Deep Dive: Revisiting Edenred ($EDEN)

Four Ways to Value Edenred – And Why the Market Might Be Wrong

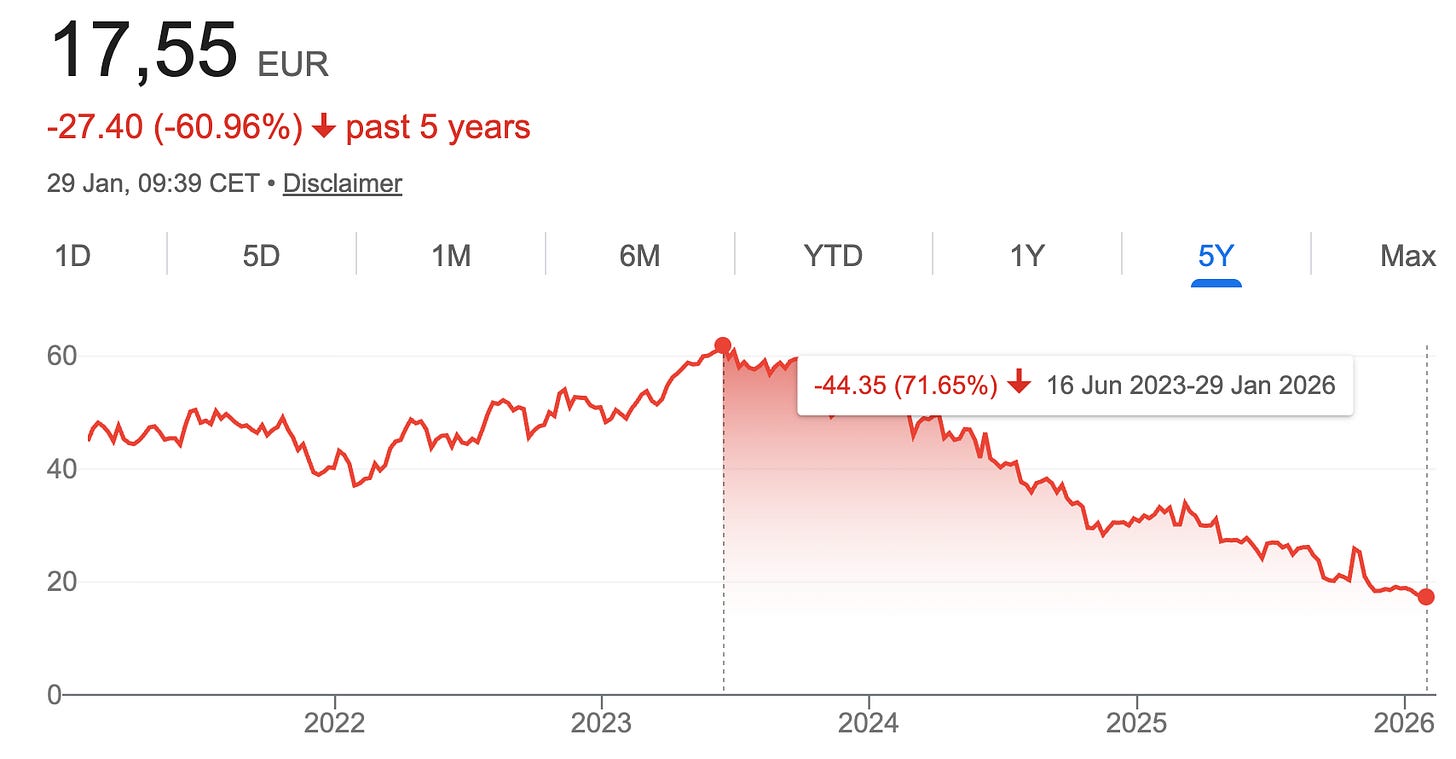

Edenred has turned into one of those stocks nobody wants to talk about anymore. The share price is down more than 60% over the past five years and roughly 70% from its peak in mid-2023. Since I first turned bullish on the stock when it trades in the low €20/share range, it has fallen another 20-25%. The trend is brutal and, so far, relentless. There is no sign of stabilization, no obvious bottom, no narrative that investors are willing to believe in.

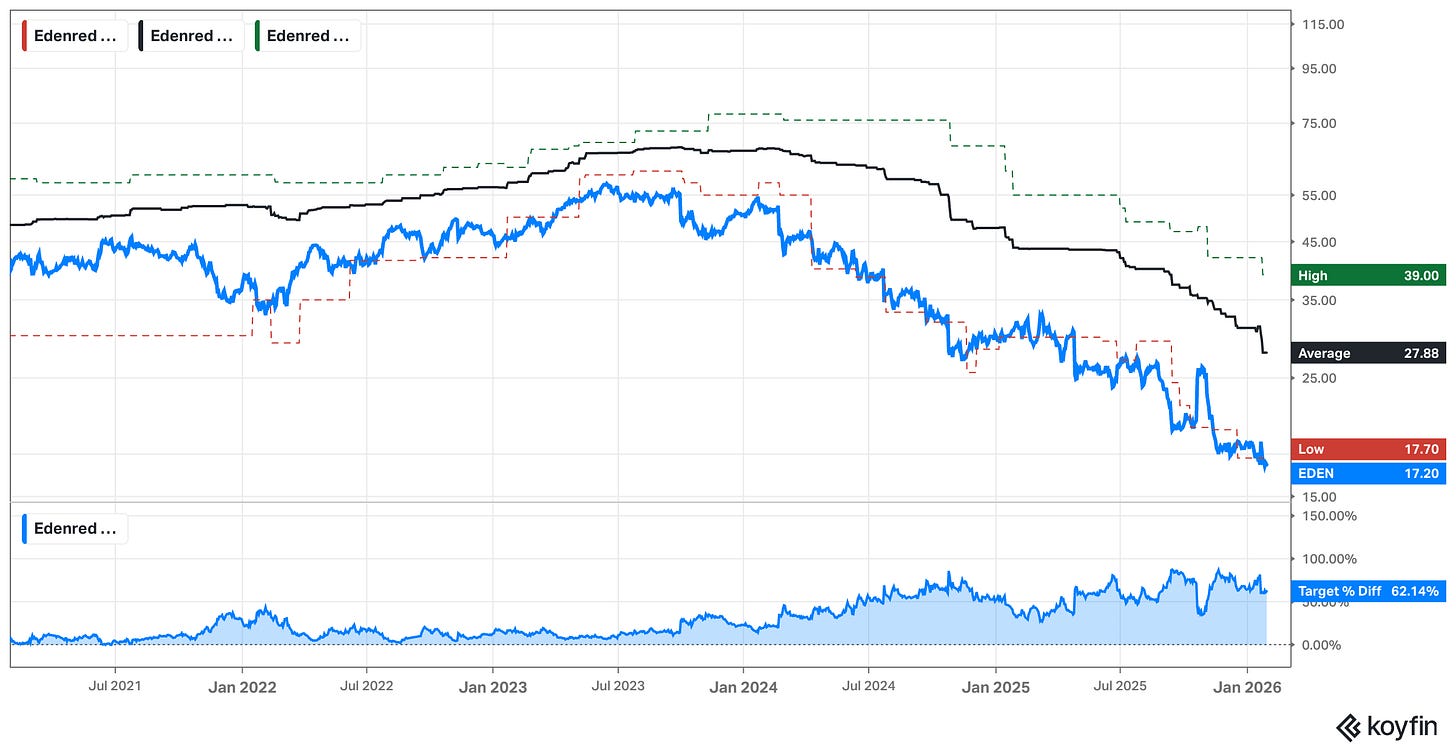

Sentiment could hardly be worse. Analysts have started to reflect this shift in tone. UBS recently downgraded Edenred from Buy to Neutral, from a 42€ price target to €19, citing regulatory uncertainty in Brazil and limited near-term visibility on earnings. The message seems to be that even after the sell-off, the market is not convinced that the worst is behind us.

This is precisely what makes Edenred so interesting. Not because the business is risk-free or misunderstood, but because the gap between perception and underlying economics has rarely been this wide. The Brazilian regulatory shock is very real. The guidance cut is real. The uncertainty is real, too. But the question is whether the current valuation already prices in a scenario that is materially worse than what the fundamentals imply.

To answer that, I look at Edenred’s valuation again, updated my prior inputs, and looked at it from four different angles:

First, a high-level valuation perspective using earnings and cash flow multiples.

Second, an assessment of how analysts like UBS are currently valuing the business and what it means for the embedded downside risk.

Third, a sum-of-the-parts analysis that separates regulated and unregulated profit pools and assigns them explicit values. Here, I conducted a scenario-based analysis that explores what Edenred could be worth under conservative, base case, and optimistic assumptions.

Fourth, valuing Edenred through the lens of shareholder distributions.

We’ll discuss each valuation angle thoroughly further below, but before we get there, let me give you a brief business update.

Disclaimer: I own Edenred shares. The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Quick Business Update Before We Get Into Valuation: Brazil – From Regulatory Shock to Legal Uncertainty

Before looking at valuation, it is worth briefly revisiting what actually happened in Brazil, because this episode explains most of the recent derating in Edenred’s share price.

In late 2025, the Brazilian government unveiled a reform of the Worker Food Program (PAT) that went materially further than what industry participants had expected, and caught both investors and the businesses themselves, who were in direct touch with regulators (or so they thought), off guard.

The proposed measures included…

a cap on merchant fees at 3.6% (vs. an estimated 7% average),

a shortening of reimbursement periods to 15 days (handicapping their float revenue; a key part of their model),

a ban on rebates and indirect financial benefits, and

the government also wants to implement “interoperability,” which effectively means merchants can accept all forms of cards and service providers, weakening the stickiness of vouchers.

Together, these changes will significantly compress margins and reduce float income, which is a meaningful contributor to profitability in the Brazilian benefits market.

Edenred reacted by cutting its FY2026 guidance from organic EBITDA growth of 2–4% to an expected decline of 8–12%. Importantly, the company did not change its medium-term outlook beyond 2026, suggesting that management views the impact as a reset of the earnings base rather than a permanent impairment of the growth trajectory.

Still, the magnitude of the guidance cut, coming just days after the Capital Markets Day, raised questions about visibility and regulatory risk.

Since then, the situation has become more complex rather than clearer. A Brazilian judge has temporarily suspended the reform as it applies to Edenred, although the government has signalled it will appeal. Edenred itself expects a definitive ruling only in late 2026 or early 2027. In other words, the company is operating in a prolonged period of legal and regulatory uncertainty, where the final economic impact remains difficult to quantify.

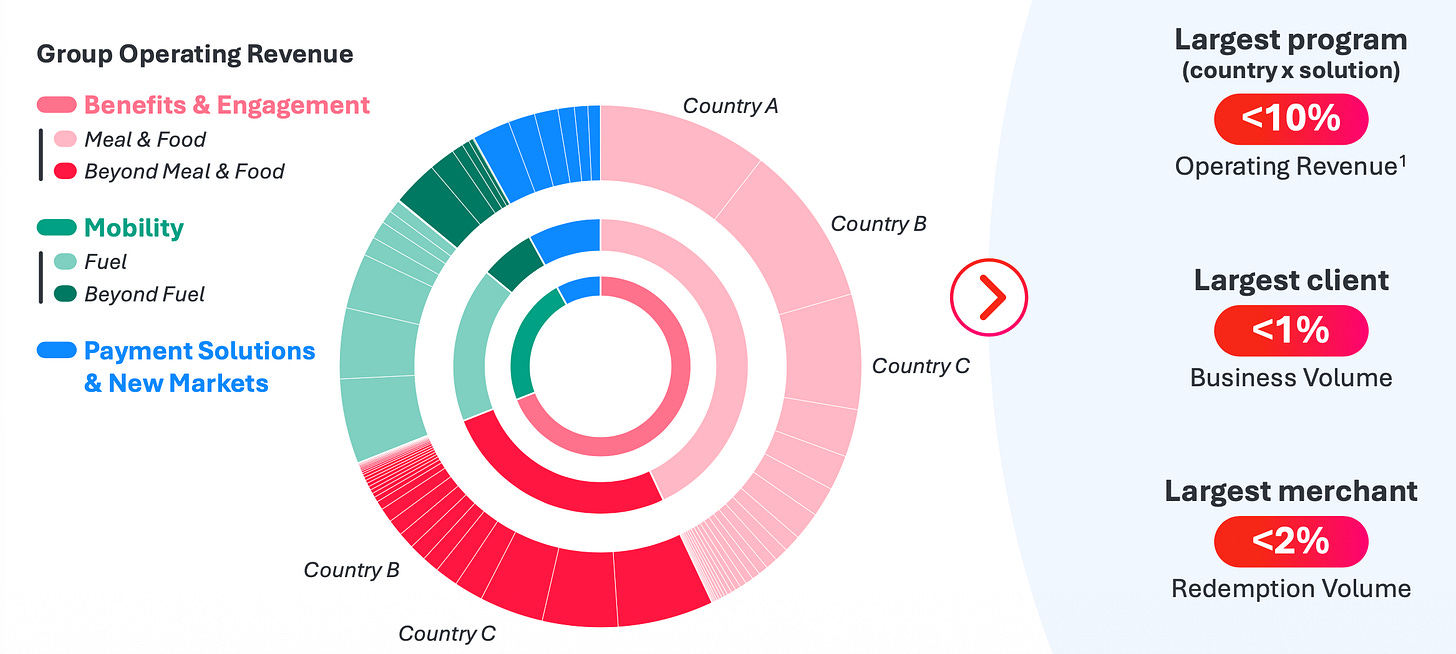

Two points are worth keeping in mind. First, Brazil represents around 19% of Edenred’s operating revenue, and only roughly half of that exposure relates to regulated employee benefits, with the rest not directly affected by the PAT reform.

Second, even in the worst case, the Brazilian business is unlikely to disappear. The more realistic scenario is a structurally smaller and less profitable market, combined with potential consolidation that could ultimately favour large incumbents like Edenred.

This is the backdrop against which the stock has been repriced. The downward trend shows NO signs of stopping.

The key question is therefore not whether Brazil is a headwind, but whether the current valuation already assumes a far more severe and widespread deterioration of Edenred’s economics than what the underlying business actually implies.

Valuation Angle #1: High-Level Overview

This is where it gets interesting

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.