Deep Dive: Celsius Holdings ($CELH)

Recent Stock Drawdown, Business Quality, and Long-Term Growth Potential

Celsius Holdings ($CELH) has been a focal point in the investment world recently due to its sharp drawdown of nearly 70% over the past few months.

But even with this significant decline, the company remains one of the market’s biggest success stories in recent years, with its stock up an astonishing 2,800% over the past five years and being a 170x-bagger since 2015.

As many members of the investing community seek to understand the implications of this pullback, it’s crucial to analyze the factors driving Celsius’s growth, the challenges it faces, its partnership with Pepsi, and its place in the broader energy drink market.

Hence, in this detailed breakdown, I’ll attempt to explore these aspects comprehensively, assessing whether this dip presents a compelling buying opportunity for long-term investors.

The Drawdown: Context, Causes, and Investor Reactions

Rapid Growth Meets Market Realities

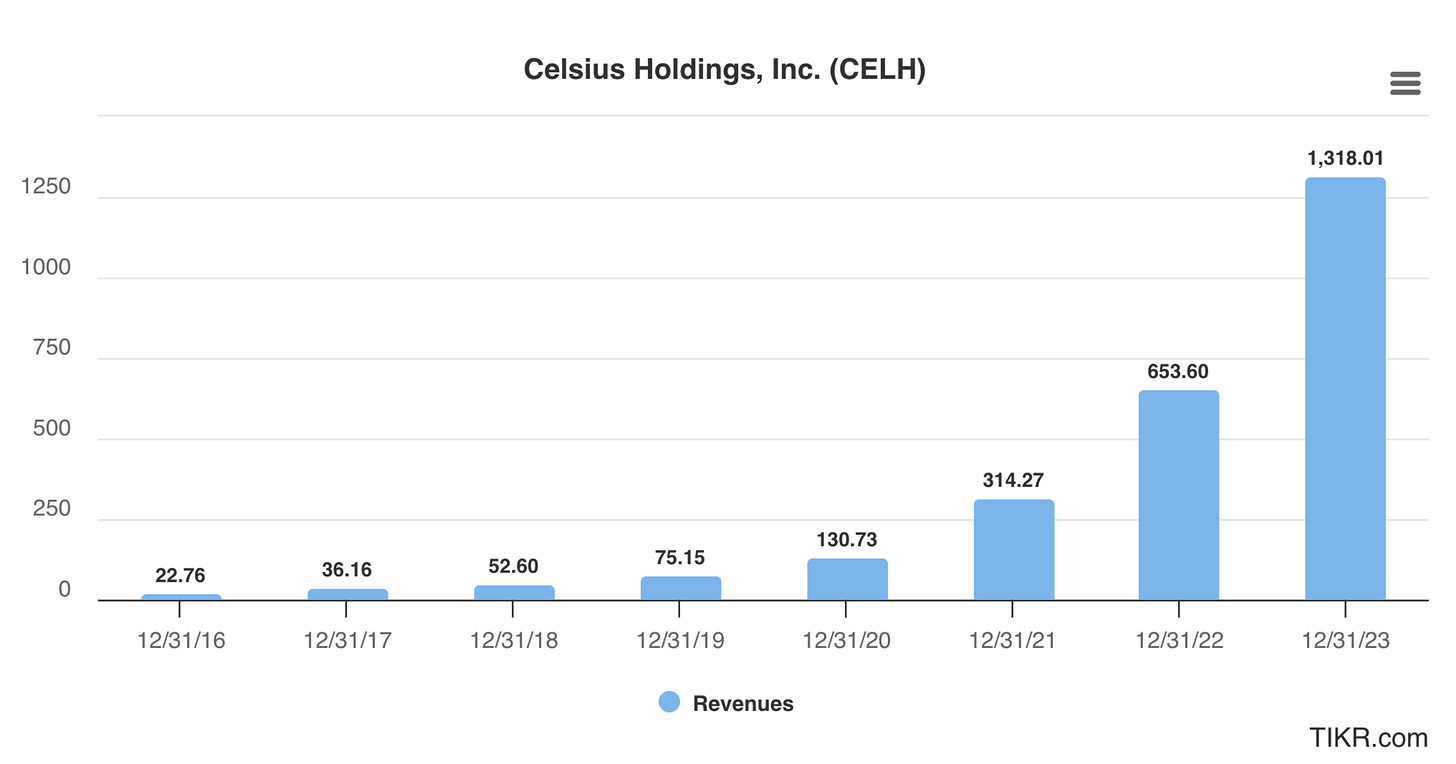

The recent 70% drop in Celsius's stock price has been alarming to many investors, especially given the company’s history of remarkable growth. From just $22 million in revenue in 2016 to nearly $1.5 billion today (over the last 12 months), Celsius's rapid ascent has been nothing short of spectacular.

However, the same high valuation multiples (above 40x sales at one point!) that celebrated its crazy-high growth (above 100% YoY at one point) also set the stage for a significant correction when the growth rates inevitably came down (to 23% YoY as of the most recent quarter).

Despite a revenue growth slowdown, what investors need to understand is that as Celsius transitioned to its new partnership with Pepsi, some of its reported revenue gains were influenced by a one-time inventory build-up/overstocking by the distributor (Pepsi).

The inventory destocking on Pepsi’s end is estimated to amount to $100-$120 million for Q3 of 2024 and is expected to significantly impact Celsius's sales and profits for both the third quarter and the full year of 2024.

As a result, the company adjusted its forecasts to align with a more sustainable growth rate. The stock correction reflects these adjustments and the market's recalibration of its expectations.

All of this caused investor anxiety as investors were (and still are) unsure how much of the growth slowdown is attributable to the frontloaded sales to Pepsi (which is now naturally, yet temporarily, ordering less) and how much to an actual slowdown of consumer demand.

Assessing The Quality of Celsius’s Business: The Jewel of the Beverage Industry?

During a recent investor call, Celsius’s Chief of Staff, Toby David, made a compelling statement by describing the energy drink category as the "jewel of the beverage industry."

This assertion underlines the immense profit potential and demand stability (which in turn increases predictability) that energy drinks bring to the market.