Deep Dive: Revisiting Ashtead Technology ($AT)

Ashtead Technology Dropped 23%: A Market Overreaction or Something Deeper?

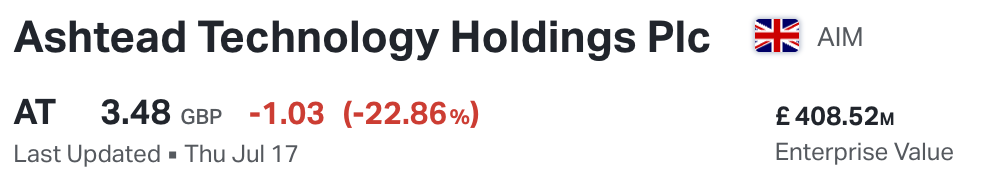

Ashtead Technology's share price just dropped another 23% after the release of its H1 2025 trading update – and that’s on top of a nearly 50% drawdown over the past year.

We’re now looking at a max drawdown north of 60% from the stock’s all-time high. Naturally, a few people reached out to me, wondering whether I’ve changed my mind on the company or whether I’d be cutting my position.

I get it. When a stock you own drops that sharply, it triggers every emotional alarm in the system – doubt, frustration, even embarrassment. The temptation to sell just to stop the bleeding can be strong.

But here’s the thing: I haven’t sold a single share. In fact, I’m as calm and committed as I was the day I wrote my original deep dive on Ashtead Technology. If anything, I feel more confident today, not less. And I think the market has completely misread what’s going on here.

This post is my attempt to unpack that in detail – to walk through the trading update, revisit the original thesis, update my valuation thoughts, and reflect on what’s really changed (and what hasn’t). More broadly, it’s a chance to talk about something I think is incredibly important in investing: how to stay grounded when prices move against you. Because if you don’t have the temperament to sit through these moments – if you haven’t underwritten the business well enough to distinguish between noise and signal – you’ll keep selling at the worst possible times.

So let’s walk through this together. Here’s what I will cover:

The sharp market reaction to Ashtead Technology’s H1 2025 trading update

How the AIM listing affects investor mindset and reporting transparency

Key insights and financial takeaways from the trading update

Why the market may have overreacted and what it’s missing

A revisit and update of the original long-term investment thesis

Deep dive into Ashtead’s acquisition strategy and integration playbook

Discussion on organic vs inorganic growth and why the distinction is often misunderstood

Updated valuation math and why the stock still looks cheap

Risks and open questions I’m monitoring going forward

You can find my initial deep dive here:

Trading Below 10× Earnings, Compounding at 20% – One of the Highest-Quality Industrial Models You Can Still Buy Cheap

Every now and then, a stock gets punished not because of deteriorating fundamentals, but because the market simply doesn’t know what to do with it. Ashtead Technology feels like one of those cases. Despite delivering blistering growth, fat margins, and exceptional returns on capital, the market seems to be looking the other way. And that disconnect is exactly what caught my attention.

AIM Listing – Blessing and Curse

Before we dive into the details of the trading update, it’s worth pausing for a second to talk about where Ashtead Technology is listed – the UK’s AIM market. If you’re unfamiliar with it, AIM stands for the Alternative Investment Market. It’s often home to smaller, more entrepreneurial businesses and comes with lighter regulatory requirements compared to the main market of the London Stock Exchange. That might sound like a technical footnote, but it actually shapes the entire investor experience – and the kind of mindset you need to approach a business like Ashtead.

Let’s start with the obvious downside. You just don’t get the same level of disclosure or financial granularity you’d see with a main market listing or a US stock. There’s not necessarily an earnings presentation, no transcript, no detailed investor deck breaking down performance across segments. Often, even the full interim results don’t come with a full P&L. If you’re used to quarterly earnings calls with slides, charts, and a clean GAAP-to-non-GAAP bridge, AIM can feel like flying blind.

But I actually think that’s part of the appeal – if you’re willing to do the work. The lack of flashy IR materials or regular hand-holding from management means you have to really think like a business owner. You can’t trade headlines or quarterly beats and misses because they barely exist. You have to understand the long-term arc of the business, the industry dynamics, the capital allocation approach, and the CEO’s strategy – and then sit with that understanding even when the numbers are sparse.

That mindset has real advantages. For one, it reduces noise. There’s less temptation to obsess over whether Q2 margins came in 30 basis points below consensus, simply because there often is no consensus. There’s no sell-side model being tweaked every few weeks. You’re not constantly second-guessing your position based on fickle sentiment shifts because sentiment, in the AIM world, tends to be slower-moving – until it’s not.

But more importantly, that information vacuum creates opportunity. When other investors panic because revenue growth dipped in one half – or when they misread a pro forma comparison – you can calmly step back and ask: Is the business still doing what I expected it to do? Is the strategy intact? Are the core economic engines of the company still compounding?

That’s exactly how I approach Ashtead. Yes, the information flow is lighter than what you’d get with a Nasdaq-listed SaaS name. But the trade-off is that the market is far less efficient. And when inefficiency meets quality, long-term ownership can be incredibly rewarding.

Ashtead has announced its intention to uplist to the Main Market of the London Stock Exchange later this year. That move might bring more attention, more analyst coverage, and yes, better reporting standards. But part of me already misses the AIM version of Ashtead – the one you have to dig into, think for yourself about, and occasionally explain to friends who ask why Google doesn’t even show the stock price when you search for it.

The full story starts here:

The rest of this post covers the content outlined above. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content) is just a click away. Upgrade your subscription, support my work, and keep learning.