Deep Dive: Duolingo ($DUOL)

Duolingo vs. the Translation Machines – Will AI Kill Language Learning & If So, When?

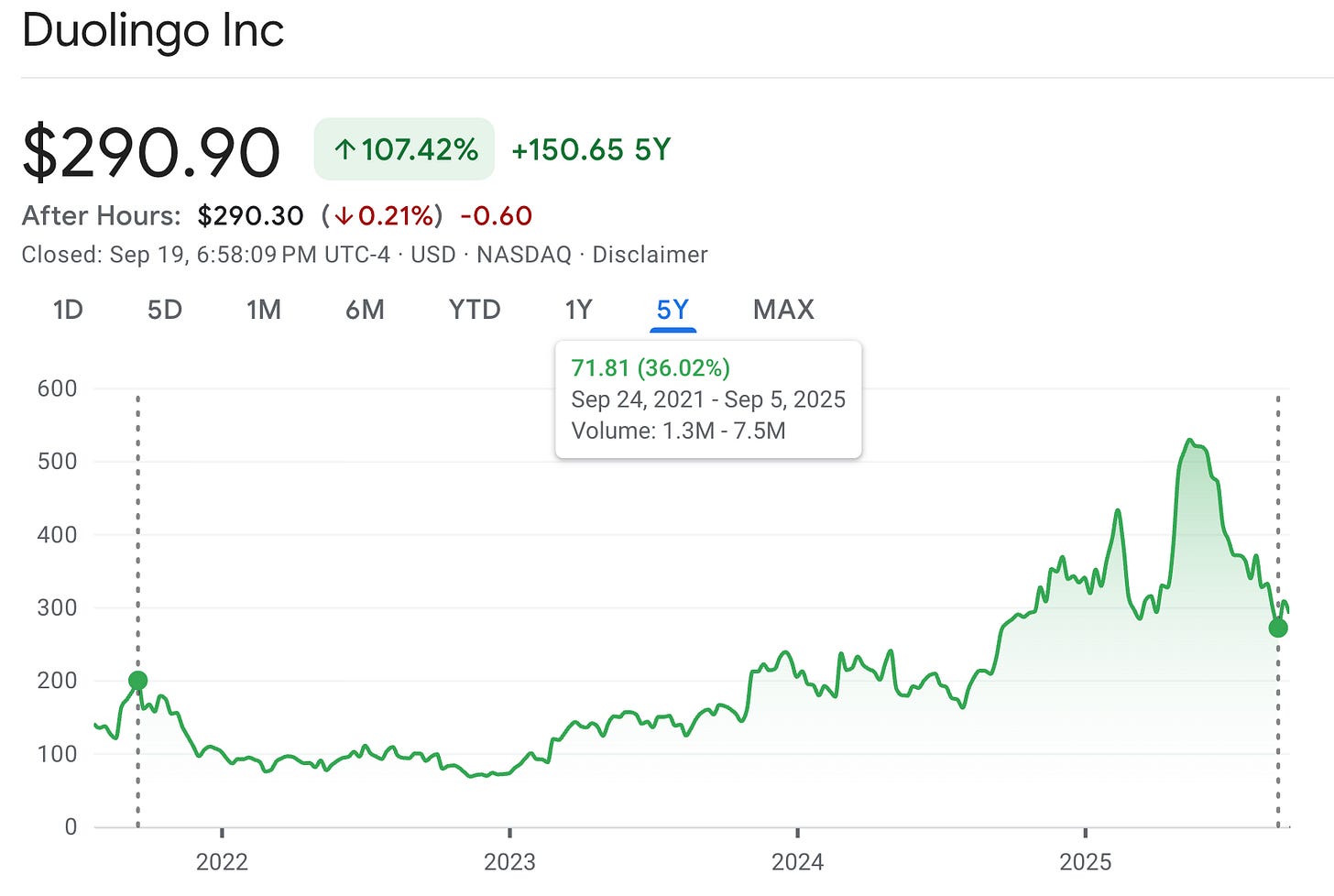

When I pull up a 5-year price chart of Duolingo, it’s hard not to notice how much of the story depends on where you set the starting point. At one end, you see a stock that has returned 107% – a decent run, outperforming the S&P by around 700 bps. But, if you adjust the timeframe by just a few days (see the chart below), the number drops to ~36%. That's the nature of endpoint sensitivity.

It makes for a great snap sentiment check, because it reminds me how quickly the market’s narrative around a name can swing from “untouchable compounder” (August 2021-May 2025 performance = 277%!) to “overhyped edtech” … and back again.

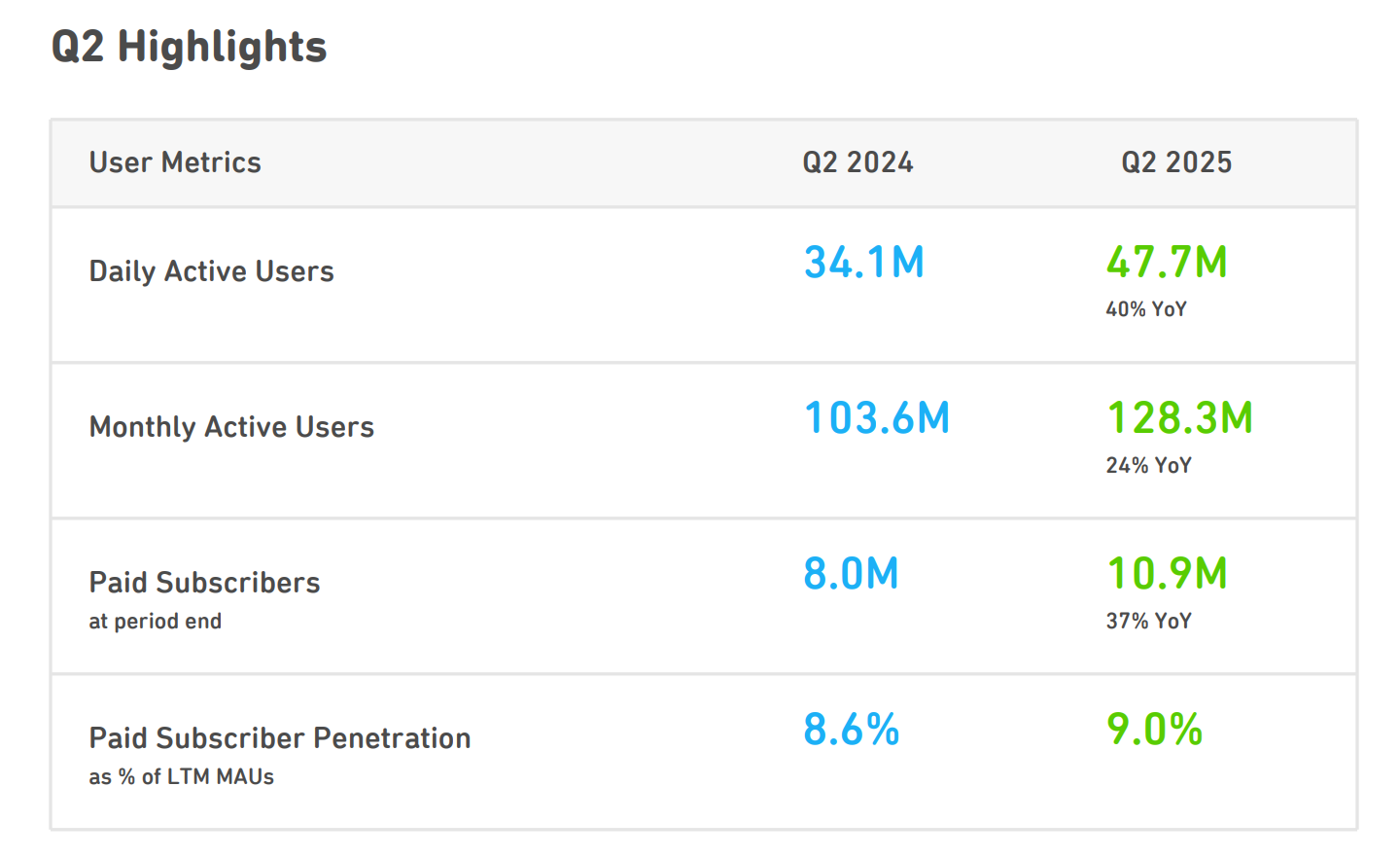

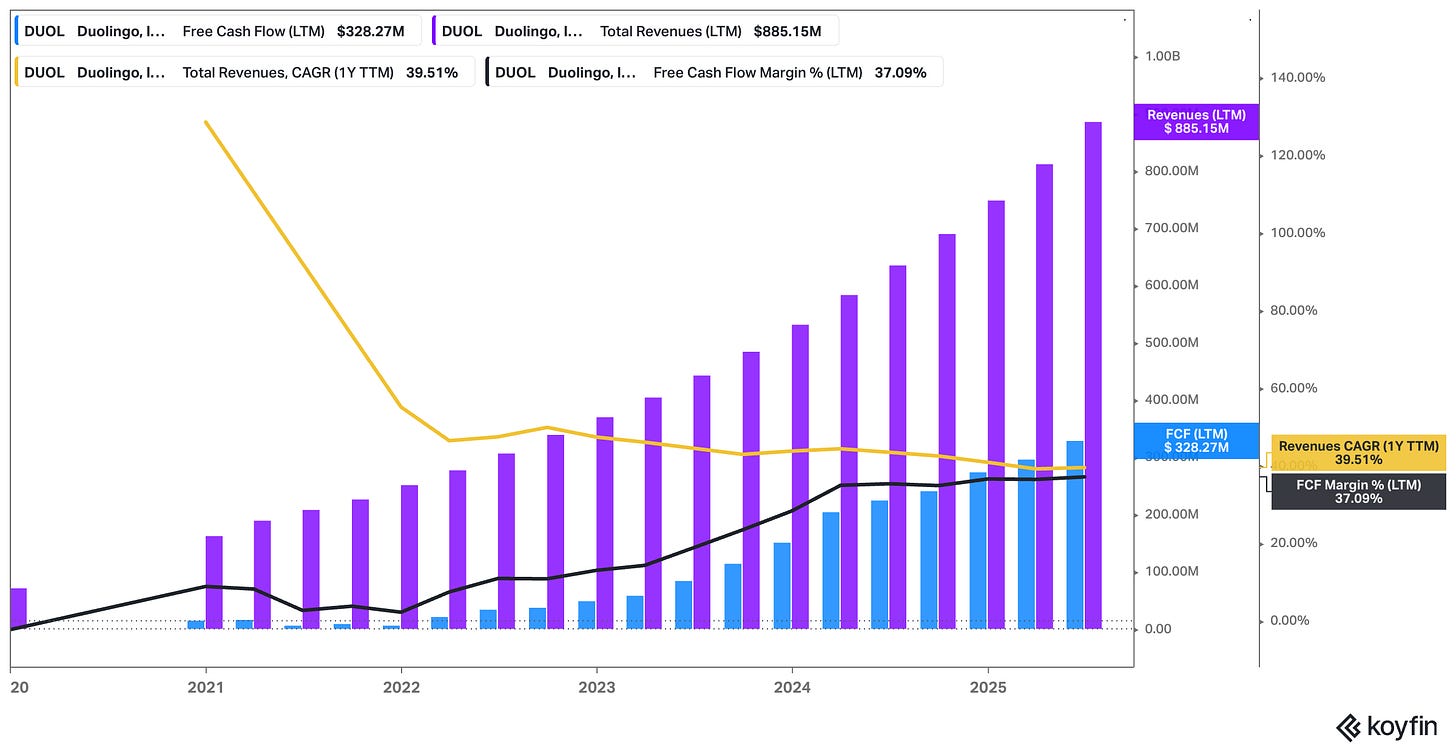

That’s exactly why Duolingo is back on my radar. By most operating metrics, the business has been firing on all cylinders – DAUs at record highs, revenue growth well into the double digits, free cash flow margins climbing steadily.

Yet the stock has pulled back meaningfully from its highs. That alone doesn’t make a stock interesting. But when the business and the stock diverge, it usually signals a point where deeper work pays off.

“We believe we’re still early in our user growth journey. We’ve delivered innovation while growing profitability—through strong performance across all subscription tiers, continued investment in our core product, and new subjects that help us increase engagement. We remain focused on building for long-term engagement and growth.” - Luis von Ahn, Co-Founder and CEO of Duolingo

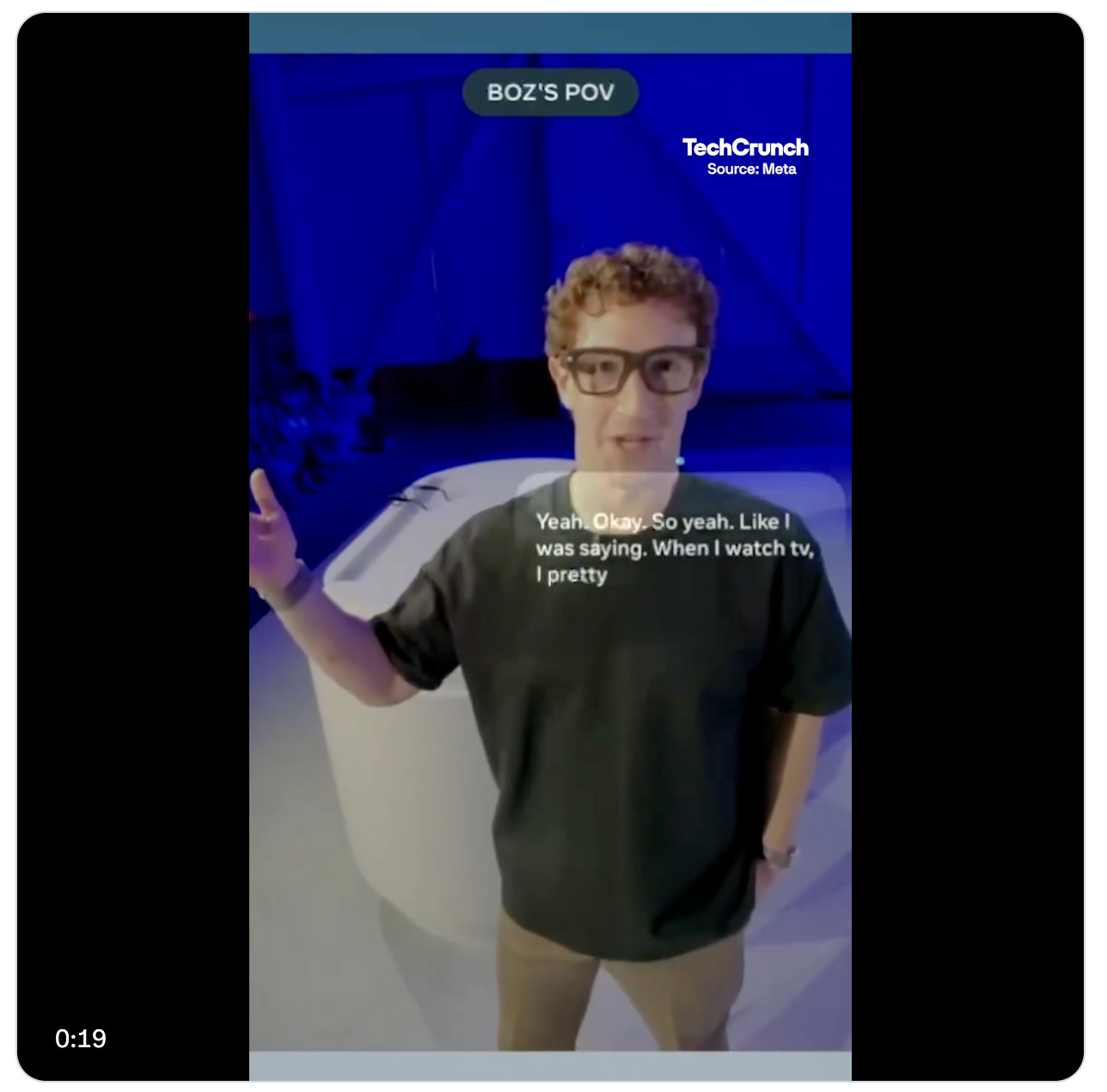

For me, the hook came from Meta Connect 2025. Watching the live demo of their AI-powered translation glasses, I couldn’t help but think about the existential bear case I’ve carried for Duolingo for years: what if the very need to learn another language gets eroded away by technology? That’s not the same as competition – it’s problem shrinkage. If AI makes language barriers melt away in real time, then what happens to a company whose entire existence is tied to helping people cross those barriers the old-fashioned way, through practice and study?

The thing is, the Meta Connect demo didn’t quite deliver on that fear. In fact, it may have pushed the threat timeline further into the future. Which is exactly why now feels like a moment worth re-examining Duolingo. Not to dismiss the bear case – far from it. But to test how durable it really is, what the company has built to defend itself, and whether the valuation makes sense once you frame the disruption risk realistically rather than hypothetically.

That’s the journey I want to take you through in this post: start with the default bearish lens I apply to Duolingo, stress-test the assumptions behind it, dig into what Meta’s latest moves actually mean, and then see how the bullish arguments stack up. Along the way, I’ll look at Duolingo’s brand, its data advantage, its optionality beyond language learning, and finally sketch out a few scenarios for how this could play out.

Paying subscribers get access to the entire post (around 5,500 words) featuring:

My default bearish filter – applying Bill Ackman’s principle of avoiding businesses exposed to uncontrollable extrinsic risks; why language learning feels like a fragile beachhead; parallels to Tesla’s robotaxi pitch and the risk of “problem erosion” rather than competition.

Meta Connect 2025 as a reality check – what Meta actually showed with its translation demo, what the “hiccups” signal Duolingo investors, and how user anecdotes (e.g. Mostly Borrowed Ideas) confirm reliability challenges; why the timeline for disruption likely shifted out.

What true disruption would require – four pillars; plus the human and market frictions of privacy, cost, comfort, and social acceptance.

The case for Duolingo – founder-operator intensity, a brand that has become synonymous with its category, behavior design that engineers habit formation, proprietary data at scale, monetization lanes (subscriptions, ads, English Test, future adjacencies), and why the market may be overestimating disruption.

Proprietary data in an AI world – how Duolingo’s granular learning data could become/remain a moat and a growth engine; potential applications

Scenario analysis – probabilistic timelines for when AR-driven translation could hit mainstream

Before we dive into the analysis …

Paid subscriptions don’t just keep this blog alive – they help me produce the best-possible content I can think of. No ads, no fluff. Just high-quality, independent research for long-term thinkers.

Your support helps me go deeper, write better, and serve smarter investors like you. If you value clarity in a noisy world, subscribe.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.

My Default Bearish Filter – Extrinsic risk and the shrinking-problem thesis

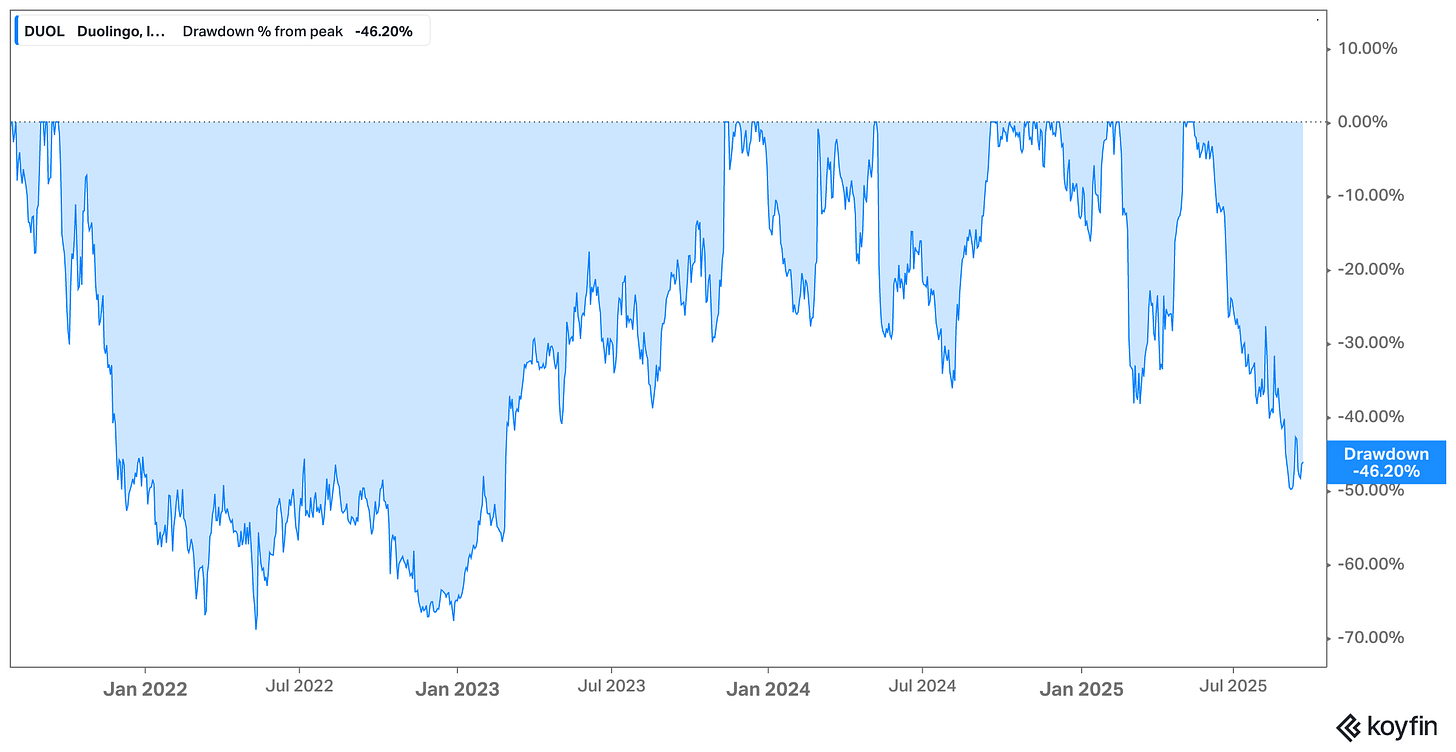

Not too long ago, Duolingo started popping up all over my timeline again. The stock had gone through a major drawdown – more than 40%, and at one point it even touched the –50% mark. The trigger? A wave of AI concerns. That’s when I shared some of my thoughts on why Duolingo doesn’t quite pass my snap judgment filter on X.

To be fair, the snap-rejection of Duolingio wasn’t based on the exact process I usually apply in my initial snap-judgment screenings. It was more of a gut check rooted in one of Bill Ackman’s principles:

Look for businesses with limited exposure to extrinsic risks outside their control.

That’s the filter I apply almost instinctively now. And Duolingo doesn’t clear it. The probability of the company being completely disrupted isn’t low enough for my liking – in fact, I’d want that probability close to zero.

So that’s not a great starting point.

Here’s why. The bull thesis for DUOL 0.00%↑ often sounds less like a language-learning app story and more like a bet on the company’s ability to design digital experiences that “engineer” the human brain into learning something new. If you view it that way, the pitch starts to resemble the Tesla robotaxi narrative. For Tesla, the transformative promise is autonomous driving – a product that doesn’t yet exist at scale, but that supposedly makes today’s car sales almost irrelevant – that’s been the thesis surrounding Tesla for many years now.

For Duolingo, the parallel would be escaping language learning altogether and reinventing itself as a foundational player in adaptive education. That’s the moonshot upside. But like Tesla’s robotaxi pitch, it’s not proven. It requires a leap in capability, product-market fit, and adoption that no one can guarantee.

The problem is that language learning itself feels like a fragile beachhead to build on. AI, even in its current imperfect state, is already starting to erode the need for traditional language skills by making translation faster, cheaper, and more accessible.

Imagine a world where high-quality translation is so seamless and ubiquitous that you no longer think twice before engaging across languages. In that scenario, the old-fashioned reason to grind away on a language app shrinks dramatically.

Of course, there will always be people who want to learn a language for cultural, emotional, or professional reasons. Language is identity, not just utility.

But if AI becomes an invisible layer that removes language barriers in real time, then the total addressable market for deliberate language learning will be far smaller than the bulls assume – and far smaller than it is today.

So that’s not a problem of competition Duolingo could face. That’s problem erosion. And that distinction should give investors pause.

This is the core tension I see in Duolingo. Its long-term upside depends on escaping the confines of language learning – its current core business – before AI commoditizes it. In other words, it needs to reinvent itself as a more general “learning optimization” platform. Maybe its brand, data, and behavioral design expertise give it a head start. Maybe not. I’m not sure about this. If it succeeds, the future could look radically different from today’s business model.

If it fails, the risk is that it builds an elegant bridge to a destination that fewer and fewer people need to reach.

I should stress here that this was always an outside-in view. I never dug deep into the company when I first formed these thoughts. But the framing stuck with me and made me pass on the idea quickly.

Enter Meta Connect 2025 …

Meta Connect 2025 – A reality check on live translation and timelines

I went into Meta Connect with the same nagging thought I laid out earlier: if live translation becomes good enough, cheap enough, and ubiquitous enough, the rationale for learning a language on purpose starts to wobble.

So I watched the keynote specifically through that lens. What I saw didn’t eliminate the long-run threat – but it did push my disruption timeline to the right. The gap between “captioned assistance” and “frictionless, expressive two-way translation in the wild” is still meaningful. That buys time, and time matters a lot for a company like Duolingo.

First, the keynote stumbled. More than once. The flagship Ray-Ban Display demo misfired on stage, with Meta’s team initially blaming Wi-Fi before subsequent coverage clarified the failures weren’t simply connectivity gremlins. The neural wristband interaction that was meant to answer a live video call didn’t trigger as expected, and several on-stage flows felt brittle rather than inevitable. Meta’s CTO later called them “demo failures” rather than “product failures,” which is fair – but for our purposes as investors, the signal is that even controlled conditions weren’t smooth. That tempers expectations about how robust this will feel out in the messy real world.

Second, what worked most reliably on stage – and in Meta’s polished promos – is better described as “live captions” with select translation rather than fully symmetric, natural, real-time interpretation.

The product page and launch blog lean into “live captioning” and “translate select languages in real time,” with current help-center materials listing English, Spanish, French, and Italian. That’s useful. It’s not yet a Star Trek universal translator. The lived experience looks like text appearing in your lens – think subtitles for speech directed at you – rather than an ambient layer that seamlessly handles nuance, tone, and timing across any environment – comparing Meta Connect 2025 to 2024 felt like a step backwards.

Now, none of this means the device isn’t impressive. Reviewers who got brief hands-on time came away intrigued by the display, and Meta’s ambition is obvious: put an always-there assistant on your face and give it a control surface via an EMG wristband. But ambition isn’t adoption. The price point for the display model is fair, but the value prop hinges on AI that still feels hit-or-miss in daily use, and even Meta-friendly observers called out the keynote hiccups.

My read is that Meta is inching toward the right product thesis, yet the delta between keynotes and day-to-day reliability remains non-trivial. That delta is your timeline buffer if you’re underwriting Duolingo.

Mostly Borrowed Ideas shared his perspective in his faily newsletter, and I think it is helpful here because it comes from a heavy daily user of Meta’s glasses – which I am not. He’s bullish on the form factor for music, calls, and capturing moments – and he’s candid that, so far, the AI layer has been hit or miss. He specifically called out that the live demo failures resembled the inconsistencies he has experienced too. Importantly, he still thought the “live subtitle” demo was cool and potentially life-changing for travel once it matures. That combo – practical enthusiasm with grounded skepticism – is exactly how I’m framing the opportunity myself. It’s not that real-time translation won’t get good. It’s that getting to “good enough for everyone, everywhere” takes more years of engineering and iteration than headline clips imply.

There’s also the human layer that rarely fits in a spec sheet. You’re asking people to wear cameras and displays on their faces in social spaces – cafés, classrooms, trains. Privacy norms, signage translation in sensitive contexts, and bystander discomfort all slow diffusion. Even with brighter LED indicators, watchdogs argue trust hasn’t been solved. Social acceptability is a stubborn adoption gate. If that gate stays half-closed, usage concentrates in travel and niche workflows rather than becoming an all-day, every-interaction utility that truly erases the need to learn. That again stretches the timeline.

Put differently: Meta showed some progress toward captioned assistance on glasses; it did not show that expressive, low-latency, environment-robust translation is here for mainstream, high-stakes interactions.

There’s a ladder to climb – device comfort and battery life, microphone arrays that cope with wind and din, models that preserve intent and affect, UX that recovers gracefully when things go wrong.

You can feel the direction of travel. You can also feel how many failure modes remain before you’d trust this in, say, a job interview or a medical appointment, which is the kind of bar that makes language learning obsolete for broad swaths of the population.

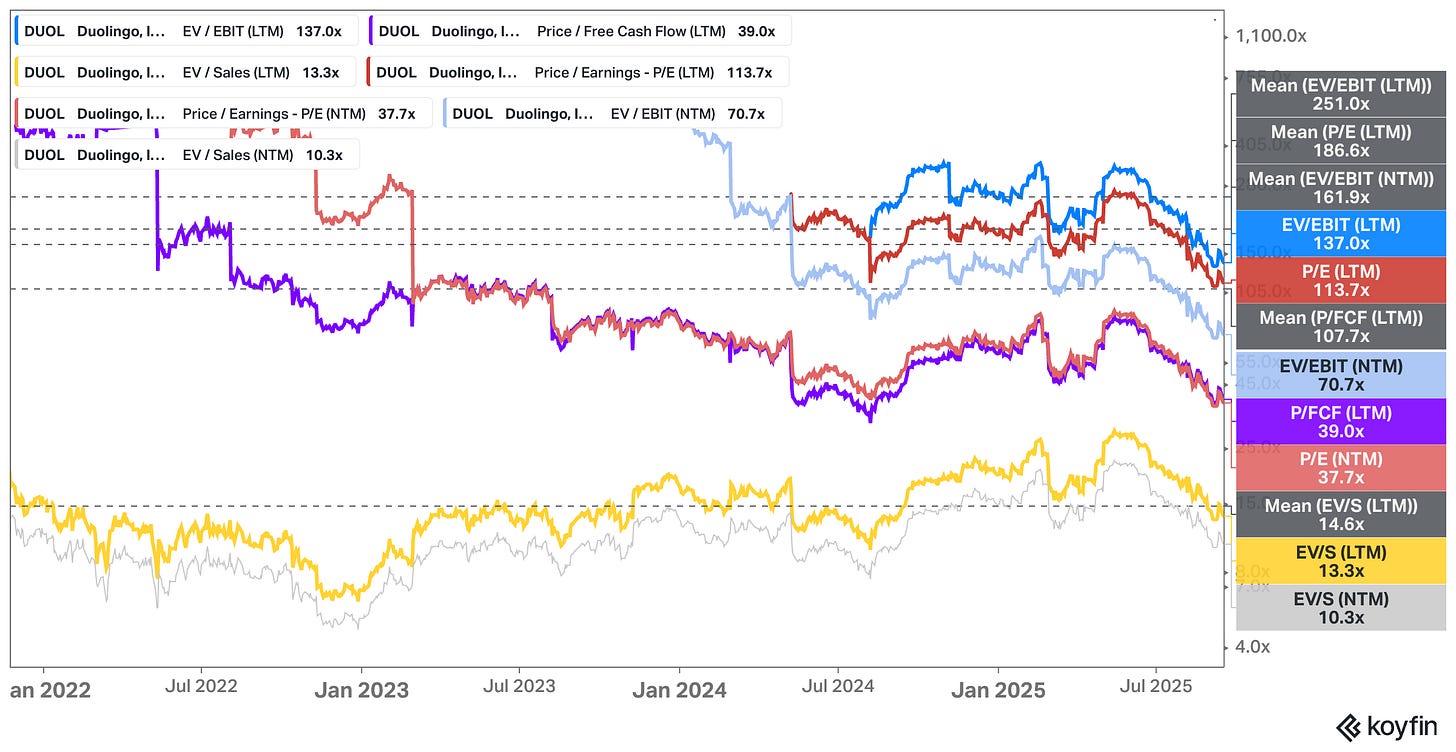

For Duolingo, that nuance is of course relevant. If the threat were imminent, you’d demand a steep discount to any growth multiple – and Duolingo’s multiples seem quite demanding.

If however the threat is material but years out – and gated by hardware adoption, social norms, and ML reliability – you have room to ask a different question: how much time does Duolingo have to deepen its moat, diversify its earnings mix, and repurpose its data and product DNA into adjacent learning domains?

That’s where the analysis heads next.

If you’re following my logic, Meta Connect didn’t invalidate the bear frame I opened with. It reframed it. Live translation still looks inevitable in some form. The keynote suggested it won’t be uniformly reliable, socially frictionless, and widely adopted as an all-day utility in the near term. That pushes my disruption clock out a few ticks – enough to reassess Duolingo’s next moves rather than writing a eulogy in advance.

What True Disruption Would Require – Hardware, latency, and human factors

Meta’s Connect demo leaned heavily on “live subtitles.” For all the attention it got, that form of translation isn’t close to what I’d call an existential risk for Duolingo.

If I’m reading subtitles floating in my lens, I’m still working harder than if I simply spoke and understood the other person directly. Whole dimensions of communication vanish the second you reduce conversation to text:

body language that gets ignored because your eyes are glued to the captions,

intonation patterns that carry emotion and intent,

pauses that reveal hesitation or confidence,

stress and rhythm that differ across languages.

These subtleties are where so much of actual understanding lives. Strip them away and you’re left with words, but not conversation.

That’s why the bar for true disruption is so much higher than what we saw on stage (again, I’ll point you to the video linked above).

In my mind, four big pillars have to fall into place before we’re in a world where live translation feels good enough to materially shrink the need for deliberate language learning.

Pillar 1: Broad mass adoption of AR glasses

Phones are already universal. Glasses aren’t. For live translation to work as a default layer of communication, AR glasses need to reach the ubiquity of smartphones – worn everywhere, all the time, not just in niche settings. That means form factor, price, style, and battery life all have to hit consumer thresholds. Right now, most devices are still bulky, short on power, and socially awkward in everyday contexts. Until adoption crosses into “everyone has them,” translation-by-glasses will be useful in some contexts but not a substitute for the deep utility of knowing a language.

Pillar 2: Frictionless audio with environmental robustness

The audio quality of Meta’s Ray-Bans is already surprisingly good. But that’s in relatively friendly conditions. For translation to feel like a natural conversation, it has to work in cafés with clanging cups, on noisy subway platforms, in windy outdoor settings. That requires not just good microphones but robust noise cancellation, beamforming, and the ability to isolate voices in chaotic soundscapes. Without it, you’ll constantly face broken snippets and half-understood exchanges. And that’s before you get into the awkwardness of eavesdropping worries – another barrier to mass adoption.

Pillar 3: Capturing meaning and affect, not just words

Language is more than literal meaning. It’s intonation, hesitation, sarcasm, emotion. AI has made big strides in large language models and also in AI voice capabilities (check out what ElevenLabs has to offer), but getting those subtleties right in real time is an entirely different problem.

Translate the words but miss the sigh or the edge in someone’s tone, and you miss the conversation’s heart. Doing this across dozens of languages with cultural nuance intact is even harder. For true disruption, AI needs to be able to capture these micro-signals and convey them naturally, either through expressive speech synthesis or incredibly fast contextual paraphrasing.

Pillar 4: Latency so low it disappears

Translation can’t just be “pretty fast.” It has to feel immediate. If you’ve ever played a fast-paced video game, you know that humans notice differences between 120 fps and 240 fps. That’s imperceptibly small on paper but obvious in practice. The same logic applies here. A two-second delay feels interminable in conversation. Arguably, even a 200-millisecond lag makes back-and-forth feel stilted. What Meta showed on stage was closer to watching a livestream with buffering. Until translation is effectively real-time – instant enough that you don’t consciously register the delay – it won’t replace the need for language learning.

And even if those four pillars fall, the human and market frictions remain. Wearing cameras on your face is a privacy minefield. Battery life and heat management are still unresolved engineering challenges. Cost has to come down from “early adopter luxury” to “daily utility” – although to be fair, the price of Meta’s AR glasses is already pretty affordable and likely subsidized by Meta’s multi-billion AI commitments.

Comfort and style can’t be afterthoughts – nobody wants to walk around looking like they’re in a sci-fi pilot episode. App ecosystems will need to emerge that make glasses indispensable for more than just translation, because otherwise, adoption stays niche. Social acceptability is maybe the hardest nut to crack: people need to feel comfortable having conversations with someone who’s wearing them, and right now the baseline is skepticism at best.

All of that stacks up to a high hurdle rate for disruption. That’s why I’m less worried by the “live subtitles” version Meta showed. It may accelerate adoption in travel or short-term settings, but it doesn’t yet erase the incentive to learn a language for richer, more authentic human interaction. For Duolingo, that gap is time – time to innovate, diversify, and entrench itself deeper before these dominoes fall one by one.

The Case for Duolingo – Brand, behavior design, monetization, and valuation

What made me look at Duolingo more carefully one more time wasn’t Meta’s keynote but a short WhatsApp exchange with MoneyFlow Research. I respect his investing chops – go and read his Wise deep dive! –, so when he mentioned that he was actually starting to like what he saw in Duolingo after doing sort of a shallow dive, I had to stop and ask myself whether I was dismissing the company too quickly.

Money Flow Research put it bluntly: “Kind of surprised that I’m liking what I see for DUOL so I’ll be digging in further. On the surface, it’s possible that the big decline is the market overestimating impact of live translation and AI on Duolingo. CEO seems like a founder owner operator, has a big audacious goal/mission, app as big Data advantages, gamification keeps people hooked, other lanes for monetization possible etc. Competition is there but Duolingo really dominates. It has a fantastic brand and marketing machine, strong free cash flow growth.”

That made me pause. I’ve been approaching the company through the lens of fragility and extrinsic risk. But the counterpoint here is that maybe the market is anchoring too heavily on AI-driven obsolescence and underestimating what Duolingo has actually built.

Start with the founder-operator angle. Luis von Ahn has been steering this ship from the beginning, and it’s clear he’s not just a caretaker CEO. He has that combination of mission-driven zeal and commercial pragmatism that investors often prize. His audacious goal has always been bigger than “teach Spanish vocabulary.” It’s to leverage technology and behavioral design to make education accessible, engaging, and effective at scale. That founder intensity often manifests in capital allocation discipline, long-term thinking, product focus, and an unusual ability to spot adjacencies.

Then there’s the brand. Duolingo has achieved something rare: it has become synonymous with its category. Ask someone to name a language-learning app and odds are they’ll say Duolingo first – I’m a language teacher and even I could only name 1-2 serious competitors. The green owl has become a cultural icon, memed endlessly, and embedded into the digital zeitgeist in ways no competitor has managed. In a space where churn is a constant risk, that kind of brand power acts as a gravity well – drawing people back even after they lapse.

The behavioral design is another underappreciated moat. Duolingo doesn’t just provide content – arguably, the app’s algorithm isn’t necessarily the best to actually learn a language –, it engineers habit formation. Streaks, reminders, gamification, little dopamine hits – all of it makes the app sticky in ways a simple content repository never could.

This matters when you think about how AI might change the landscape. Even if real-time translation becomes viable, there will still be millions of people motivated to learn for reasons beyond pure utility. Culture, career mobility, relationships, intellectual challenge – these don’t go away, but yes, the TAM would shrink.

“I don't believe any AI LLM will stop people from WANTING to learn languages.” - A user in the comment section on X

But when those describe above go looking for a tool, the one engineered to keep them engaged is likely to win.

Money Flow Research’s point about data is critical too. Maybe it is the most critical one. Duolingo’s corpus of user interactions is enormous. Billions of exercises completed, pronunciation attempts, error patterns – all of it feeding a feedback loop that allows the company to refine content, personalize pacing, and improve outcomes. In an AI world where models are only as good as their training data, owning that corpus gives Duolingo optionality to build adaptive systems that are hard to replicate. It’s not just “they have data.” It’s “they have proprietary, granular, labeled learning data at a scale few can match.” That’s a potential moat.

On monetization, the company has shown it can convert engagement into revenue without alienating its base. The premium subscription model is scaling, advertising is a meaningful add-on, and newer lanes like the English proficiency test (and potentially math or literacy offerings) create diversification. Free cash flow growth has been strong – this isn’t an edtech burning cash to chase TAM. It’s a business with improving unit economics and optionality.

That leaves valuation. At ~13x sales, this isn’t cheap, especially if you carry the kind of existential disruption risk I outlined earlier. But the bull case reframes that multiple as buying growth with optionality attached. If live translation remains a niche or slow-moving threat, then Duolingo is still looking at years of double-digit revenue expansion, growing free cash flow, and the potential to layer on adjacencies. That might justify the multiple, or at least explain why the market hasn’t thrown the stock into the edtech bargain bin.

So the bull case is clear: founder-led intensity, a category-defining brand, habit-forming product design, proprietary data, monetization expansion, and a market that may be overestimating disruption.

The Power of Proprietary Data in the Age of AI – Moat, optionality, and what I’d build next

A quick detour before we map potential future scenarios and their timeline. I already brought up Duolingo’s data advantage. Let’s discuss the importance of data in the age of AI.

When I talked with Andrew Letendre about Samsara, another world-class company, the conversation kept circling back to a simple observation: in an AI-first world, the raw material that compounds is not lines of code but streams of proprietary, high-fidelity, behavior-labeled data.

Models come and go; the right data keeps getting more valuable as model quality improves.

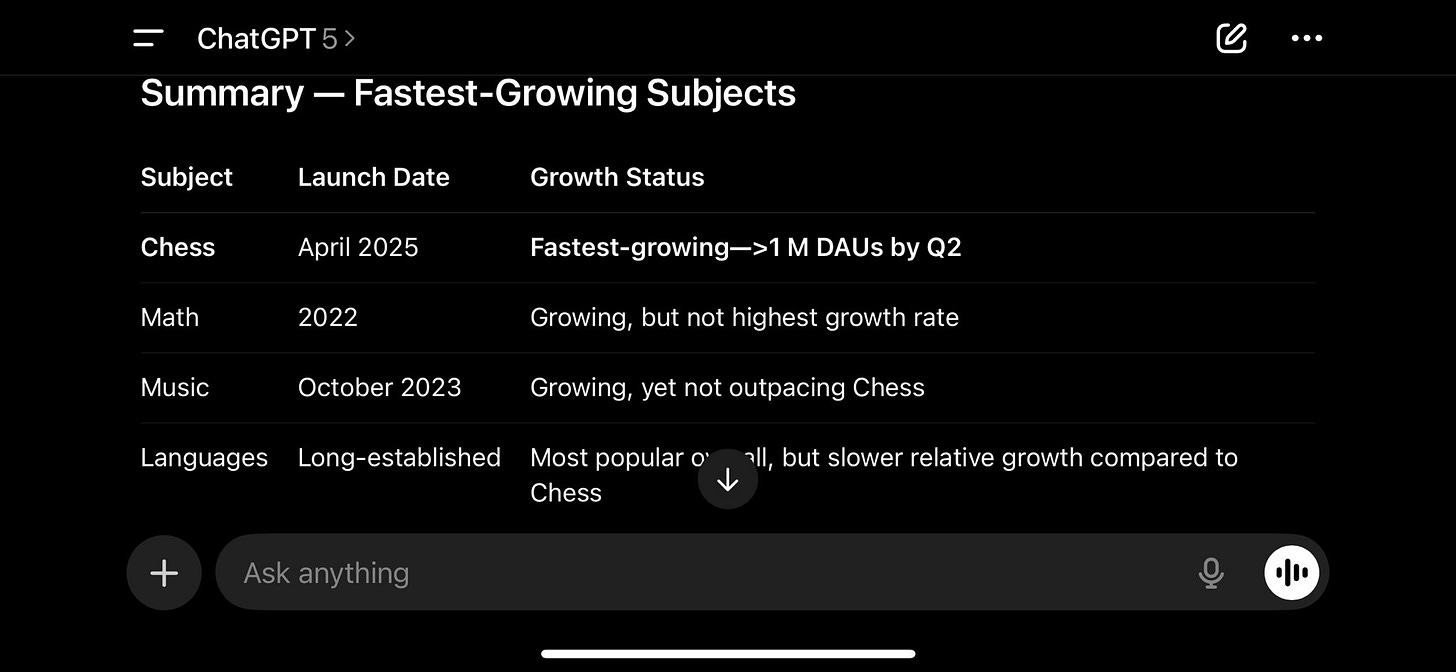

That framing travels well to Duolingo. At scale, Duolingo doesn’t just have “content.” It has billions of micro-observations on how people actually learn – which items trip them up, how quickly they recover, what timing drives stickiness, which accents are hardest by language pair, where speech recognition fails in the wild, how motivation waxes and wanes across cohorts and price points. If you accept that premise, the question changes from “Will AI kill language learning?” to “How can Duolingo weaponize the data exhaust of learning to build products others can’t?” T

hat’s the angle I want to push on here. I’ll keep this part crisp and idea-dense because it’s meant to be a build list you can stress-test.

So here’s a list of somewhat random ideas for where Duolingo’s data could unlock new products and revenue:

Real-time mastery graph as an API – package Duolingo’s knowledge-tracing signals (what I truly know, what I’m guessing, where I’m decaying) into a developer API so third-party learning apps, HR platforms, and LMS vendors can personalize pacing and difficulty. Monetize via usage-based pricing to B2B.

Accent intelligence and speech coaching – train models on mispronunciation patterns by native-language pair, then sell a premium “accent lab” that gives phoneme-level feedback and daily micro-drills. Offer enterprise licenses for call centers, hospitality, and aviation where accent clarity is measurable ROI.

Assessment everywhere – extend the English Test playbook into “micro-certs” for industry contexts (healthcare bedside Spanish, airport ground ops English, front-of-house Italian). Price per attempt; bundle with employer dashboards and candidate shortlists.

Motivation OS for education – export Duolingo’s habit-formation mechanics (streak recovery, goal calibration, nudge timing) to schools and edtech partners as a white-label SDK. Districts pay per active student; Duolingo earns platform fees and data-sharing rights.

Speech-in-the-wild dataset – curate a privacy-safe corpus of real user audio across devices, environments, and accents to train robust ASR and prosody models. License to OEMs making earbuds, headsets, and in-car assistants with strict governance and consent layers.

Conversation copilot – a paid add-on that shadows live practice calls and gives private, just-in-time prompts: rephrase suggestions, cultural nuance notes, “you’re talking too fast” coaching. A soft bridge between learning and the real world.

Employer upskilling bundles – team licenses for logistics, hospitality, and healthcare with role-specific modules plus manager analytics: time-to-competency, QA sampling of recorded practice, and compliance reporting.

Teacher cockpit – K-12 and language-school dashboards that recommend who needs which intervention today. Export weekly summaries parents can actually read.

Personal knowledge graph – a longitudinal map of what you know that travels with you across subjects. If Duolingo expands into math, reading, or civics, the graph becomes the cross-vertical spine for personalization.

Hardware partnerships – ship on-device ASR/pronunciation models in collaboration with earbud and AR vendors for low-latency feedback. Revenue via licensing plus co-marketing that turns devices into “Duolingo-ready.”

Granular A/B engine as a product – the experimentation stack that tunes streaks, reminders, and reward schedules is valuable beyond languages. Wrap it into a SaaS product aimed at education apps that don’t have Duolingo’s scale.

Privacy-preserving model training – offer on-device and federated-learning options for institutions nervous about data leaving their perimeter. Win segments competitors can’t serve due to compliance constraints.

Cross-sell into immigration and study-abroad workflows – verification, placement, and prep bundles tied to visas and university admissions. Think “Duolingo On-Ramp”: test + short course + institution reporting.

Of course, Duolingo won’t ship all of it. The company doesn’t need to. It just shows the optionality embedded in being a massive data curator.

If I had to draw the loop, it would look like this: more learners → richer item-level telemetry → better personalization and speech feedback → higher efficacy per minute → better word of mouth and premium conversion → more revenue to fund R&D and creator economics → more differentiated content and models → back to more learners. The point is that data improves outcomes, outcomes improve growth, and growth deepens the data advantage, which can be applied to other realms outside language learning.

All the above assumes consent, transparency, and value back to the user. Speech data, in particular, is sensitive. If Duolingo leans into enterprise and assessment, governance has to keep pace. I’d default to on-device processing where feasible, explicit opt-ins for any licensing, and user-visible controls that trade accuracy for privacy if someone wants that. Long-term brand equity depends on being trusted with the audio in your living room.

Scenarios, timeframes, and what would change my mind

I’ll close this section with a simple, falsifiable map. The point isn’t precision. It’s clarifying what I think the next few years could plausibly look like.

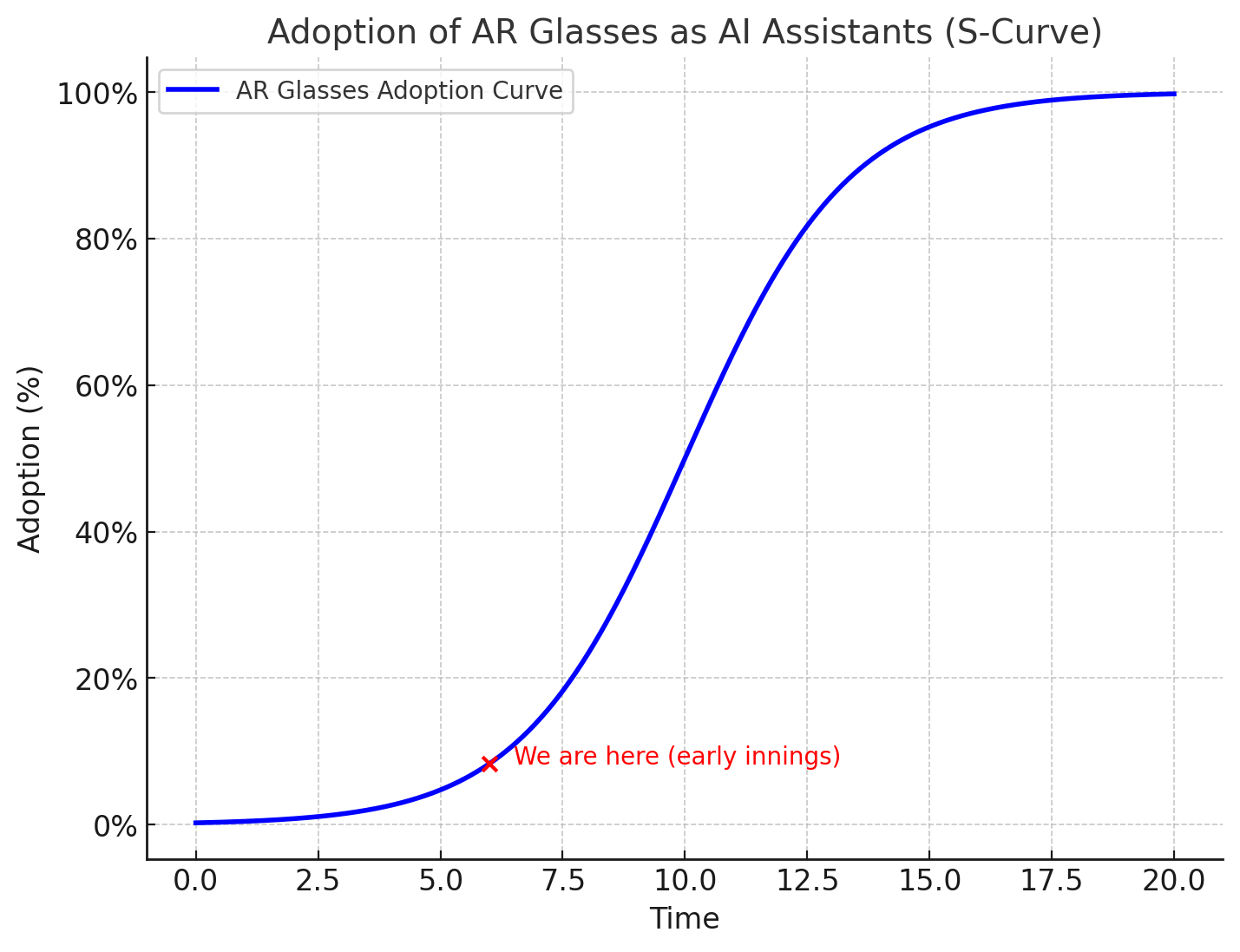

Scenario 1: Early Adoption Stalls – mainstream post-2035 (Probability: ~35%)

AR glasses adoption moves more slowly than expected. Price, battery life, comfort, and privacy remain unsolved bottlenecks deep into the 2030s. Translation gets good in niche settings (travel, customer service, classrooms) but fails to become a “default mode” of conversation. By the time hardware matures in the late 2030s, Duolingo has had more than a decade to entrench itself and diversify. In this world, the disruption thesis matters far less to today’s investors.

Scenario 2: Gradual Uptake – mainstream by 2032–2035 (Probability: ~50%)

This is my base case. Adoption resembles the smartphone curve but shifted later: limited enthusiasts in the late 2020s – we’re already seeing it today –, followed by a clear inflection in the early 2030s as hardware gets lighter, cheaper, and socially acceptable. By 2033–35, tens of millions – maybe more – will be wearing AR glasses daily, with translation fast and reliable enough to change behavior. At that point, the utility-driven language learners start peeling away. Duolingo keeps the cultural, intellectual, and professional learners, but its growth engine looks different.

Scenario 3: Faster-than-Expected Acceleration – mainstream by 2029–2030 (Probability: ~15%)

The “bull case” for disruption, but still several years further out than the hype cycle suggested. A major platform nails the trifecta of form factor, battery life, and price in the late 2020s, early 2030s, and translation models make a generational leap in latency and nuance. By ~2030, AR glasses hit critical mass, and within a year or two, live translation becomes a widely accepted utility. That shrinks Duolingo’s utility-driven TAM materially sooner than the base case, and the company needs to lean heavily on adjacencies.

In terms of the timeline, Meta’s demo was impressive but also revealing. Latency is still too high, social acceptance is fragile, and the glasses themselves are nowhere near ubiquitous. The 2033–35 timeline feels most realistic to me: far enough away for Duolingo to keep compounding, but close enough that investors need to watch the signals.

Signals I’d track to recalibrate:

Hardware shipments crossing >30–40m AR glasses annually

“Meta’s Ray-Ban smart glasses—built in collaboration with eyewear juggernaut EssilorLuxottica—have become a surprise hit. Since launching the second generation in October 2023, they’ve sold more than 2 million units. Sales tripled in Q2 2025 alone, helping drive Meta’s 22 percent year-over-year revenue growth. Zuckerberg has reportedly challenged teams to push that figure to 5 million by year’s end.“ - Wired

Translation latency benchmarks under ~200ms with preserved prosody

Signs of normalization (offices, classrooms) where wearing AR glasses becomes routine

Widespread adoption of “anchor apps” beyond translation that make AR glasses indispensable (primarily apps giving you access to your personal AI assistent)

So to put numbers on it: ~35% chance mainstream arrives post-2035, ~50% chance around 2032–35, ~15% chance by 2029–30. For Duolingo investors, that timeline is relevant as it gives the company some breathing room to “outinnovate” the potentially disruptive forces.

Also, a market that believes in the 2030 scenario will keep punishing the multiple. A market that shifts toward 2035 or beyond may be underestimating just how much time Duolingo has to grow, diversify, and build defensibility.

That’s the piece I needed to write to reconcile my bearish filter with the counter-arguments I respect.

Proprietary, behavior-labeled learning data isn’t a magic shield. It is, however, a set of compounding advantages that get more valuable as the world turns more AI-native.

If Duolingo leans into that and ships a few of the right ideas from the list above, the conversation about disruption starts to sound very different.