Brockhaus Technologies and the Fragile Foundation of Policy-Driven Demand

Updated Thoughts on the Brockhaus Technologies Story

I’ve spent the last few weeks revisiting Brockhaus Technologies with a more skeptical eye. Not because the underlying concept of combining high-margin niches with a platform-like Bikeleasing business has broken, but because the market’s message is becoming hard to ignore.

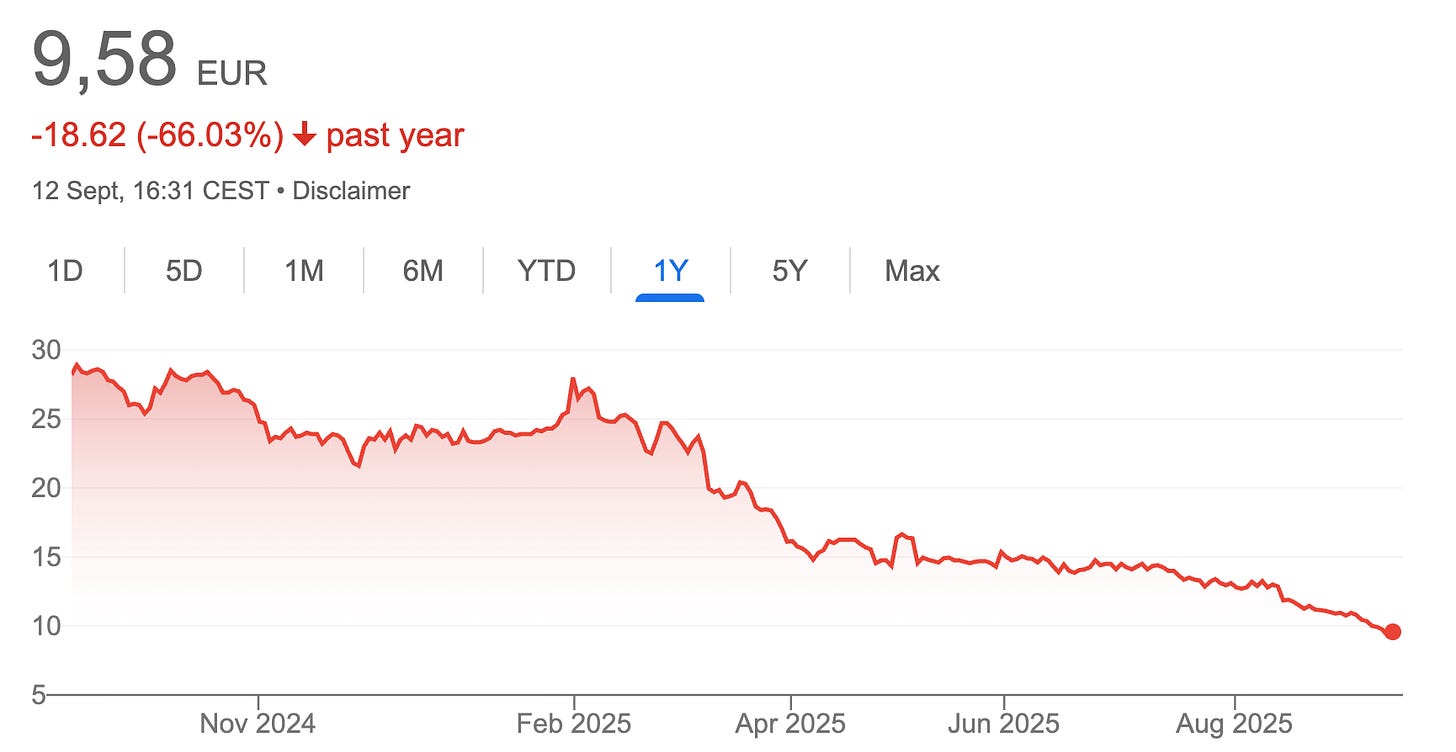

The share price has now slipped below the 10 €/share mark – a level that might be psychologically important for traders, even if I don’t base my own investment decisions on round-number thresholds.

What matters more to me is that the selling pressure doesn’t seem to ease. And as much as I like to think in fundamentals rather than charts, price often drives narrative. Watching the stock grind lower forces me to ask whether I’m overlooking something.

There are two major issues shaping that narrative today. The first is a credibility gap that’s starting to look baked into the multiple. Investor relations feel guarded, management offers sparse answers to straightforward questions, and shareholder outreach often meets radio silence.

None of this changes the basic unit economics of Bikeleasing or IHSE. But it does mean that trust – in management discipline, in capital allocation, in communication – is underpriced, and the discount reflects that.

The second issue might be regulatory risk. What once felt like a remote possibility now looks more tangible – to me at least. That updated view is based on a decision made in Finland, where the government proposed ending the tax exemption for employer-provided bikes starting in 2026. Framed as a budgetary necessity, the move has already rattled the local market, with trade groups warning of sharp declines in bike sales.

Germany, of course, has a slightly different political and legal architecture, with the framework codified in the Einkommensteuergesetz through at least 2030. But the Finnish case serves as a reminder that policy scaffolding can wobble when fiscal consolidation looms. And since Bikeleasing’s demand engine rests directly on that scaffolding, I can’t responsibly ignore the tail-risk, and I’ll share my thoughts in this piece.

Layered onto this backdrop is a company-specific picture that hasn’t helped sentiment. IHSE keeps stumbling, with weak 2024 results leading to covenant breaches and impairments. Brockhaus also booked sizeable non-cash charges that depleted retained earnings, limiting options like dividends or buybacks under German stock law. Add this to the lack of fresh M&A, and the “serial acquirer” story feels like it’s running on fumes for now.

None of this means the equity is broken. But it does mean that the discount assigned by the market isn’t something I can brush aside as short-term noise – if anything, I think the stock is rightfully “punished.”

My aim in this piece is to separate what’s genuinely structural from what’s fixable, assess the regulatory risk with clear-eyed probabilities, and connect that back to valuation ranges. I’ll also be candid about where my own conviction has shifted and where I still see upside if certain dominoes fall the right way.

This is where it gets interesting.

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

Choose your level of commitment and unlock your next edge.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.