Deep Dive: Universal Music Group ($UMG)

Music as an Unstoppable Asset: Why I am Bullish on This IP Compounder Trading Below Its IPO Opening Price

Universal Music Group is a company most investors have heard of. It sits at the heart of the global music industry, owns an unparalleled portfolio of intellectual property, and counts prominent long-term shareholders among its owners.

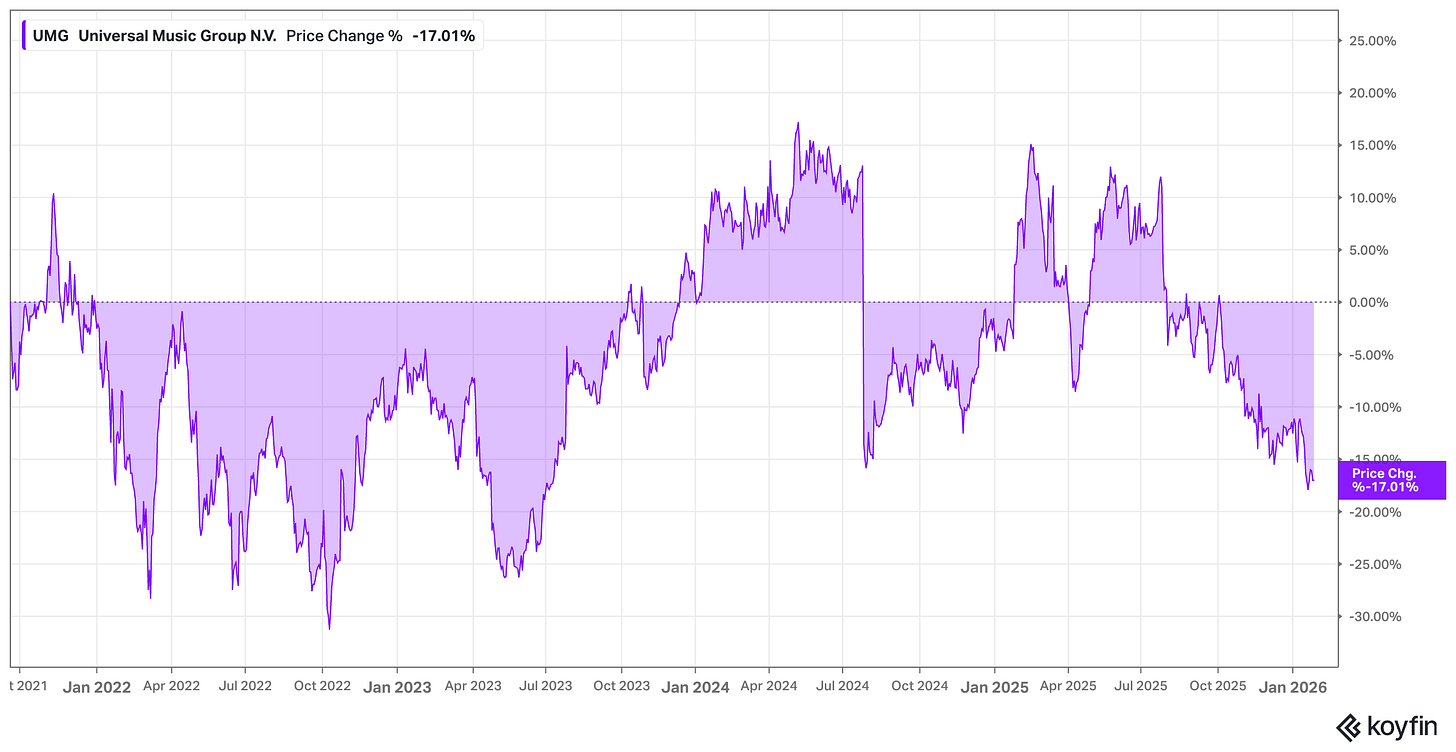

In a weird way, it feels almost too well-known to be worth analyzing. Yet that familiarity may be precisely the reason why the stock has slipped into a blind spot. Since going public, the share price has largely gone nowhere and is currently down meaningfully from its highs.

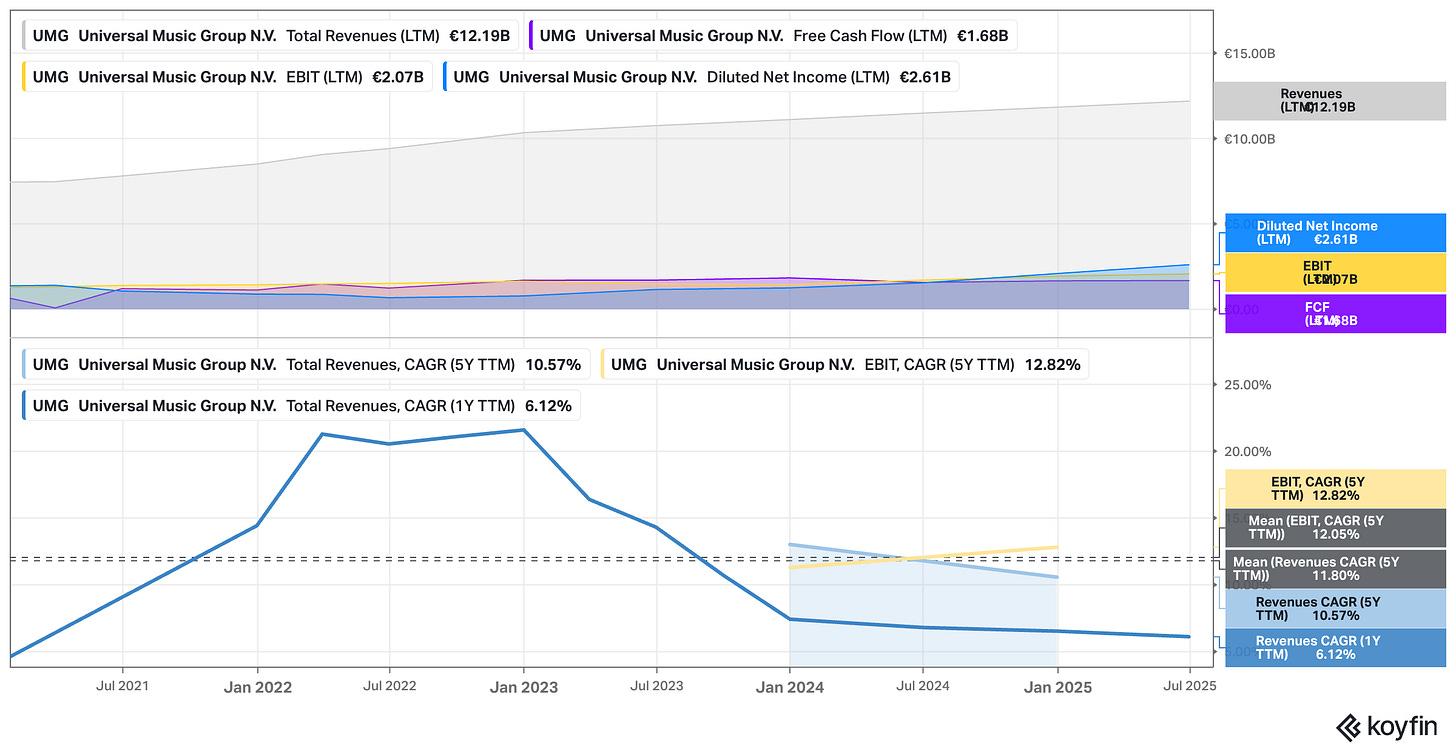

And all of this despite being a business that has continued to grow steadily, generates attractive margins, and produces highly predictable cash flows; and will likely continue to do so for decades to come. The predictability of this business is arguably its biggest strength.

That disconnect – and the fact that UMG is trading at a 52-week low – is what caught my attention.

When I look at UMG today, I see a company that behaves more like a long-duration asset than a cyclical media business. Its catalog allows it to monetize intellectual property decades after its creation, turning music into something closer to infrastructure than entertainment. The company will still be earning money in 30 years from songs recorded half a century earlier. Few businesses have that kind of temporal leverage.

At the same time, UMG remains capital-light at its core, even though it needs ongoing investment to acquire new catalogs and nurture talent. The result is a business with an unusually long runway and unusually high visibility. That alone should make it interesting.

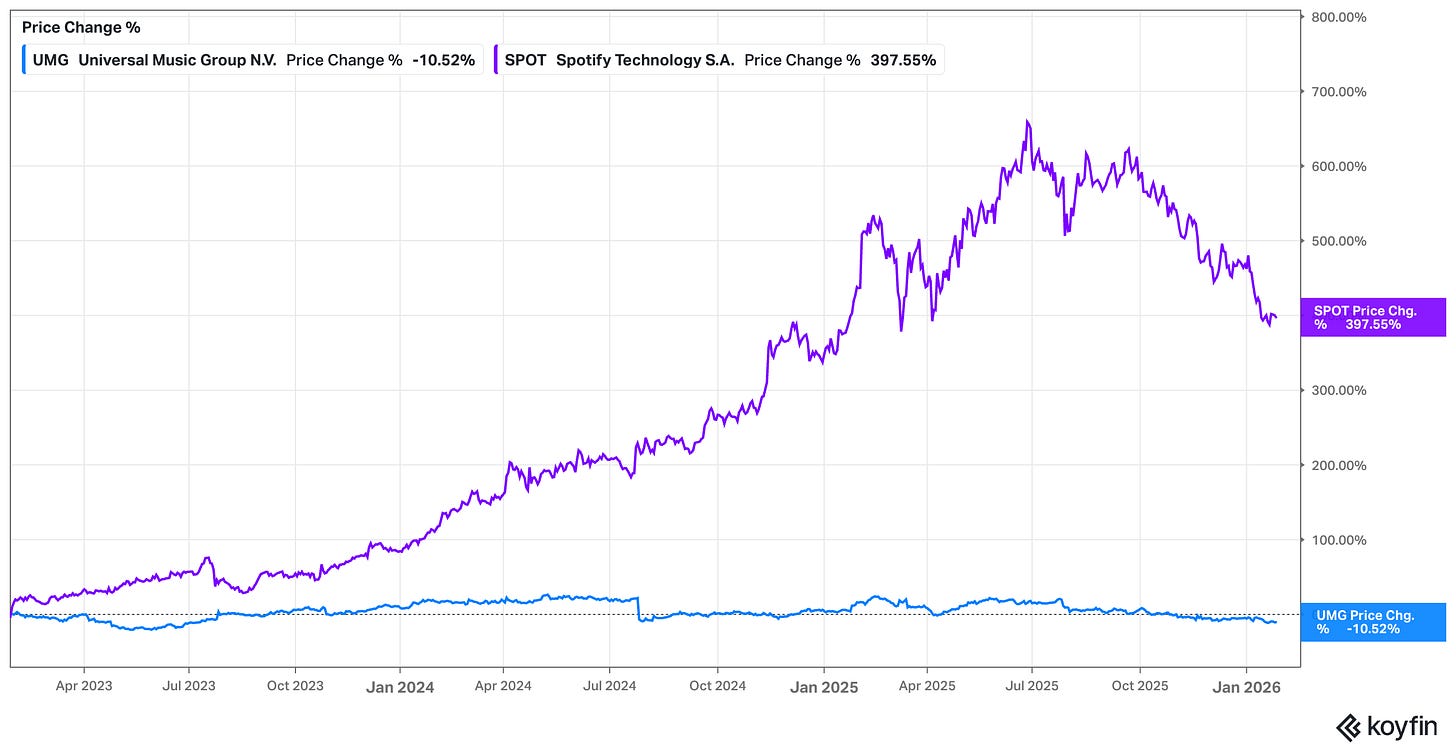

And yet, the market treats UMG as if it were a mature, low-growth company with limited upside. The stock has lagged peers in the broader audio and streaming ecosystem, such as Spotify, massively over recent years, which reinforces the perception that it is the “boring” part, the old guard, of the value chain.

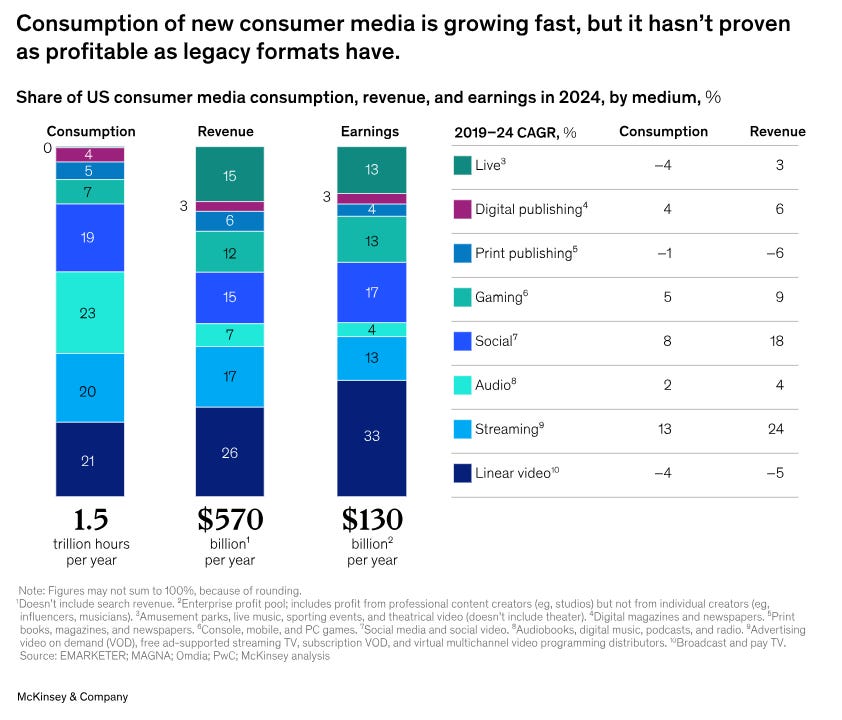

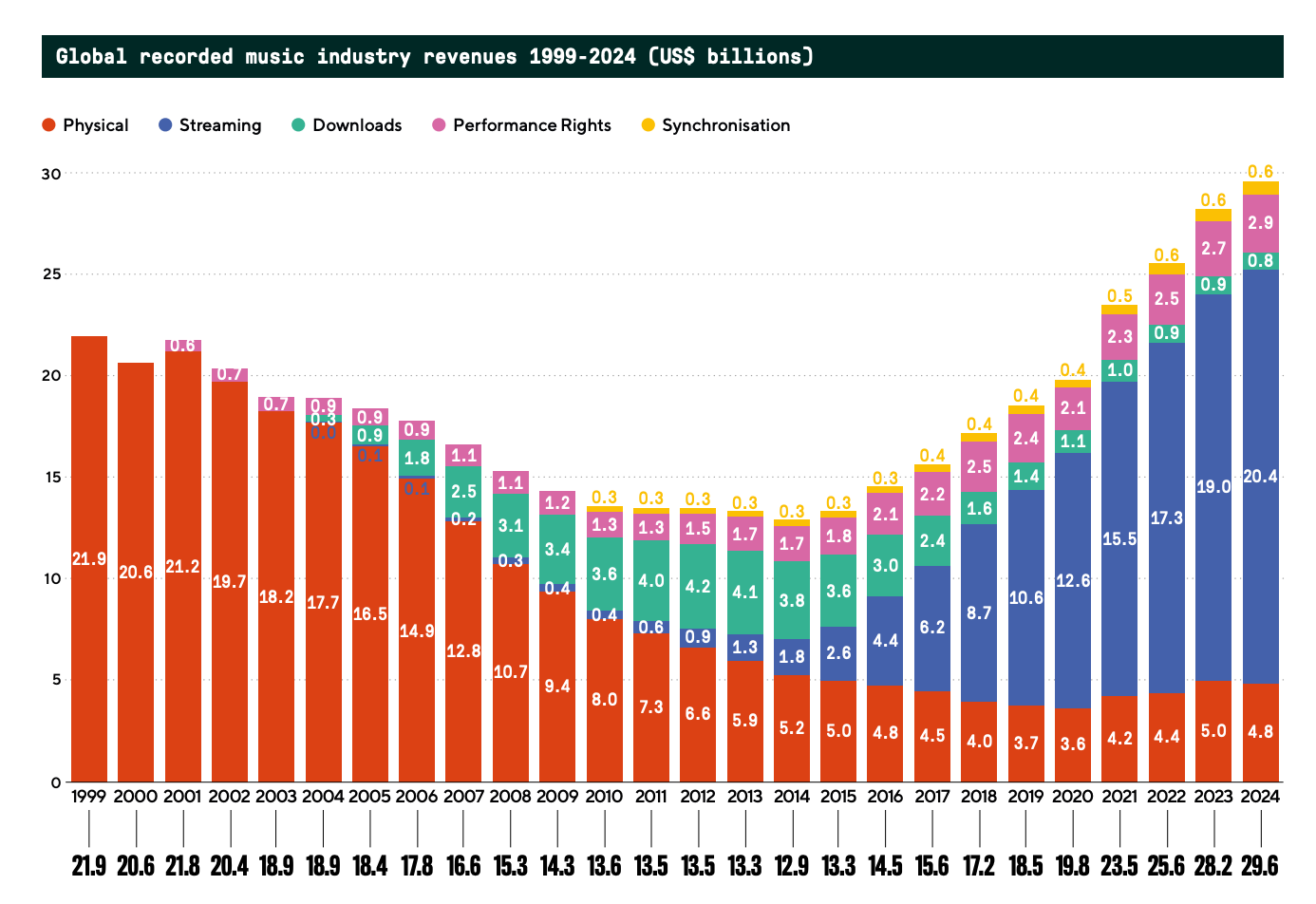

But this perception ignores a deeper imbalance in how music is valued. Audio accounts for a large share of global media consumption, yet captures only a small fraction of industry revenues and earnings. In other words, music is everywhere, but monetization is still surprisingly thin.

That structural gap is not a short-term anomaly. It is a long-term opportunity. If music were even partially re-priced within the broader media economy, the implications for rights holders like UMG would be significant.

This is why UMG’s valuation feels difficult to reconcile with its fundamentals. The business combines mid-to-high single-digit growth with strong margins and durable cash flows, yet trades at a multiple that seems more consistent with a low-growth, lower-quality asset.

Even more striking, the value of its existing catalog alone appears to represent a substantial portion of its market capitalization. The market narrative around the stock is dominated by concerns about AI disruption and dependence on streaming platforms like Spotify, but those narratives may be oversimplified. They frame UMG as a vulnerable intermediary rather than as the owner of scarce, irreplaceable assets. We will primarily focus on these two narratives in this write-up and discuss the merit of them.

There is also a structural reason why this mismatch exists. UMG is listed in Europe, which limits its visibility among US-centric investors and reduces its inclusion in major growth-oriented portfolios. Global cultural relevance does not automatically translate into global investor attention. In practice, the European listing may contribute to a valuation that fails to reflect the company’s strategic importance and long-term economics. Ironically, the very fact that UMG is so well known as a cultural institution may have made it easier for the market to overlook it as an investment.

The idea I want to explore is simple: UMG is not a hyper-growth story, but it might be something more interesting – a high-quality compounder that could as a “stabilizer” in your portfolio, a company with an exceptionally long runway, misunderstood by the market and priced accordingly.

If that is true, then the real question is not whether UMG will survive technological change, but whether the market has fundamentally misjudged the value of owning music itself.

Here’s an overview of some of the topics covered in this 23,000-word deep dive:

A detailed look at UMG’s business model (products, customers, operations, etc.)

Exploration of key growth drivers

Analyzing unit economics and UMG’s diverse revenue streams

A breakdown of UMG’s Total Addressable Market (TAM)

A look at UMG’s competitive position in the global music industry and opportunities for continued streaming penetration.

An assessment of UMG’s structural competitive advantages

A risk assessment of who has the bargaining power in UMG’s relationship with major digital service providers (such as Spotify)

Review of management, including leadership under Sir Lucian Grainge, compensation structures, and long-term incentives alignment.

Examination of capital allocation and ownership, focusing on Bill Ackman’s stake and his impact on UMG’s long-term strategic direction.

A deep dive into UMG’s financial health, addressing balance sheet risks, debt obligations, off-balance-sheet obligations, and long-term commitments.

Consideration of AI as a risk or tailwind, with a focus on AI-enhanced music services like remixes and personalized versions, and their potential impact on UMG’s growth.

Discussion of UMG’s upcoming U.S. listing and how it may increase demand, improve liquidity

Bill Ackman’s investment thesis

An assessment of valuation

Analysis of strategic risks and opportunities, considering temporary vs. long-term factors like regulatory changes and partnerships with streaming platforms.

There’s even more! As always, I believe this is one of the most thorough analyses of the business you’ll be able to get your hands on.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

High-Level Thesis: “Bam Bam Bam Bam Bam”-90 Second-Pitch

The full analysis starts here:

The rest of this post covers the aspects covered above (and more). If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more) and powerful investing frameworks. is just a click away. Upgrade your subscription, support my work, and keep learning.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.