Deep Dive: Video Game Stocks (Nintendo, Sony, Unity, Roblox, Take-Two et al.)

Everything in the World of Gaming Will Change! What the AI Revolution Means for Investors

The video game sector is no stranger to volatility. But on a seemingly ordinary Friday in early 2026, the market witnessed a particularly sharp drop in video game stocks, leaving investors and analysts alike scrambling for explanations. Some of the industry’s most well-known names saw significant losses, prompting a wave of concern regarding the future of this once-booming market.

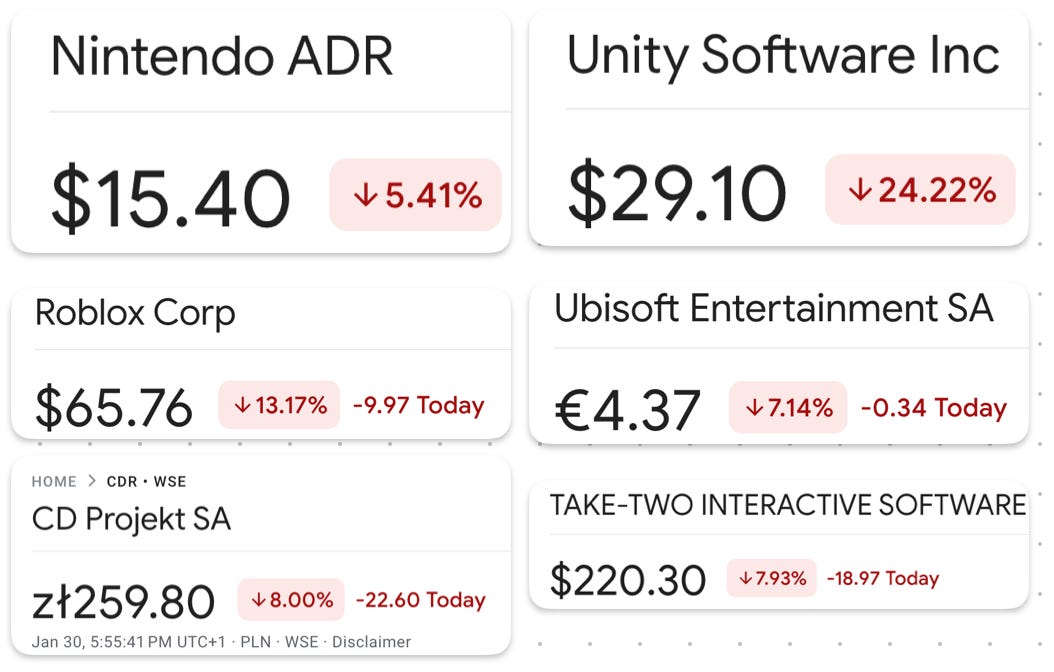

Take a quick look at the one-day performance of some of the biggest video game companies, and it’s hard not to be struck by the magnitude of the declines. Nintendo, one of the most established names in the gaming industry, ended the day down by around 5%. Unity, the platform that powers many modern games, dropped a staggering 24%. Roblox, Ubisoft, and Take-Two Interactive saw similar declines, with losses ranging from 7% to 13%. CD Projekt, a company famed for its hit Cyberpunk 2077, too, was not immune, shedding roughly 8% of its value.

For a sector that’s traditionally known for its resilience—thanks to a loyal consumer base and consistent demand for new titles—these drops are hard to ignore. Investors are clearly rattled. But what could have triggered such a dramatic shift in sentiment?

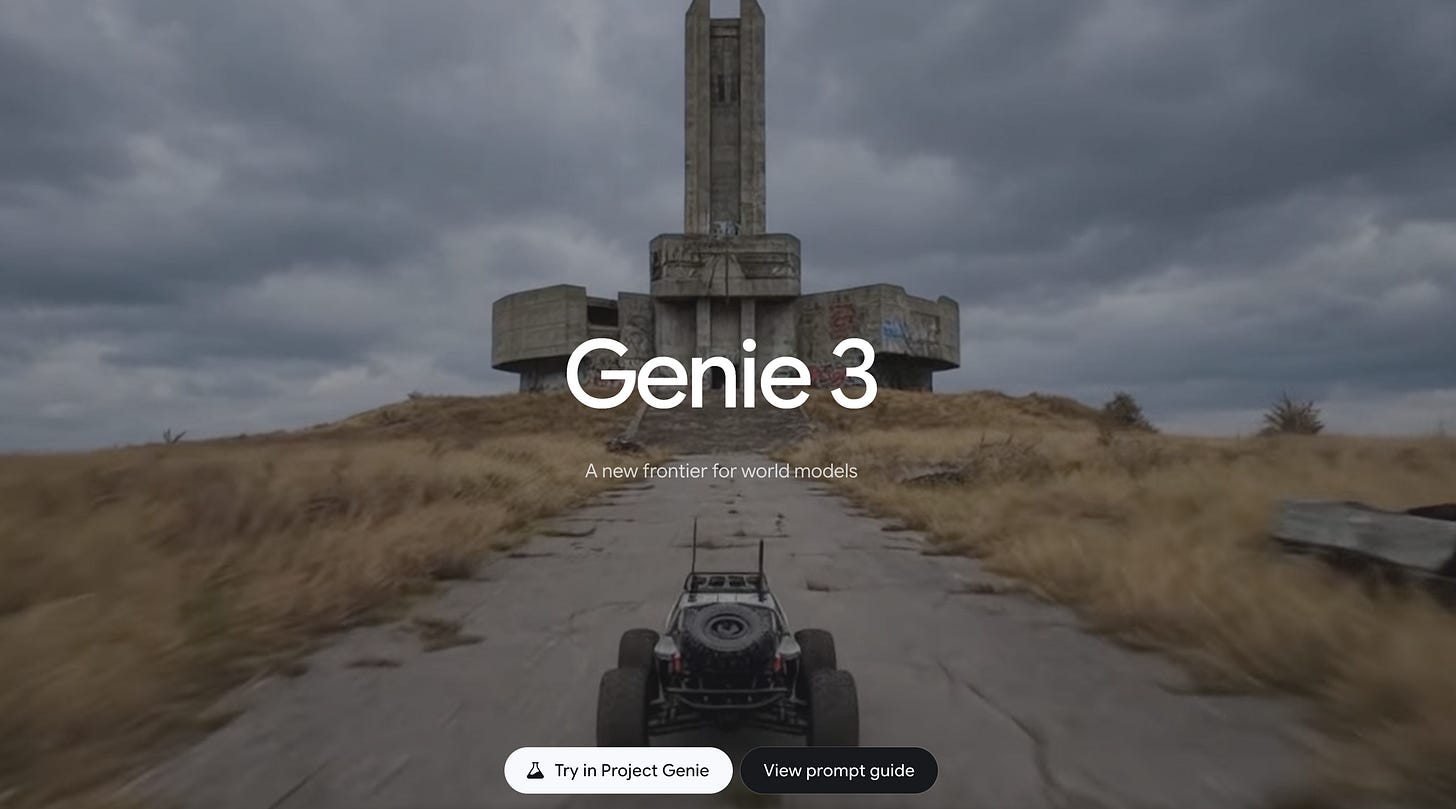

The catalyst, as it turns out, was a groundbreaking announcement from none other than Google. The tech giant revealed its experimental prototype, Genie 3, an AI-driven model capable of creating and exploring vast, infinite virtual worlds in real-time. This tool, a prototype for now, designed by Google DeepMind, allows users to generate immersive virtual environments and even design characters simply by describing them in text.

For those unfamiliar with the implications, this isn’t just another incremental leap in AI technology – it’s a potential game-changer for the gaming and entertainment industries. Genie 3 could enable anyone, regardless of coding experience, to generate and interact with complex, 3D worlds. Imagine the ability to create vast landscapes or intricate characters at the push of a button, with AI managing all the backend logic – something that traditionally required months of work from a team of skilled developers.

To get a sense for what’s possible with this powerful tool, take a look at the X thread below that curated ten illustrative examples:

And this is just a prototype. In the coming months and years, this technology is only expected to improve, accelerating the pace at which new content can be created and lowering the barrier to entry for game developers.

As noted by industry expert Jacob Navok, former executive at Square Enix, “World models present staggering and extraordinary opportunities for content creation […] [b]ut they also underscore the need for game engines and game design principles more broadly, which will provide the structure and stability for the output layer that is necessary for game development.”

This statement captures the very essence of the dilemma faced by traditional game developers today: while AI tools like Genie 3 promise to revolutionize the content creation process, they don’t yet provide the deterministic, rule-based structures that game engines offer to maintain consistent gameplay.

Naturally, the announcement sent shockwaves through the stock market. Investors, worried that AI-driven tools like Genie 3 could fundamentally disrupt the business models of traditional video game companies, began selling off their shares. After all, if anyone can create a game without the need for expensive developers, what’s the role of companies like Ubisoft or Take-Two Interactive? What protects their “right” to earn (superordinary) profits over the next few decades?

While some may argue that this reaction is knee-jerk, the underlying fear is clear: the introduction of AI tools in game creation is an absolute game-changer for the industry, a Gutenberg moment that will most definitely (?) significantly reduce development costs and could lead to a more fragmented industry. As the cost of creating a game drops, so too does the need for large, established studios. The risk of being replaced by smaller, nimble competitors is very real. And for investors, uncertainty is always unsettling.

As pointed out by Matt Bromberg, CEO of Unity: “Advances in large-scale ‘world models’... materially expand the frontier of interactive content creation. These models can generate high-quality, interactive, video-like experiences from natural language or minimal input. However, as they are probabilistic and non-deterministic, they’re not suitable on their own for games that require consistent, repeatable player experiences.”

This highlights an important distinction: while AI tools like Genie 3 can generate impressive visuals, they don’t yet meet the rigorous standards required for building a commercially successful video game. Yet …

But let’s not get ahead of ourselves. In the next chapter, we’ll explore whether these fears are justified or if this is just another case of market overreaction, giving long-term investors interesting opportunities to initiate positions in the likes of Nintendo, Sony, Unity, Take-Two, Ubisoft, CD Projekt, Roblox, etc.

Here’s what we will cover in this 6,500-word deep dive:

The potential disruption AI poses to traditional game development, lowering barriers to entry and impacting established studios.

How AI tools like Genie 3 can help reduce development costs and increase profitability for video game companies.

The risk of AI creating increased competition, leading to the devaluation of major IPs and business models reliant on large-scale game production.

The differences between single-game developers, diversified developers, platform owners, and game engine providers.

How AI can complement existing game engines like Unity and Unreal, rather than replace them.

Insights from Matt Bromberg (Unity) and Tim Sweeney (Epic Games) on the integration of AI into game engines.

The potential for a Cambrian explosion of new game creators, with AI tools lowering the barriers to entry.

Shifts in consumer behavior

The evolution of business models

The Future of AAA Games

In what way Roblox is built differently

Investor perception analysis: how perception risks could continue to suppress valuations of video game companies

1) Trap or Opportunity?

With the sudden plunge in video game stocks following Google’s unveiling of Genie 3, it’s clear that the market is divided. Investors are left grappling with one big question:

Is this the beginning of a new era in gaming, or are we witnessing a temporary overreaction?

For those who are more cautious, Genie 3 might look like the start of a storm that could change the very fabric of the industry. But for the more optimistic investors, the AI-driven world generation tools could prove to be an exciting innovation, offering new opportunities for growth and efficiency.

Let’s take a look at both sides of the argument.

The Bullish Case: A New Age of Cost Efficiency and Profitability

For those with a more optimistic view, Genie 3 and similar AI-driven technologies represent the next great leap forward in game development. If AI tools can simplify and accelerate the creation of complex virtual worlds, they could dramatically reduce the cost of game development – an expense that has traditionally been one of the highest barriers for many game studios.

Take Ubisoft, for example. In its most recent fiscal year, the company spent a significant portion of its operating budget on research and development (R&D). According to their latest annual report, R&D made up roughly 50% of the company’s total revenue. For large studios like this, the prospect of reducing R&D spending by even a fraction could have a dramatic impact on profitability. Imagine being able to cut development costs by 30%, 40%, or even 50% (or more?) with the help of AI-generated worlds, characters, and environments. For a gaming companies this could lead to much better profit margins.

Moreover, while the emergence of AI models like Genie 3 might seem like a threat to traditional game creators, it could actually complement their existing tools and processes. As Matt Bromberg, CEO of Unity, explains: “Rather than viewing world models as a risk, we see it as a powerful accelerator. Video-based generation... would further enhance [Unity’s] pipeline and materially improve the fidelity and speed of early-stage content creation.” In other words, rather than completely replacing game developers, AI tools could serve as a speed-up mechanism, helping teams create games and worlds (bigger, better, more asset- and detail-rich) faster, which could ultimately allow them to focus more on the creative and gameplay aspects of the experience – an area many developers have recently struggled to excel in.

In sum, AI could help video game companies generate more content, with fewer resources, leading to exceptionally higher returns on investment going forward (ROIIC), justifying significantly higher multiples. In this scenario, Genie 3 is not a disruptive force—it’s a tool that could enhance the profitability of established companies, making them even more attractive investments in the long run.

The Bearish Case: Increased Competition and Threatened IP

On the flip side, there are those who view the AI-driven revolution as a potential disruptor that could create new competitors and reduce the value of established gaming IPs. If anyone can create a game with minimal technical expertise, it opens the door for an explosion of new indie developers and small studios. These new entrants could flood the market with a wide variety of games, many of which may be created with little more than a text prompt and AI-generated assets. While some of these games may not be of the same caliber as AAA titles, the sheer volume of content could change consumer expectations and make it harder for traditional studios to justify their premium prices.

As highlighted by Jacob Navok, former exec at Square Enix, “World models... should lead to a dramatic increase in the number and quality of games developed. However, they also underscore the need for game engines and game design principles... which will provide the structure and stability for the output layer that is necessary for game development.”

Moreover, the emergence of cheap, AI-generated games could lead to a situation where players are less willing to pay $60 or $70 for a AAA game, when they could have access to equally enjoyable experiences for a fraction of the cost – or even for free. Imagine a world where a player can create a game of their own using an AI tool and experience it without spending a dime. This could pose a serious challenge to the traditional business model of the gaming industry, where revenue is largely generated through the sale of new titles, expansions, and/or in-game purchases.

A further risk to traditional game developers is the pressure to adapt to changing consumer behaviors. As more users create and share their own games, large developers may find it harder to maintain the same level of loyalty. The rise of microtransactions and live services in games like Fortnite has already changed the industry’s focus, making the creation of deeply engaging, long-term virtual worlds more important than ever (which is exactly why Nintendo, despite its lackluster graphics, remains so successful in my view). But if players start shifting their attention to AI-generated worlds, it could undermine the foundation that traditional developers rely on for steady, recurring revenue.

For investors with a more cautious outlook, these dynamics present a valid concern. While the potential for cost savings and efficiency gains exists, the long-term effects of AI on the competitive landscape could outweigh these short-term benefits. Capitalism is brutal. Where (lots of) money is to be made, competitors will emerge if there aren’t any structural barriers to entry.

They exist right now, but tools like Genie 3 could lower them meaningfully.

The risk of being overtaken by nimble competitors who simply produce better games, who can now produce games more cheaply and can produce games more on par with the likes of the major gaming studies (in terms of visuals, gameplay depth, etc.), or even disrupt the market entirely, is very real.

As a result, investors may want to approach the video game sector with more caution – and the stock price moves on Friday reflected that stance – particularly in the face of a rapidly evolving technological landscape.

Ultimately, the introduction of AI technologies like Genie 3 into the gaming industry represents both an opportunity and a potential risk. For the bullish investor, AI can drive efficiency, enhance profitability, and fuel innovation in game development. But for the bearish investor, it raises concerns about increased competition, disrupted business models, and the potential devaluation of established IPs.

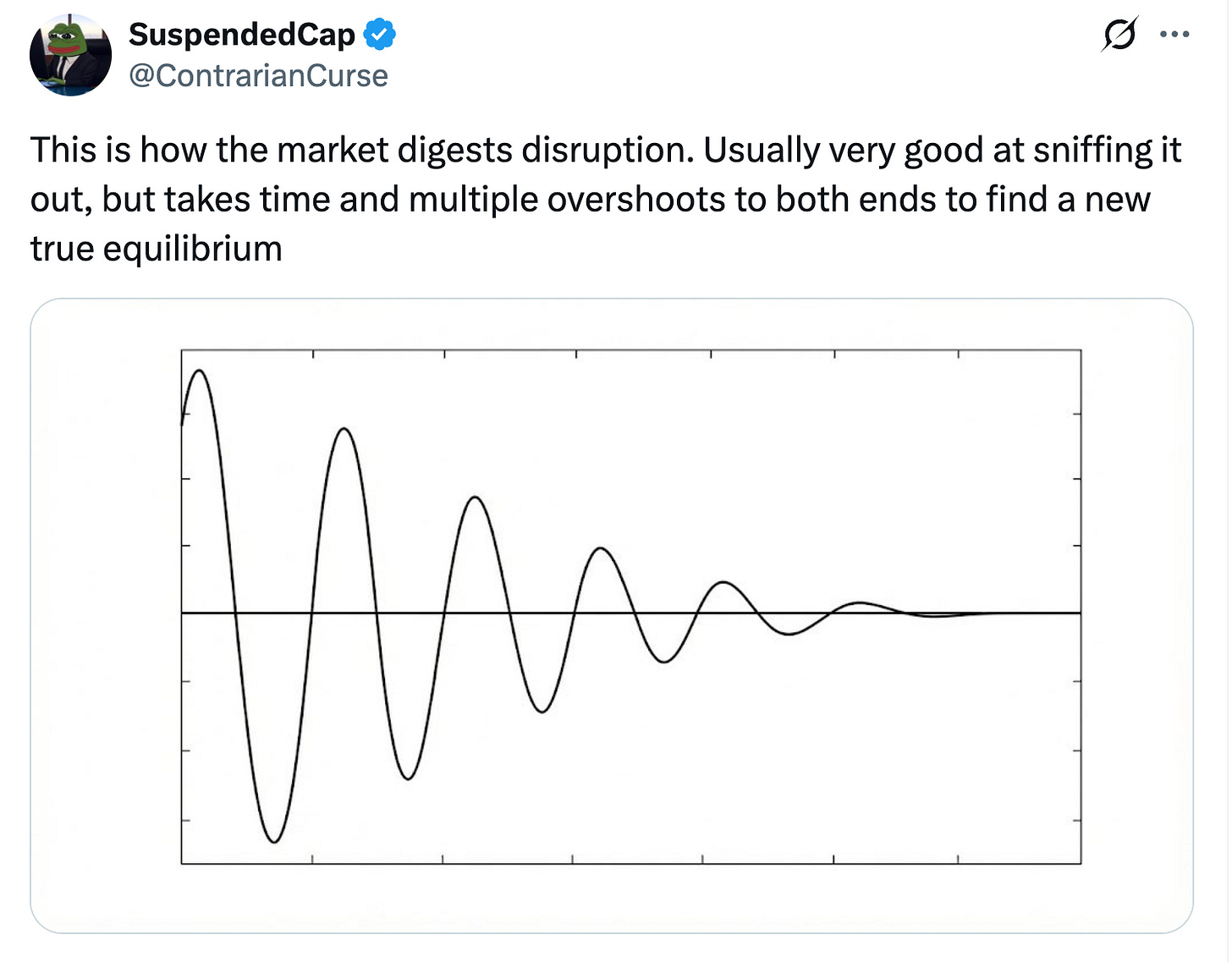

While we can’t yet predict how this will all play out, one thing is clear: the video game industry is on the cusp of a major transformation. The rate of change just went up. Whether this will be a temporary bump or the start of a profound shift remains to be seen, but as with any new technology, there will be winners and losers. The key to success will be understanding how these shifts impact not just the technology itself, but the companies that rely on it – and most importantly, how these changes are reflected in the market’s perceptions and stock valuations. This is what we will cover next.

2) Not All Video Game Stocks Are Created Equal

As we dive deeper into the future of the video game industry, it’s essential to acknowledge that not all video game companies are in the same position. We saw indiscriminate selling in Friday’s trading session, which I believe was unjustified.

The rise of AI-generated content and virtual worlds might seem like a one-size-fits-all disruptor, but in reality, different types of companies within the gaming ecosystem will be impacted in vastly different ways. The landscape is far from uniform, and understanding these differences is key to identifying where the opportunities and risks lie.

Join the private WhatsApp community!

Discuss stock ideas, ask questions, and get behind-the-scenes thoughts in real-time.

Available exclusively for paid subscribers. Want in? Choose the annual subscription plan + reply with your number (more details in the welcome email).PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.