Deep Dive: Revisiting Computer Modelling Group ($CMG.TO)

CMG 4.0 Hits a Speed Bump: Is the Strategy Still Intact?

When I first wrote about Computer Modelling Group (CMG) (read it here), I laid out a thesis that was equal parts cautious and curious. Here was a niche vertical market software company – quietly compounding for decades in the shadows of oil fields and enhanced recovery wells – now trying to transform itself into something broader.

CMG 4.0, the CEO called it: a strategy to evolve from single-product legacy to multi-product platform, from oil & gas cyclicality to energy transition resilience, from slow-and-steady to something more scalable and acquisition-ready.

Since then, a lot has happened. CMG reported its full-year results for fiscal 2025, and while the headline numbers don’t scream disaster, they certainly didn’t scream momentum either.

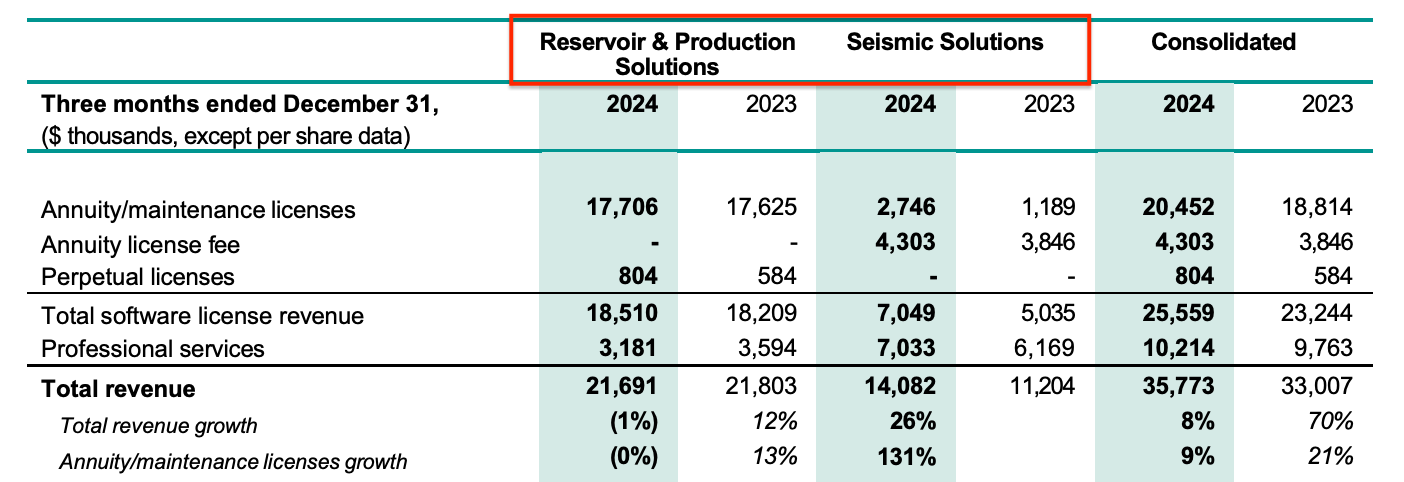

The company reported a slight increase in revenue, but a decline in revenue if you exclude inorganic growth from acquisitions, and perhaps most notably, the company chose to pull back on the segment-level disclosures. If this was supposed to be a new era of strategic clarity, that move raised some eyebrows.

The market reaction was swift. Shares dropped substantially following the release, reflecting investor disappointment not just with the deceleration in organic growth, but probably also with the reduction in segment-level transparency. It wasn’t just this quarter that spooked the market – it was what the quarter seemed to signal.

Longer term, the stock is still up from its pre-Bluware lows in 2022, but that upward trajectory has stalled. Also, over the past 12 months, CMG is down 44% and down 50% from its previous ATH.

Despite the disappointing results, CMG’s tone hasn’t wavered. The CEO’s Q4 letter doubled down on long-term thinking, reiterated faith in the M&A roadmap, and positioned the current headwinds as more cyclical than structural.

For investors willing to zoom out, the vision might still be compelling: a high-margin, software compounder led by former CSU employees with enough cash on its balance sheet to fund future acqistions, a team that seems disciplined and to have an understanding of what great capital allocation looks like, and arguably, there’s a growing sense of urgency (this can be both a positive or a negative …).

But compelling doesn’t mean easy. What we’re seeing now is a company in transition, caught between where it’s coming from and where it wants to go, and that on top of this needs to deal with the underlying cyclicality of the industry it is operating in.

In this follow-up, I want to take a closer look at how that transition is playing out – across operations, capital allocation, and investor sentiment – and whether the long-term case for CMG 4.0 still holds up.

Here’s what I will cover in this post:

A breakdown of CMG’s fiscal 2025 Q4 results and why the growth slowdown matters

Concerns about reduced segment-level disclosure and the resulting hit to investor confidence

Analyst and investor reactions to the quarter, including market sentiment around competition and transparency

Management’s stated plans to ramp up acquisitions and expand beyond the oil and gas sector

The strategic tension between maintaining a sizable dividend and pursuing aggressive growth

My current view on CMG’s positioning, my conviction level, an update on valuation, and what I’ll be watching going forward

Let’s start by unpacking the growing pains.

The full breakdown starts here:

The rest of this post covers the content outlined above. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content) is just a click away. Upgrade your subscription, support my work, and keep learning.