Deep Dive: Revisiting Novo Nordisk ($NVO)

Is Novo Nordisk Still a Strong Bet? Breaking Down the Company’s Multiple Challenges and Future Potential

Novo Nordisk has long been a juggernaut in the pharmaceutical industry, known for its dominant position in the diabetes and obesity markets. With drugs like Ozempic and Wegovy leading the charge, the company had seen an unparalleled rise, becoming a household name not just among healthcare professionals but also investors.

Its innovative treatments, particularly in the GLP-1 space, sparked tremendous optimism – so much so that Novo Nordisk’s stock surged to all-time highs, with investors seeing the company as a near-impervious growth story.

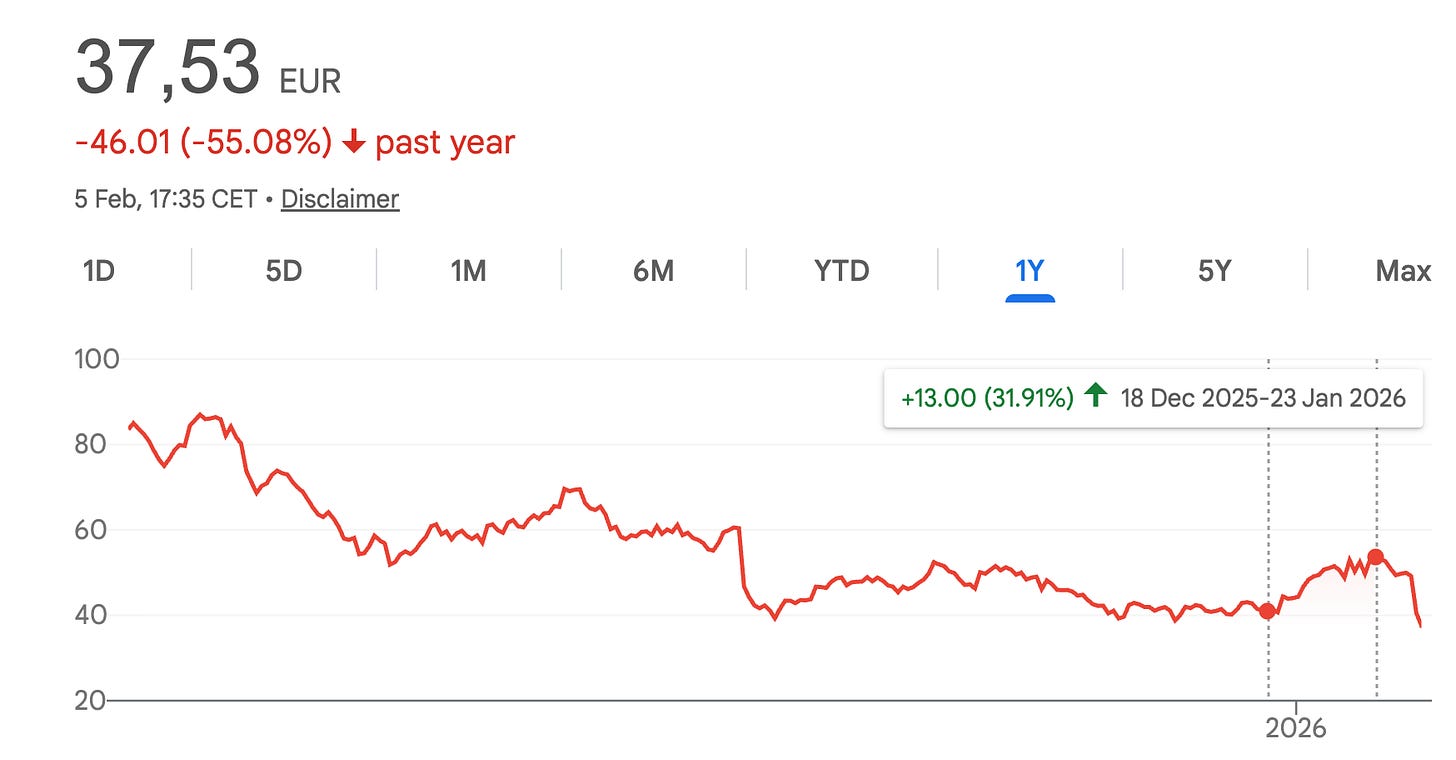

However, that optimism took a sharp turn in mid-2024. And the stock’s struggles have continued up until today. In the early months of 2026, when the company dropped a bombshell – a significant guidance cut for 2026, forecasting a sales and earnings decline between 5% and 13% – the stock dropped back to levels last seen in 2022.

This came as a shock to many who had grown accustomed to robust growth. The once-unfaltering stock price, which had enjoyed a remarkable rebound of over 30% in just a few weeks, suddenly fell off the cliff AGAIN.

Novo Nordisk is basically experiencing the worst drawdown in its public history – an eye-watering 69% crash that almost rivals the 1987 stock market collapse.

But what’s driving this (recent) volatility?

Several key events have recently played into the company’s deteriorating outlook.

First, there’s the pressure from U.S. pricing, particularly stemming from the controversial “Most Favored Nation” pricing deal initiated during the Trump administration, which is set to hurt Novo Nordisk’s bottom line for the foreseeable future.

Add to that the rising competition from Eli Lilly in the GLP-1 space, and things start to look a little more precarious.

But perhaps the biggest threat is coming from a surprising source: compounders. Companies like Hims & Hers have entered the market with compounded versions of Wegovy, offering cheaper alternatives that directly compete with Novo’s blockbuster weight-loss drug. The compounding market, which had been relatively under the radar for most of Novo’s rise, is now gaining traction. This presents a unique set of challenges: not only is Novo facing direct competition, but it’s also dealing with an emerging legal and regulatory storm, which may pose a threat to the very patent protection that has allowed it to dominate the space.

In this write-up, I’ll break down how these pressures are impacting Novo Nordisk’s business, starting with the unsettling guidance cut and moving into the growing competition from Eli Lilly and copycat players.

We’ll also take a closer look at the stock’s technicals.

By the end of this post, you’ll have a deeper understanding of whether this volatility represents a temporary blip or signals a longer-term shift for Novo Nordisk.

Is this a company facing an existential crisis, or is it merely going through a necessary recalibration before it comes back stronger than ever?