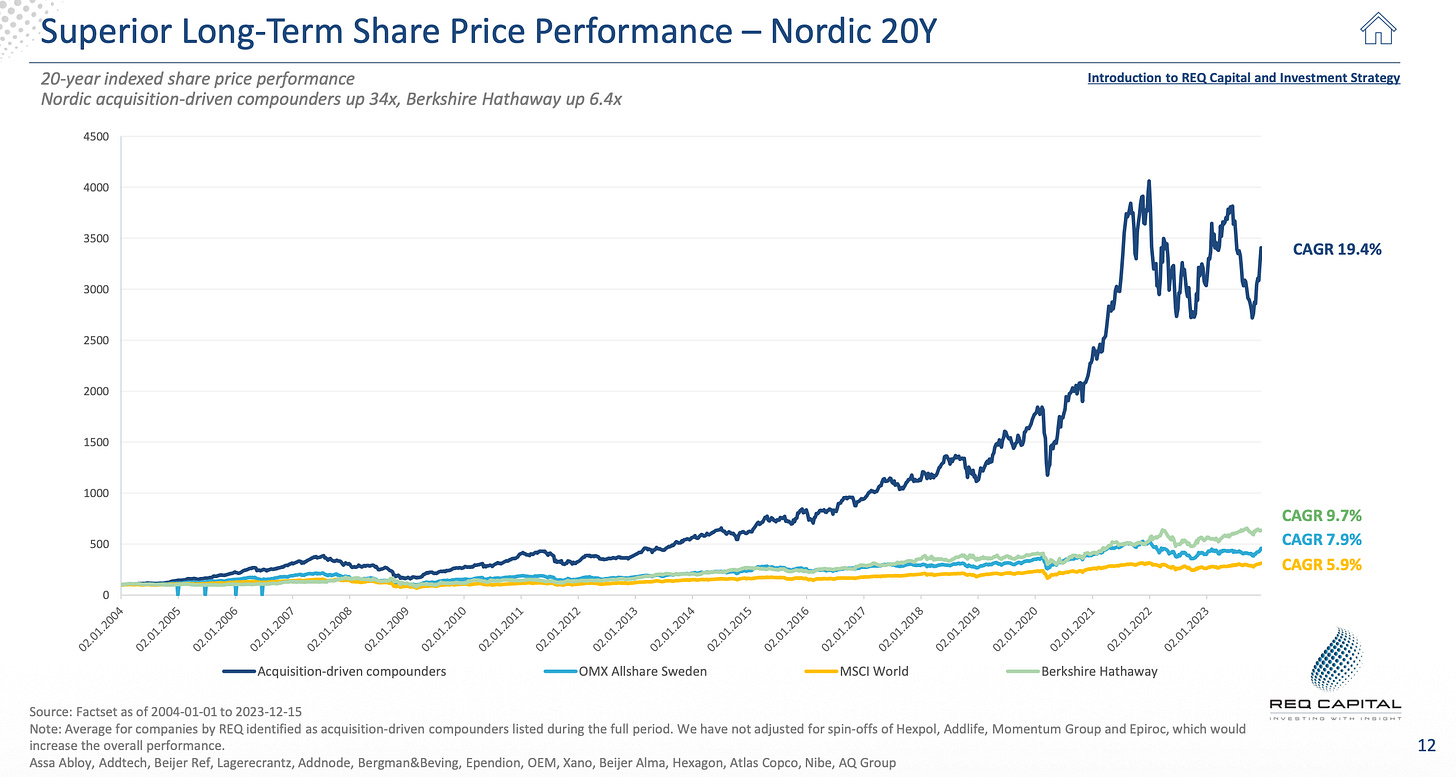

I remember about a year ago, a few members of the community and I decided to commit four weeks to dive deep into the world of serial acquirers – a space that I had been fascinated by for a long time. We spent hours studying, sharing, and discussing theoretical concepts, reading up on acquisition strategies and various types of acquirers (e.g. generalists vs. specialists, programmatic vs. tactical, global vs. regional, etc.), and absorbing all the wisdom shared by REQ Capital specifically, whose founders recently released a book, too. Here’s a quote from that very book that sums up the attractiveness of the serial acquirer model:

“If compounding had a soul mate, it would be the group of compounders in this book. Their power lies in their ability to perfect two engines of growth: organic reinvestments and programmatic acquisitions of small private companies. These dual engines provide a unique level of capital deployment that single-engine companies, relying only on organic growth, can rarely match. Unlike companies tethered to a single industry or market, they operate across a broad landscape, unconstrained by sector or geography. The global SME (small and medium-sized enterprise) market is their playground, offering a virtually endless runway of opportunities. Additionally, what truly sets compounders apart is their ability to sustain this growth over the long term. […]“ - The Compounders: From Small Acquisitions to Giant Shareholder Returns

This journey eventually led us to study how serial acquirers create long-term shareholder value, particularly through the lens of capital allocation and acquisitions. I remember feeling a bit intimidated at the complexity of businesses like Topicus and Constellation Software (CSI), given how intricate their structures are. But this business model deep dive was also an eye-opener – especially when I realized how these companies – and their management teams in particular – operate with an entirely different mindset compared to most other firms.

Something else I thought about recently, regarding serial acquirers, was prompted by a tweet I came across. It was about CSI and how, while their business is well-run, they may not be in the top 15 companies anyone should invest in. The tweet argued that owning CSI might not be the best choice, considering the opportunity cost.

And honestly, after thinking about it, I agree with some of the sentiment. Companies like CSI and Topicus bring a unique advantage to the table that many others don’t – an almost infinite runway, great visibility on ROIIC, and internal diversification – to mention just a few.

But when you get to the core of it, these are businesses that thrive on capital allocation rather than incredibly strong structural advantages that other single-product/-service companies (like Airbnb, Uber, Timee, Hermes, Monster Beverage, Wise, or Interactive Brokers) may possess and that often neatly fit into your textbook moat taxonomy.

This got me thinking about the broader question of what really matters in investing:

Is it the business itself, or is it the management that makes the biggest impact on long-term returns?

I don’t have a definitive answer, but it’s something I constantly wrestle with. And it’s something we will explore in this deep dive as the answer is very relevant to a potential CSI or Topicus investment thesis, where management’s ability to deploy capital efficiently seems to outweigh other weaknesses.

The Software Selloff

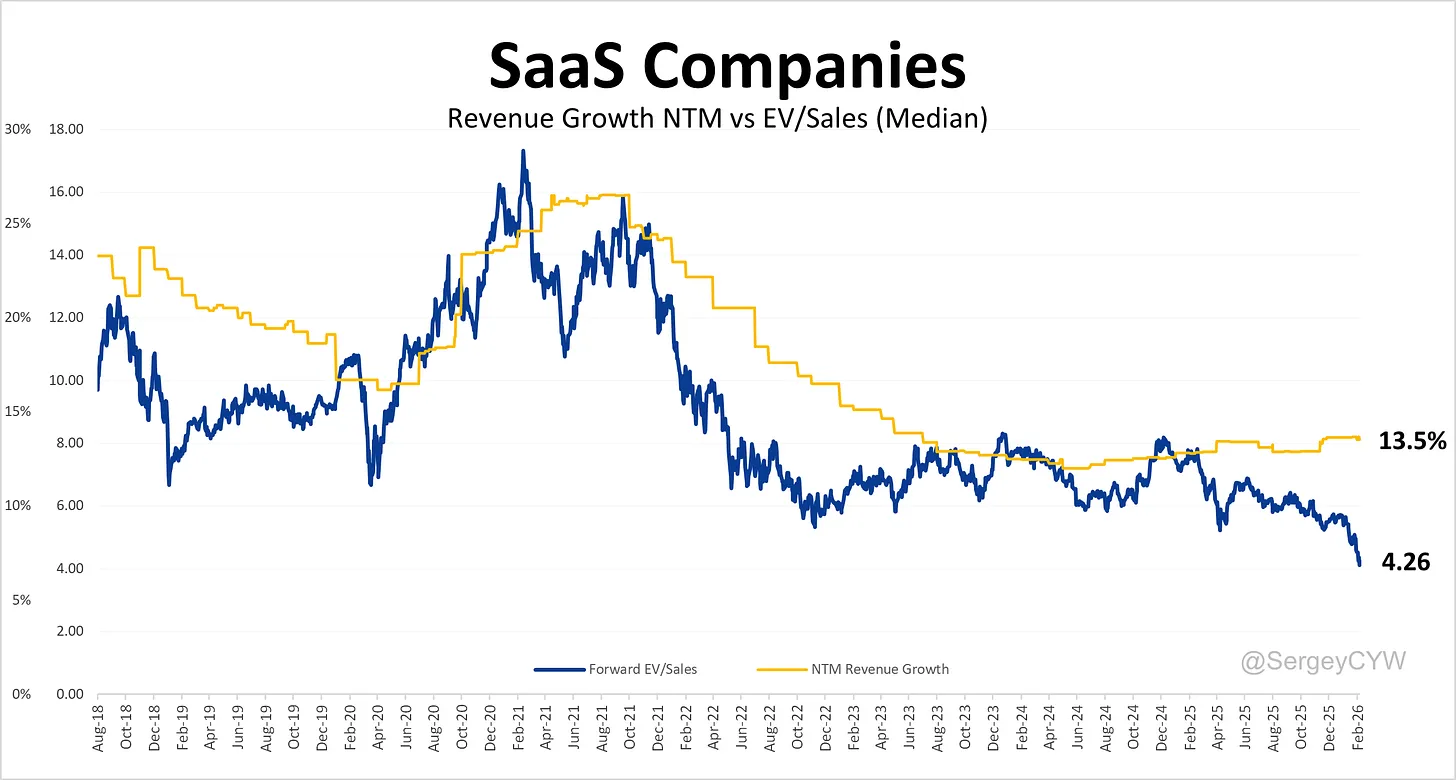

When we concluded our serial acquirers deep dive around a year ago, we didn’t find any opportunities that got us excited from a valuation point of view. Today, as most of my readers will know, valuations in anything software-related have come down significantly over the last few months.

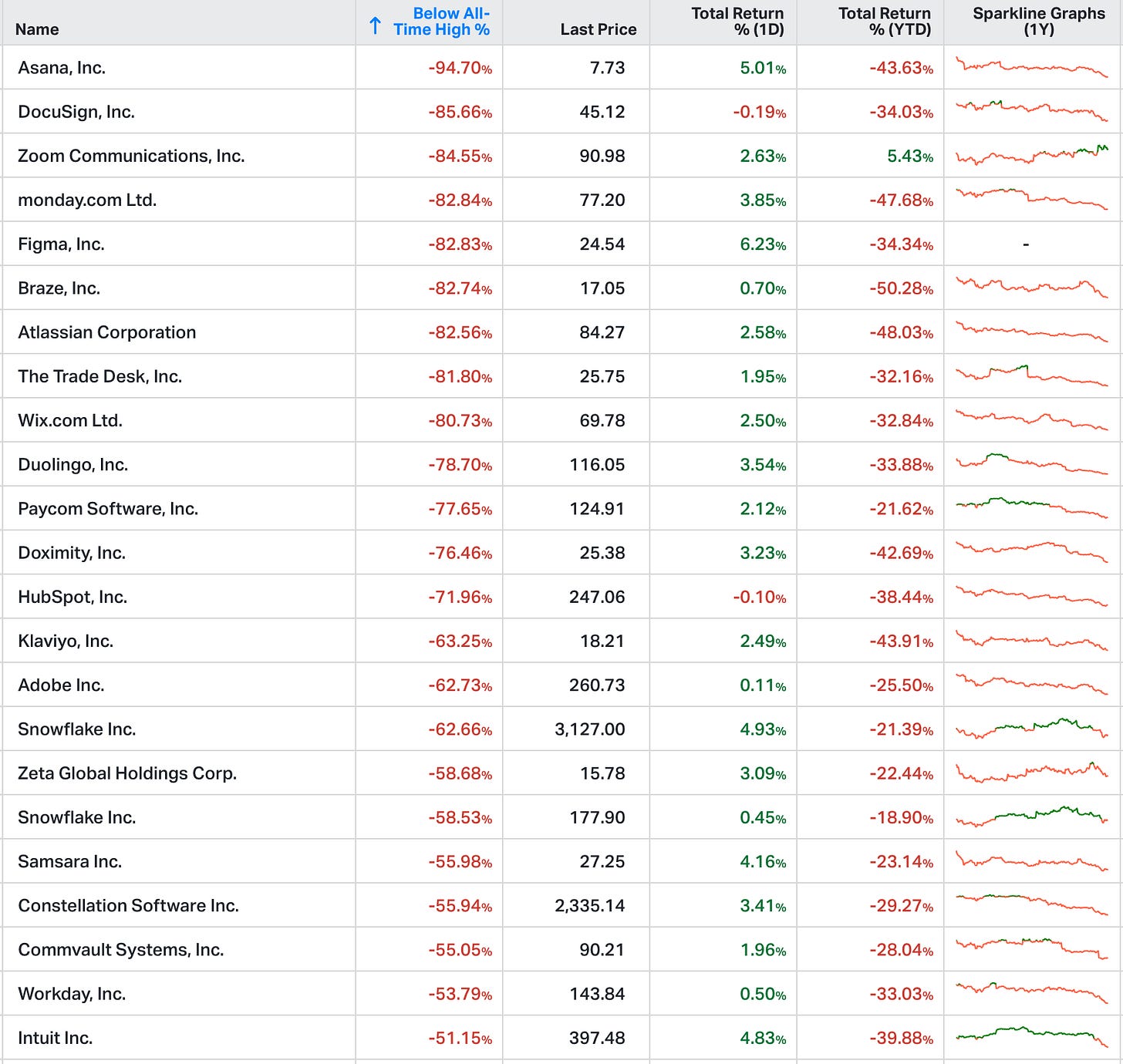

The software space, and specifically the SaaS industry, is currently experiencing what some are calling the “SaaSpocalypse” or “SaaSmaggedon.” The valuation of software companies – especially those in the SaaS category – has taken a BIG hit, and the market seems to be in the midst of a major reset. A lot of the high-growth, high-valuation software stocks have been hit hard, as we can see in the three charts below. Software stocks have experienced huge declines, particularly in the past year, as AI-driven fears, coupled with broader economic pressures, pushed valuations lower across the board. And arguably to levels that now make an entry attractive.

Or at least it is intelligent, contrarian investors’ duty to take a look…

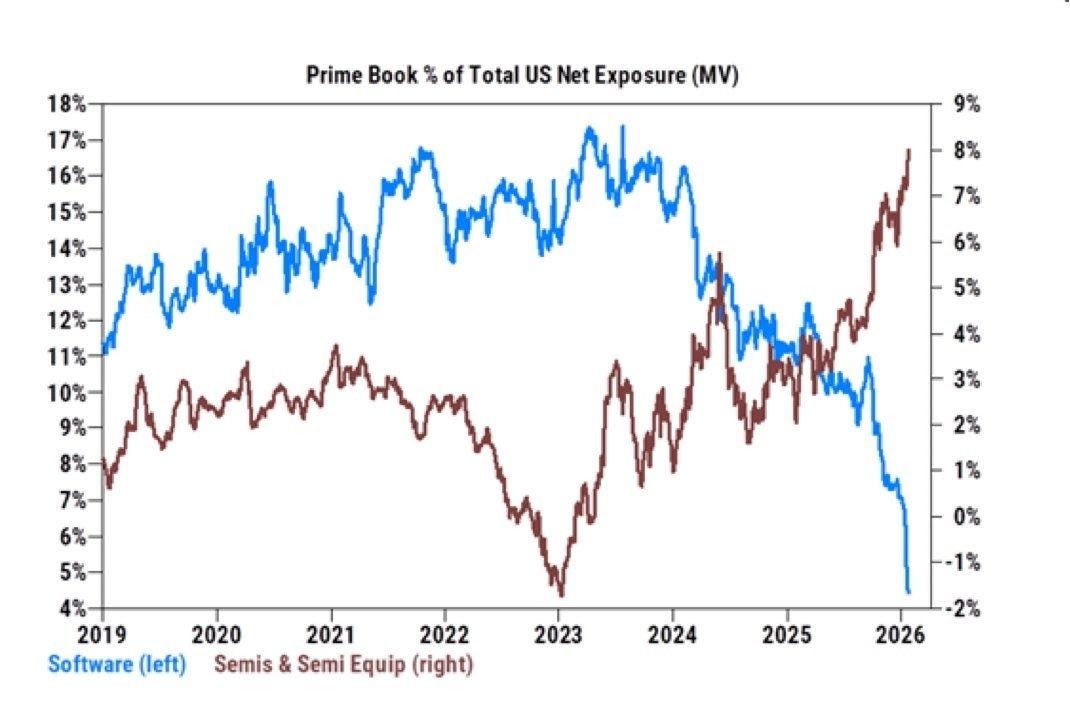

Take a look at the first chart: it compares the prime book percentage of US net exposure between software and semiconductors (the blue and brown lines).

The software sector had been on an upward trajectory, peaking in 2023, but ever since, the sector has been on a steady, and more recently quite sharp, decline, diverging sharply from its semiconductor counterpart.

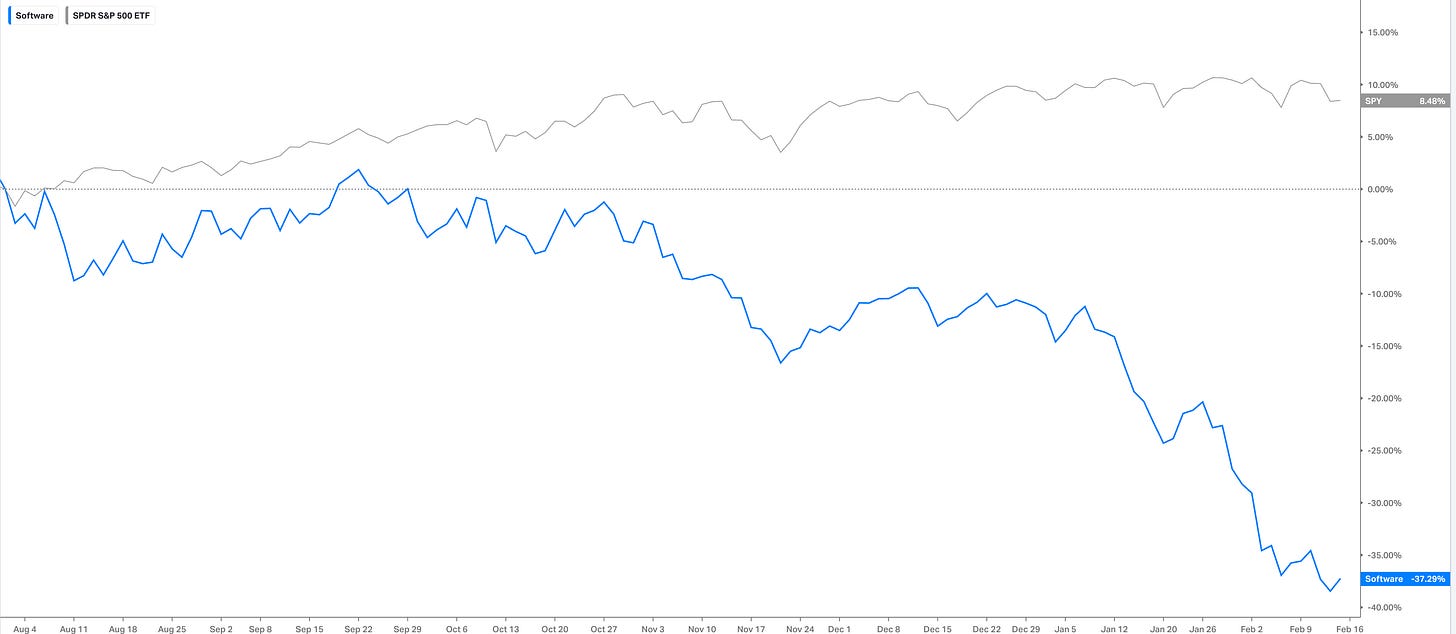

Then, in this second chart (below), we can see the 1-year performance of an equal-weight basket of 31 software stocks – a massive 37.29% drop, underperforming the S&P by a staggering 45%+, showing how dramatically the market has turned on software companies in the past year. This is a clear indication of how growth stocks (especially in tech) have fallen out of favor.

In many ways, this broader sell-off makes it seem like the entire software sector is in trouble. Yet, I believe there’s a distinct lack of nuance in how the market is treating different types of software companies. Software is being viewed as one giant category, without differentiating between SaaS companies that are vulnerable to AI disruption and VMS companies like Topicus, which arguably are far less exposed to the risks of AI replacing their core offerings.

Yet, my equal-weight basket of VMS-/software-focused acquirers (Chapter Group, Lumine Group, Topicus, Roper Technologies, Constellation Software, and Vitec Software) also underperformed the market by a large magnitude (an even bigger one).

This brings me to a key point: Vertical Market Software (VMS) is arguably, in many ways, a safer place to invest in software today. Unlike general SaaS firms that compete on coding costs, VMS companies compete on trust and reliability. Their products are often deeply embedded in their customers’ operations – mission-critical solutions that simply can’t be replaced by AI in the near future. Switching costs are high.

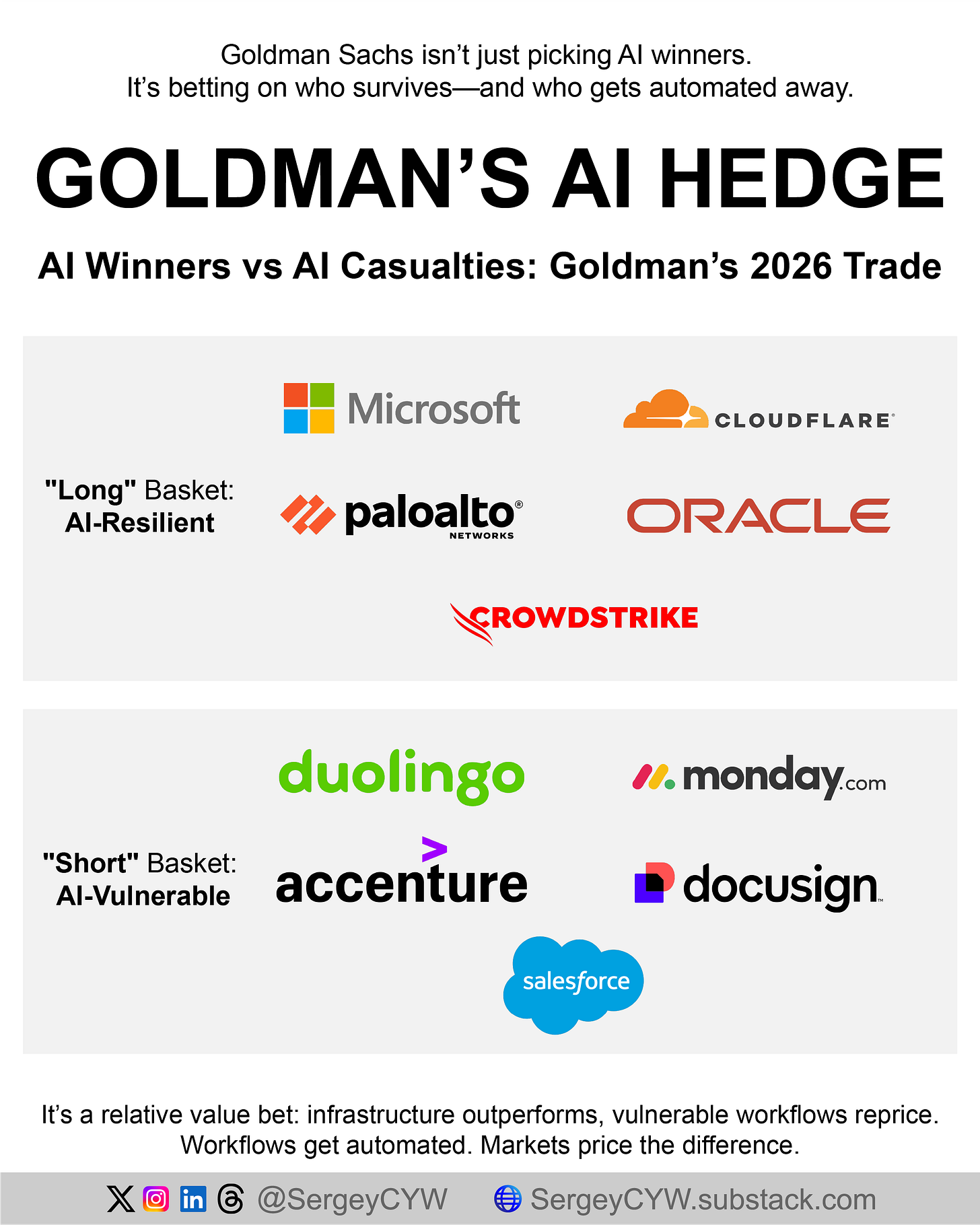

In the broader SaaS market, the fear of AI disruption is real. AI tools could potentially replace simpler, off-the-shelf software solutions like Monday.com or Salesforce systems, learning platforms like Duolingo, or communication platforms (like Zoom). Goldman Sachs, in fact, proposed the following long- and short-baskets:

But again, for VMS businesses, it’s a different story. These companies have built long-term customer relationships based on the reliability of their specialized software. And while AI might be used to enhance some of these systems, it’s highly unlikely that customers will replace their mission-critical software just because a new AI-powered tool enters the market.

A Stock Picker’s Dream

So this indiscriminate sell-off across the software sector has opened up what I see as a huge opportunity for intelligent investors. While the broader market has sold off software indiscriminately, this is exactly the kind of environment where a stock picker’s dream emerges.

The market has largely lumped all software stocks together, without taking the time to distinguish between those that are particularly vulnerable to AI disruption and those that are less exposed to this risk. This is where Topicus, Constellation, and other VMS serial acquirers like Vitec Software or Chapter Group come in: these are businesses with strong fundamentals, high margins, and resilient growth that are trading at attractive multiples.

When deciding which VMS acquirer to take a closer look at, my gut feeling was that Topicus is possibly the more attractive opportunity than CSI, given the size constraints that Topicus’ parent CSI faces.

“The opportunities to consolidate different vertical software markets in Europe are even better than in the US. European vertical software markets are more fragmented and have a higher proportion of family-owned companies. […] We believe Topicus is relatively new to investors. Analyst coverage is low. We have observed the VMS consolidation playbook at Constellation and see many similar features at Topicus. We believe the company has a long runway of profitable growth in the coming years.“ - REQ Capital (2023): Our Best Global Compounders

“Also worth noting, the IRR dispersion for CSI’s small acq is greater than on the larger deals and investors now view the dispersion as even wider (and hence, greater uncertainty but hard to understand what’s priced in on that front). The quality of the additions in their acq funnel has already come down (versus the first 700 acquisitions) but that’s not necessarily a bad sign.” - A comment from The Compounding Tortoise below a recent Substack note

Alright, it's time to finally move on to the deep dive. As we transition into the analytical work and our research findings regarding Topicus, it’s important to recognize the sheer complexity and depth of what we’re about to explore. This won’t be just a quick overview – this will be a massive research effort that will require careful analysis of Topicus’ acquisition strategy, capital allocation capabilities, growth prospects, and its place within the broader VMS market. Given the complexity of the company’s structure, ownership models, and financial intricacies, this analysis will be split into multiple parts – four in total – of a larger series. We’ll break down how Topicus differentiates itself from its peers, the risks and opportunities it faces, and the unique business model that has positioned it for long-term success. So, buckle up – this deep dive into Topicus will cover every angle you can imagine, and I’m excited to take you on this detailed journey.

Here’s what I plan cover in this series:

“BAM BAM BAM BAM BAM” 90-Second Pitch – Why Topicus and Why Now?

1) Understanding Topicus

1.1. The History of Topicus

1.2. Understanding the Ownership Structure of Topicus

1.3. Product

1.4. Business Operations

1.5. Customers

1.6. Industry & Competitive Landscape

2) Business Quality

2.1. Competitive Advantages Analysis

2.2. Other Thoughts on Business Quality

3) Management and Governance

3.1. Management Background

3.2. Integrity, Incentives, and Compensation

3.3. Capital Allocation and Management Talent

3.4. Board of Directors

4) Financial Health

4.1. Balance Sheet Health

4.2. Operating Perspective

4.3. Off-Balance Sheet Items & Hidden Risks

5) Risks

5.1. The Elephant in the Room: AI

5.2. Topicus vs. Chapters Group

5.3. The New Dutch Wealth Tax

5.4. False Moat Analysis

6) Sentiment Analysis & Thoughts on Timing

7) Valuation

7.1. Past Growth

7.2. Future Growth (including a TAM analysis & discussion of the European market fragmentation)

7.3. Topicus’ Acquisition Strategy & Track Record

7.4. Recent Strategic Move Toward Minority Stakes

7.5. My Valuation Work

Conclusion

Appendix

Disclaimer:

The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.