Deep Dive: Revisiting Brockhaus Technologies ($BKHT)

Brockhaus Q1 2025: A Disaster on the Surface – But Something Changed

Back when I first wrote about Brockhaus Technologies (read my deep dive here), the investment case looked messy but fixable – a classic situation where market sentiment might have overcorrected, and the underlying fundamentals still seemed largely intact if you could zoom a few years out.

My original thesis leaned on solid structural tailwinds, a platform-like strategy centered around Bikeleasing, and an ambitious management team that had executed well in the past.

Since then, though, a lot has changed.

When the Thesis Gets Tested

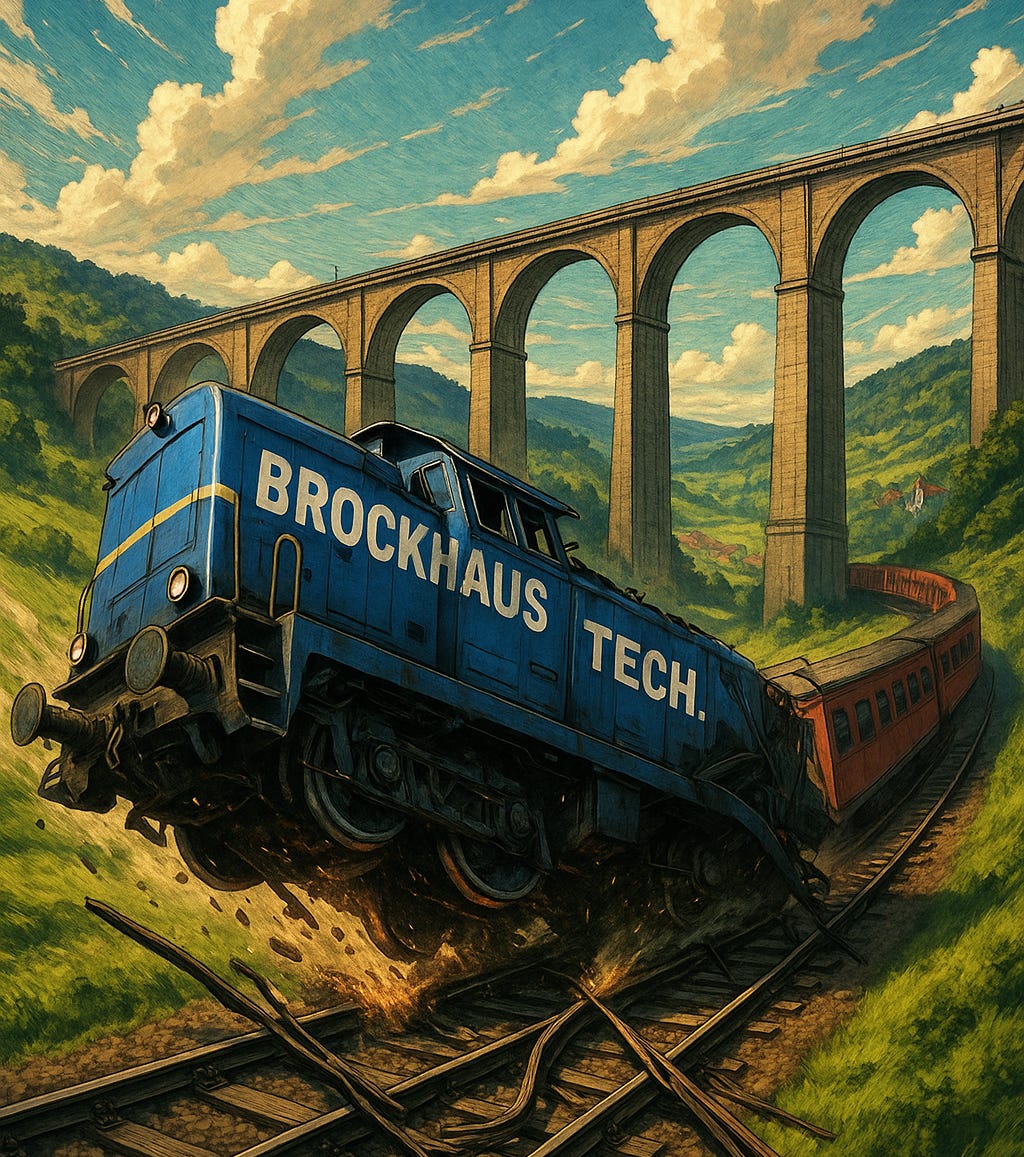

The last few months have felt like watching a train slowly derail in real-time – audit delays, governance questions, operational missteps, and one earnings disappointment after another. To make matters worse, communication from management became increasingly sparse just when investors needed it most. And when they finally did speak up, the message was often vague, reactive, or evasive.

When I first invested in Brockhaus, I sold after just a few days as the facts changed and one of the risks I highlighted in my deep dive seemed to materialize. And now, after the most recent press release and Q1 update, I’ve bought back in – at almost exactly the same price I exited.

This post is my attempt to walk you through that decision. It’s a post-mortem, an update, and a recommitment, all in one. I want to revisit what’s happened since my original write-up, break down the good and the bad in light of the latest Q1 numbers, and explain why I’ve chosen to re-enter the position – even if, by doing so, I might very well be setting myself up to look like a fool. As always, I encourage you to critically challenge me assessment.

If nothing else, I think this is a good case study in process, humility, and the ever-changing nature of public market investing. Because when the facts change, you have two choices: stay stubborn, or adapt. This is me doing the latter.

Here’s what I’ll cover in this post:

How a once-promising investment turned into a slow-motion train wreck – and what made me pull the trigger and sell.

What changed just weeks later that had me re-entering the position at nearly the same price (and why I’m surprisingly okay with that).

The 5 reasons I think the market might be too pessimistic right now – including one overlooked KPI that could change how you see the whole business.

The 5 big red flags that still make this an uncomfortable hold – and why this stock isn’t for the faint of heart.

Why, in the end, this is no longer a bet on margins or multiple expansion – but a test of management’s integrity and execution under pressure.

Let’s get into it!

Part 1 – From Yellow Flag to Red Flag to… Green Light Again? A Chronological Recap

Let’s rewind for a moment. Since my last write-up on Brockhaus Technologies, the story has taken several sharp turns – the kind of turns that challenge your conviction and force you to reassess whether the thesis still holds or is quietly cracking at the edges.