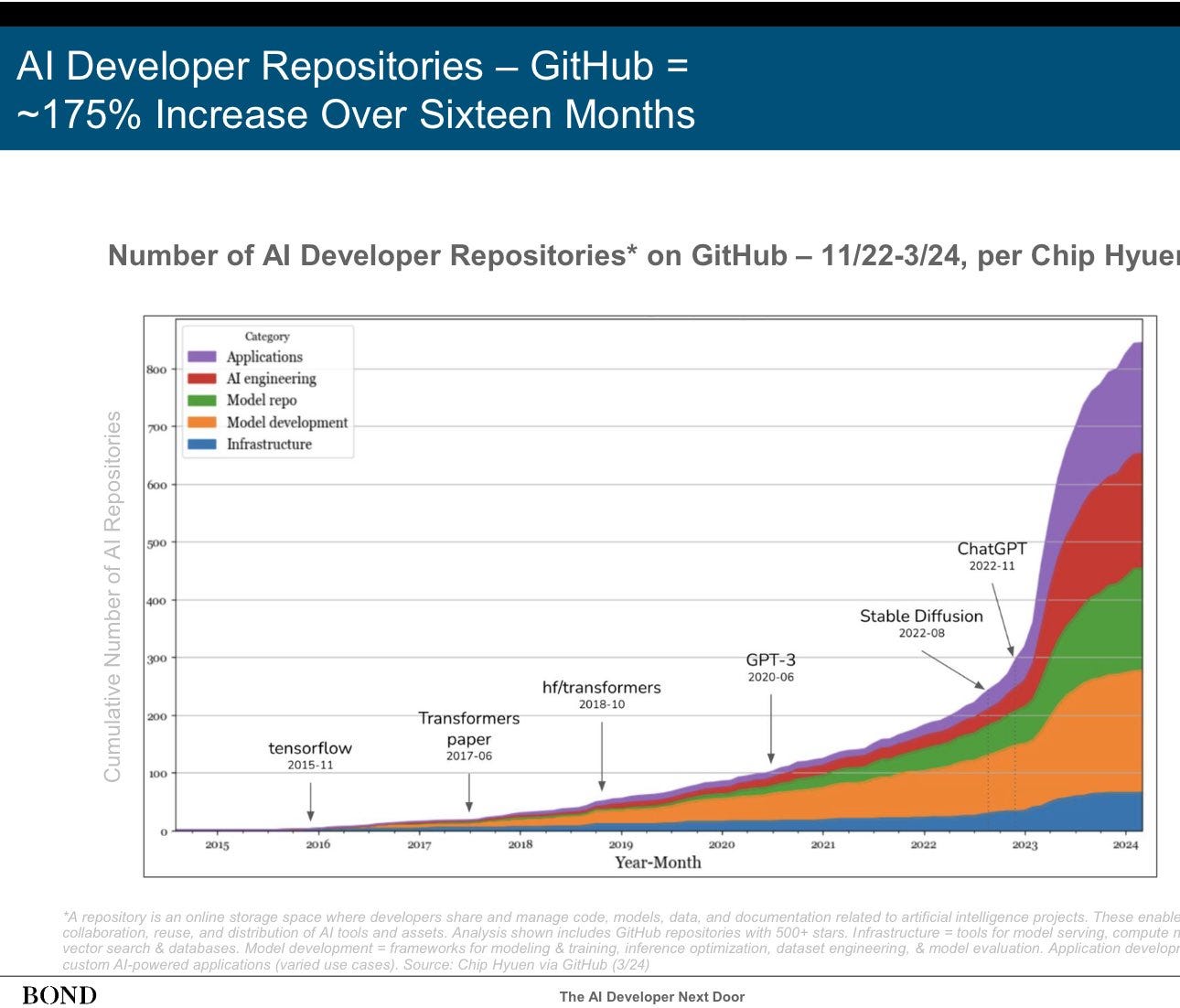

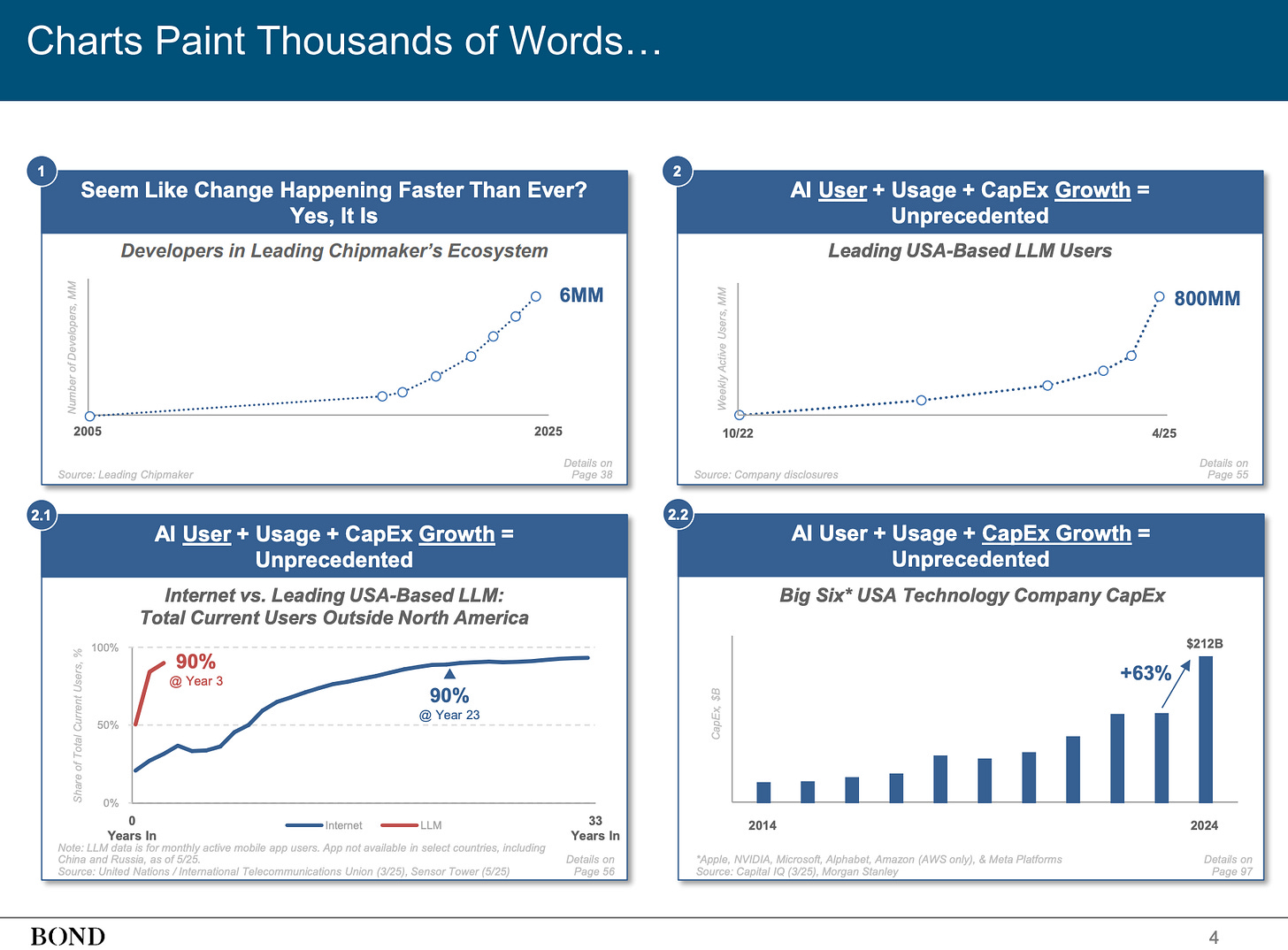

In May 2025, BOND Capital published a report titled “Trends – Artificial Intelligence (AI)” that tried to quantify what’s happening. It didn’t just rely on opinion – it brought charts, lots ot charts. AI adoption is exploding. For instance, the number of GitHub repositories tagged with AI is going vertical. CapEx is spiking. DigitalOcean reported that its AI business is up 160%. Inference costs – the cost of running large AI models – have dropped 99.7% in two years. Energy per token has fallen 105,000x over the past decade. Training costs for frontier models are now flirting with the $1 billion mark, and yet companies are still pouring in.

Microsoft’s CEO Satya Nadella underscored just how massive this is during the company’s recent earnings call:

“We processed over 100 trillion tokens this quarter, up 5x year-over-year... including a record 50 trillion tokens last month alone.”

He wasn’t just flexing on usage metrics. He also signaled that demand is outstripping supply. Microsoft expects AI capacity constraints beyond June. That’s despite adding data center capacity at full speed. For an enterprise as large and well-capitalized as Microsoft to run into supply-side limitations is telling.

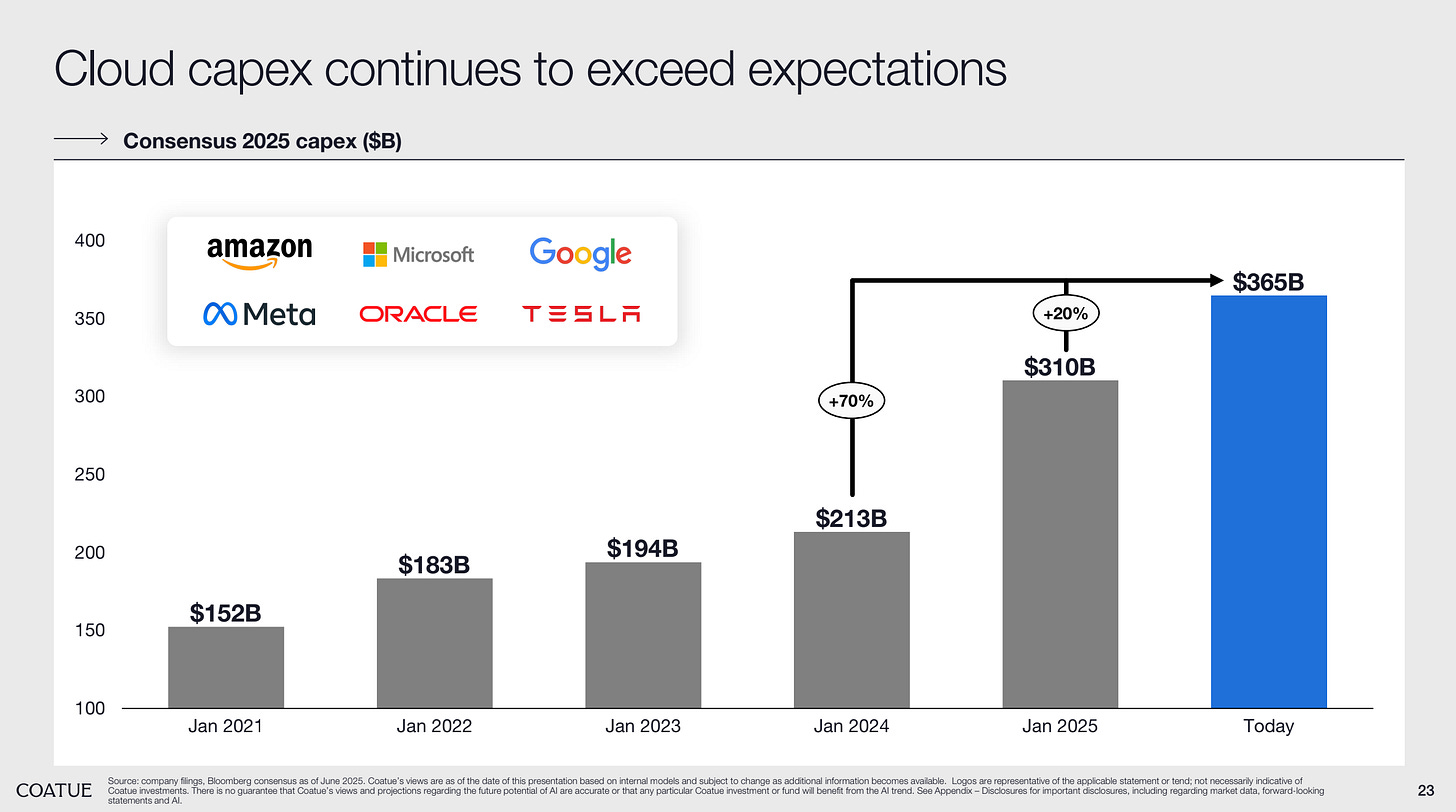

That brings us to CapEx. You’ve probably seen the headlines:

Amazon, Microsoft, Google, Meta, Oracle, Tesla – collectively planning $365 billion in infrastructure spend, a large chunk of which is AI-focused.

CoreWeave, a once-obscure cloud provider, is growing at triple-digit rates and raising billions to meet GPU demand. The scale here is unlike anything I’ve seen. These aren’t startups burning VC cash – these are possibly the emerging titans of the modern economy, and they’re all leaning into the same arms race.

Tech has outperformed all other sectors over the more recent past. And I’m not talking about shorter time period of 3-4 years – I’m referring to decades. The Nasdaq 100 has crushed other benchmarks over the last few decades. One dollar invested in the Nasdaq in 1985 is worth about $228 today. The same dollar in the Dow Jones? About $90.

Over the past 18 years, the Nasdaq’s 15.25% CAGR has been enough to beat the returns of almost any legendary investors. That’s not a knock on those investors – it’s a reminder that platform shifts reward index exposure to the right themes more than almost anything else.

As Tiho Brkan put it:

“It’s very difficult to beat the market, even for the greatest investors. Charlie Munger talked about this often.”

And that’s the mental model I keep coming back to. The “effort vs accuracy” tradeoff. Sure, you can spend countless hours building models, meeting management, and optimizing your portfolio. Or you can just buy a tech-heavy index and let the secular tide lift you. The internet era proved that. The cloud and mobile era reaffirmed it.

So what if AI is the next one?

What if all it takes to beat the market for the next 15 years is to be overweight AI?

Of course, it's not that simple. Valuations matter. Hype cycles exist. Some companies will go bust. But the larger point remains: we may be living through the early innings of a shift even bigger than those that came before – so big it’s hard to fathom for most.

And if that’s true, being underweight AI isn’t just a missed opportunity — it’s a liability.

2. Speed, Scope, and the Shock of Acceleration

Most investors understand the concept of exponential growth in theory. In practice, it breaks brains.

We’ve all seen the chart: the slow, flat curve that suddenly bends up and goes vertical.

That’s what exponential adoption looks like. But there’s a difference between seeing that curve and living inside it. And make no mistake – right now, we are inside it.

The AI transformation isn’t following the decade-long diffusion path of previous tech waves. It’s compressing that arc into years – in some cases, quarters. The scope of what's changing is enormous. But it’s the speed that makes it especially destabilizing.

Look at Microsoft again. Just one year ago, token volume on their platform was a fraction of what it is today. Now it’s over 100 trillion tokens per quarter. That’s a fivefold increase, and still accelerating. Nadella didn’t just mention rising usage; he warned of capacity constraints. Despite bringing data centers online at full clip, demand is still outpacing infrastructure. That’s not normal tech growth - that’s system strain.

Zoom out, and the picture gets even more extreme. According to BOND, AI inference costs have fallen 99.7% in two years (see chart in the top left).

Energy per token has collapsed by a factor of over 100,000 in a single decade. These aren’t marginal gains. They’re orders of magnitude. And they’re happening faster than the market’s ability to digest them.

That’s why this moment feels different. Investors are used to trendlines. They like time to run DCFs, test assumptions, build valuation frameworks. But when tech moves this fast, those models become outdated almost as soon as they’re built.

Most software businesses today still operate under mental models shaped by the mobile and cloud era – where market leadership endured, moats thickened, and cycles played out over years. AI doesn’t play by those rules.

The implication? Forecasting gets harder. Competitive dynamics become less stable. Valuation multiples become harder to justify – or harder to dismiss – no one really knows.

Because in an environment of extreme speed, what matters most isn’t where things are now, but how fast they’re changing.

This isn’t just theory. We’re watching it happen in real time with agentic AI – a term that’s starting to show up more often in earnings calls, pitch decks, and investor memos. Agentic models don’t just assist users, they take actions autonomously, execute workflows, and start to replace human decision-making altogether. It’s not about answering your query – it’s about handling the entire task from end to end. Search, reason, act.

That’s a profound shift. Over the last few decades, software was designed around one core assumption: humans are at the center of the workflow. Agentic AI breaks that. It introduces a new architecture where the agent becomes the actor. Morgan Stanley recently highlighted how this change could redefine the $630 billion software market. Companies that adapt – architecturally, commercially, and culturally – might thrive. The rest? They’ll get left behind.

And here’s where it gets tricky.

Speed breaks things. It breaks assumptions, it breaks incumbents, and it breaks portfolios built around slow-moving variables. In most investing environments, change is an opportunity. But when change becomes unmodelable, it becomes a threat to every traditional analytical tool we rely on. Moats look shallower. TAMs become squishier. Time horizons shrink. Duration risk shows up in places you didn’t expect.

That’s why I keep saying: everyone is underweight AI. Not because they don’t believe in it, but because most portfolios aren’t built for this kind of acceleration. The tools we use weren’t designed for a world where fundamental assumptions get rewritten every quarter.

So what do you do? That’s what I’ll explore next.

The best part is just ahead — unlock the full post to continue.

My paid posts are designed to be reference tools – not just interesting reads. Templates, checklists, case studies, valuation breakdowns – it’s all there. Unlock the rest of this post and the full archive with a paid subscription.