Deep Dive: Edenred ($EDEN)

A 35% CAGR Setup in Europe Right Now? – How Regulatory Fear Has Crushed Edenred's Stock

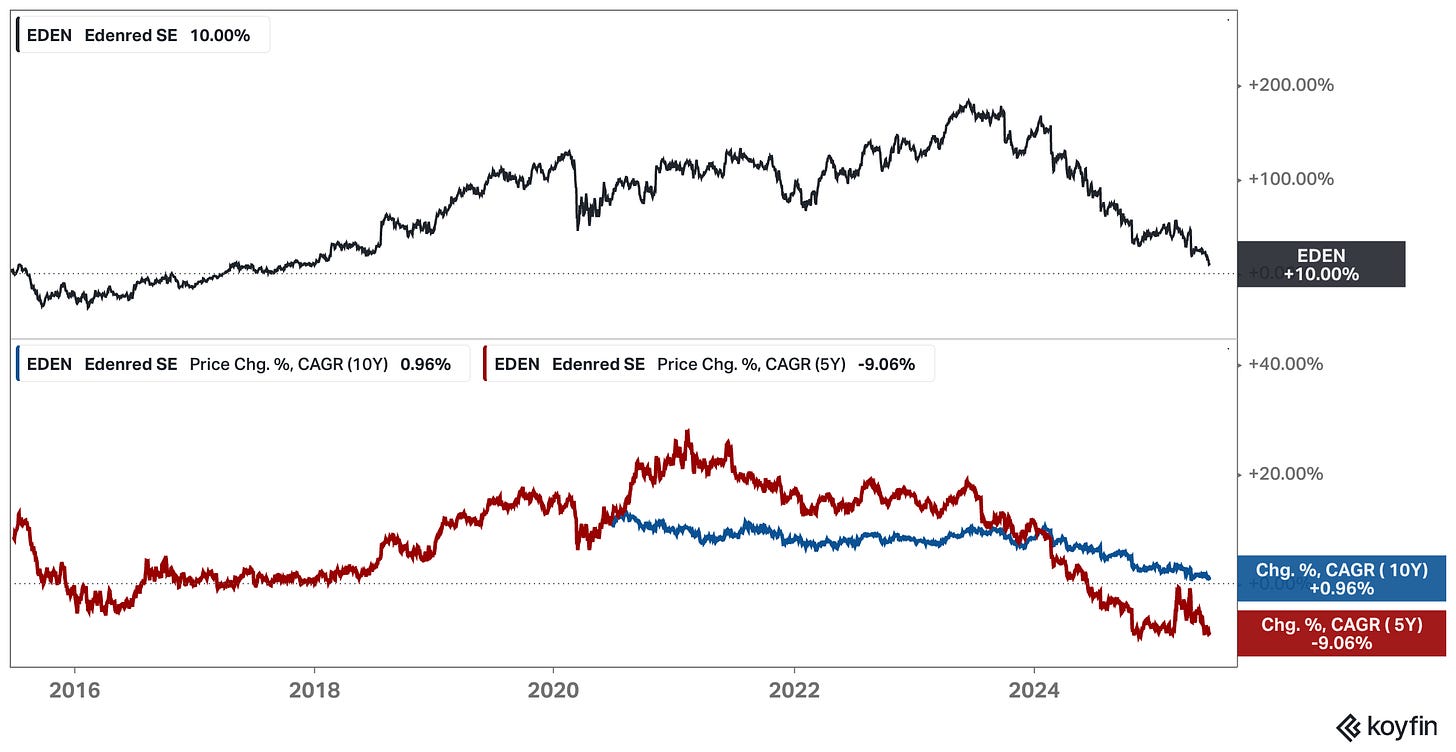

It’s not every day you come across a company that doubled its earnings, expanded its margins, scaled into new verticals and geographies… and yet delivered virtually no return to shareholders over a ten-year stretch.

That’s Edenred.

Since its all-time high in 2023, the stock is down around 60%. Even after years of solid execution, consistent free cash flow generation, and disciplined capital allocation, Edenred trades at a valuation that implies stagnation – just over 10x NTM earnings and a free cash flow yield approaching 11%.

It’s what happens when a great business experiences challenges and runs into narrative gravity: in Edenred’s case, a decade marked by increasing regulatory scrutiny, fee cap debates, and recent allegations tied to public tenders in Italy. Add the latest twist – Brazil potentially bypassing the voucher system altogether – and you get what looks like a slow bleed, capped off with a 17% drop in a single trading day this April.

But underneath the headline risk and bruised sentiment, the business itself has quietly kept compounding.

Revenue has nearly tripled since the 2010 spin-off from Accor. Margins have expanded slightly. Edenred now operates in 45 countries, with a growing presence in corporate payments, fleet and mobility, and employee engagement tech.

“Edenred is a leading digital platform for services and payments and the everyday companion for people at work, connecting more than 60 million users and over 2 million partner merchants in 45 countries via 1 million corporate clients.“ - Company’s Corporate Profile

It’s a tollbooth business with negative working capital, strong recurring revenue, and enviable unit economics – precisely the kind of model you’d expect to trade at a premium. And yet, here it is: priced for decline, priced like a deteriorating commodity business.

In this massive 21,000-word deep dive, I’ll lay out why I think Edenred is one of the more interesting mispriced assets in Europe today. We’ll dig into the business model, its competitive advantages, management, growth levers, and the risks that have spooked the market. But we’ll also ask a simpler question: when a “lost decade” is mostly a story of multiple compression, what happens if the business keeps performing… and sentiment finally turns?

Here’s a bullet-point overview of topics covered in the post:

Why I believe Edenred is a misunderstood compounder currently mispriced by the market

What Edenred actually does – including a breakdown of its business model, segments, and monetization mechanics

How the company creates value for each stakeholder: employers, employees, merchants, and public authorities

The quality and predictability of its earnings stream, including unit economics and recurring revenue dynamics

Edenred’s competitive advantages – and whether its moat/s is/are real, shrinking, or defensible

A close look at management’s background, integrity, and capital allocation track record

The state of the balance sheet, including debt, float, and any off-balance-sheet risk

A rigorous inversion of the bull case – what could go wrong, and where the market might be right to be skeptical

My valuation work, including return expectations

A final summary of the thesis and the core reasons this stock made it onto my radar now

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

Thank you for your support!

Disclaimer: I do own Edenred shares. The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Bam Bam Bam Bam Bam – Why Edenred’s Stock Deserves Your Attention

Before committing to a 21,000-word deep dive, you probably want to know if this pitch is worth your time. Is this investment right for you? Here's the "Bam Bam Bam Bam Bam" pitch, which is just under 300 words:

Edenred is a €5.8 billion market cap B2B payments platform trading at ~10x NTM earnings with a free cash flow yield above 10%. The stock is down over 60% from its 2023 peak, making it one of the rare companies to deliver consistent revenue, margin, and earnings growth while also delivering a “lost decade” to shareholders. It’s a structurally advantaged, cash-generative business with powerful network effects, but the market is pricing it like a melting ice cube. Why? Regulation fears in Italy, France, and Brazil have triggered headline risk, and investors are worried about spillover effects to other regions, while fundamentals continue to compound beneath the surface.

I think Edenred could be an attractive opportunity for five reasons:

Bam – Edenred is a tollbooth business with negative working capital dynamics and high recurring revenue, structurally built to generate cash.

Bam – It has multiple moats: network effects, regulatory expertise, and switching costs.

Bam – New verticals like corporate payments and EV mobility expand the TAM and drive faster-than-expected growth.

Bam – Despite all-time high free cash flow, the stock trades near its lowest valuation multiples ever.

Bam – Most regulatory concerns are either contained, misunderstood, or already priced in – creating asymmetric upside.

The market is missing that Edenred’s business model might be strengthening, not weakening, through this regulatory cycle. While fears around Brazil and Italy dominate the narrative, Edenred continues to grow double-digits, invest in new categories, and consolidate share in a highly concentrated industry. If the regulatory clouds lift even slightly – or if the company simply keeps executing – there’s a clear path to a re-rating and significant shareholder returns from here.

Part 1: Understanding the Business

What Does Edenred Actually Sell?

Edenred doesn’t sell a physical product. It sells access to a network, control, simplicity, and alignment – packaged as specialized payment solutions.

At its core, Edenred is a B2B2C platform that enables companies to deliver specific-purpose financial benefits to their employees: meal vouchers, fuel cards, commuter perks, or corporate payment cards. These aren’t just debit cards or branded coupons. They’re programmable, ringfenced instruments that allow money to be spent in a targeted way – at a specific time, in a specific place, for a specific category of goods or services.

That layer of control is the product. And companies, employees, and merchants all value it for different reasons.

The flagship product is the Ticket Restaurant meal voucher, which is used by tens of millions of employees across Europe and Latin America (roughly 43 million users daily). It debuted in France in 1962 and has since gone global. It allows employees to pay for meals at restaurants or supermarkets using a tax-advantaged, prepaid card funded by the employer.

It’s a classic “everyone wins” setup:

employees get more purchasing power than they would via salary,

companies benefit from lower payroll tax, and

restaurants and grocery shops gain reliable, recurring lunchtime traffic.

“For instance, if you have a EUR 10 voucher, you tend to spend EUR 15. So the actual luncheon vouchers account for EUR 9 billion or EUR 10 billion and another EUR 5 billion in additional expenses or additional spending.” - 2025 AGM

Over time, Edenred has expanded this core model into several adjacent categories. In Mobility & Fleet, companies can equip employees or commercial drivers with fuel cards that track usage, enforce restrictions (e.g. fuel-only purchases), and consolidate all expenses for reimbursement and tax optimization.

Edenred recently expanded this offer to electric vehicles as well: the 2023 acquisition of Spirii enables Edenred users to pay for charging across more than 500,000 charging stations globally and even get reimbursed for home charging.

There’s also a Corporate Payments segment that lets companies handle B2B transfers through single-use virtual cards, turning accounts payable into a rebate-generating, fraud-resistant workflow.

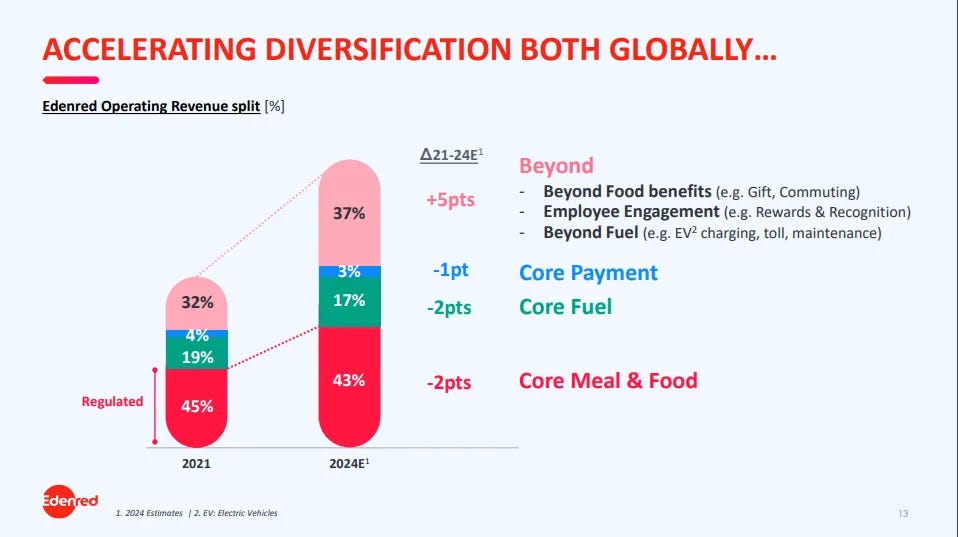

An important distinction is the one between regulated and unregulated revenue.

Regulated revenue stems from products that are tightly bound to public policy frameworks – like Edenred’s Ticket Restaurant meal vouchers, which benefit from tax exemptions and legal caps on usage. These offerings are typically stable and recurring, but also constrained by legislation and dependent on government support.

In contrast, unregulated revenue comes from purely commercial solutions such as virtual corporate payment cards, employee rewards, and fleet services that aren’t tied to public tax incentives or regulatory schemes. These offerings give Edenred much greater flexibility to innovate, scale, and capture margin.

This difference matters because it shapes how Edenred grows. Regulated products often offer defensive qualities and long-standing client relationships, but they grow slowly and vary by jurisdiction. Unregulated offerings, on the other hand, are Edenred’s main lever for expansion – they open doors to new industries, allow global rollouts without needing legal harmonization, and carry fewer compliance burdens.

Understanding this distinction is crucial to grasping the company’s long-term strategy: use the resilience of regulated revenue as a foundation, while aggressively pushing into unregulated solutions that can drive faster, more profitable growth.

What ties all of the above-mentioned products together isn’t the sector. It’s the idea of pre-configured, purpose-specific payments. Edenred allows money to move in a controlled, visible, and tax-optimized way. That might sound abstract, but it solves real-world pain points: HR teams save time, CFOs increase benefit ROI, employees get more value, and small merchants get paid quickly and reliably.

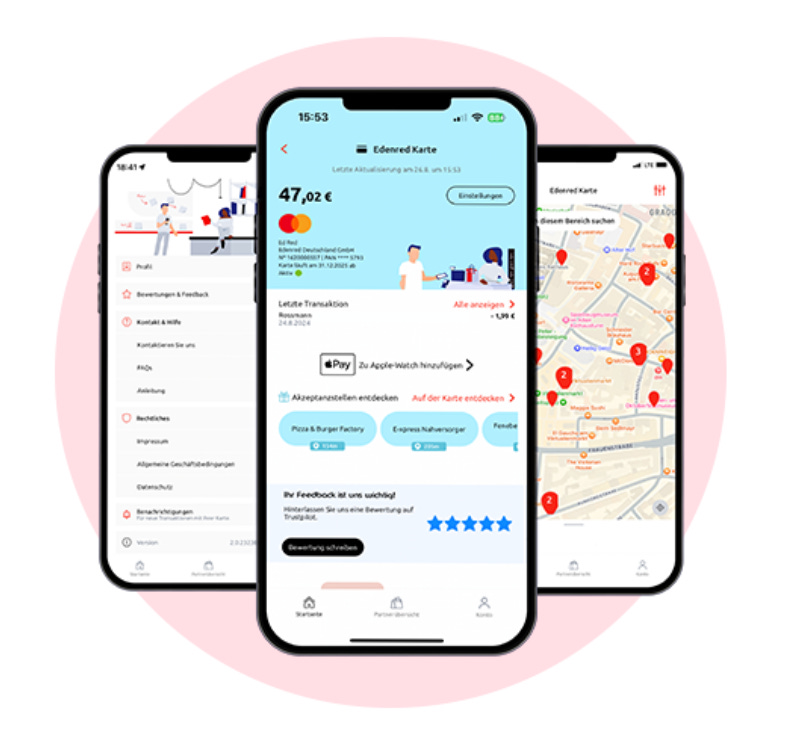

This is not a commodity. Edenred’s products are highly differentiated by both user experience and network reach. Unlike a basic bank card or digital wallet, Edenred’s solutions come with granular spending controls, sophisticated backend reconciliation, real-time app functionality (via MyEdenred), and often a large ecosystem of merchant perks.

The ability to integrate multiple services – like meal, transport, rewards, and even peer recognition – into a single interface is something competitors have struggled to replicate. And that differentiation is only growing: Edenred is now embedding services like Reward Gateway, an employee engagement platform it acquired in 2023, to combine “hard” benefits (meal/fuel cards) with non-monetary and monetary “soft” ones (peer shoutouts (a digital “thank you”), discount catalogs, recognition tools).

“…we have an increased share of platform-based revenue. Why? We did some strategic acquisitions over the last 2 years, Reward Gateway in Benefits & Engagement and Spirii in Mobility. And the two businesses of those companies are increasing the part of revenue that is coming from client setup fees and platform subscription fees. [...] And then once the platform has been deployed, you have subscription fees, and you charge per employee per month fees to Reward Gateway client, but we do the same at ProwebCE as well in France. And then you have a program management fees. Especially in Mobility, you can charge fee per vehicle per card, you charge for the toll box or for the freight. So those revenue, the platform subscription fees are recurring revenues, and you see that we expect them to grow strongly in the coming years.” Earnings Call on February 20, 2024

In terms of market position, Edenred operates in the mid- to high-tier segment. It’s not trying to be the cheapest provider. Instead, it offers a premium experience – complete with broad acceptance, seamless integrations, and high-quality tech. That positioning is strategic. Corporate clients aren’t price-shopping; they’re outsourcing an annoying, sensitive part of their HR or finance stack. What they want is trust, automation, and flexibility, and Edenred delivers that better than almost anyone else.

As for the product pipeline, there’s plenty in motion. Edenred is expanding into new verticals like general-purpose corporate cards, experimenting with hybrid benefit wallets for remote workers, and rolling out new use cases in underpenetrated markets. The vision is clear: become (or remain) the “everyday platform for people at work,” handling everything from lunch to logistics to recognition. That future isn’t a pivot – it’s an extension of the model Edenred already runs exceptionally well.

So while the company doesn’t sell consumables or durable goods, what it does sell – regulated, value-added access to money – is arguably much stickier. If Edenred vanished tomorrow, thousands of HR departments would scramble, employees would feel a drop in net income, and restaurants across Europe and Latin America would see fewer customers at lunch.

A Payments Engine Hidden in Plain Sight

To understand Edenred’s business model, you have to look past the plastic cards and branded apps and focus on what really drives the machine: transactional infrastructure with a take-rate.

Edenred was spun out of French hospitality giant Accor in 2010 and began life with a single product – Ticket Restaurant meal vouchers – and a deep concentration in France. From there, it expanded geographically across Europe and Latin America while layering on new verticals: fuel cards, employee gifting, and more recently, corporate payments and digital employee engagement. What hasn’t changed is the core mechanism: Edenred facilitates specific-purpose spending between employers, employees, and merchants – and charges a fee to sit in the middle of that flow.

The economic engine is deceptively simple. Edenred earns revenue by taking a cut from the funds it administers. An employer tops up an employee’s meal card or mobility wallet; the employee spends that money at a participating merchant; and Edenred clips a transaction fee – usually from the merchant side. This is similar to how Visa or Mastercard make money: they charge merchants a small percentage of the transaction value.

These fees typically range between 3–5%, though they vary by region, product, and merchant type. The model is powered by volume and reinforced by regulation: in many jurisdictions, Edenred’s product is the most tax-efficient way to deliver certain employee benefits, which keeps the funds flowing through its rails.

While Edenred typically earns its revenue by charging merchants a transaction fee, employers may also contribute through various forms of payment. In some cases, companies pay platform fees for onboarding, system maintenance, or access to advanced features like custom reporting. Certain products – particularly unregulated ones such as Reward Gateway or Edenred’s corporate payment solutions – may involve subscription or service fees charged directly to employers (16% of FY 2024 revenue).

In regulated markets, employers might also bear the cost of printed vouchers or card issuance.

Employees, on the other hand, usually don’t pay anything, especially when it comes to core regulated benefits like meal vouchers.

Essentially, at the heart of Edenred’s business model lies a three-sided ecosystem (B2B2C) connecting employers, employees, and merchants.

Let me illustrate how exactly Edenred makes money with an example:

Take the example of Maria, an average employee in Spain. Her employer wants to provide her with a monthly meal allowance of €200 as part of her benefits package. Instead of simply adding this amount to her salary, which would incur significant payroll taxes, the company opts to distribute it through Edenred’s meal voucher system. This not only reduces the employer’s tax burden but also gives Maria access to a flexible, government-approved food benefit.

Maria receives a prepaid Edenred card – either physical or digital – loaded with €200 at the start of each month. She then uses it to pay for groceries at supermarkets or meals at restaurants that are part of Edenred’s partner network. From the employee’s perspective, the experience feels much like using a debit card, but behind the scenes, a different dynamic is at play.

When Maria makes a purchase, say €20 at a local café, Edenred doesn’t simply pass along that €20 to the merchant. Instead, Edenred takes a cut – usually around 5% – from the gross transaction value. In this case, the café would receive €19, and Edenred retains €1 as revenue. Multiply that by millions of users across dozens of countries, and you get a business with powerful transaction-driven economics.

Beyond this core revenue stream, Edenred may also earn income from the float – the time delay between when employers fund the accounts and when employees actually spend the money – especially in a higher interest rate environment.

Even though employers usually top up balances monthly, employees can’t use all of it at once due to spending caps. This spreads out the spend across the month (or longer), naturally creating a built-in delay in how fast the funds are used – and thus, how long Edenred can earn interest on them. The time between when employers load funds onto Edenred cards and when employees actually spend that money – known as the "spend delay" – typically ranges from 30 to 90 days for products like meal vouchers. This delay can vary depending on usage patterns, country regulations, and employee behavior. For instance, some employees may not use their full benefit each month, allowing balances to accumulate temporarily. In contrast, services like fuel cards or mobility wallets tend to have shorter usage cycles, with funds often spent within a week or two.

Additionally, the company offers a range of digital services to employers, such as reporting dashboards, compliance tools, and integrations with HR platforms, further deepening client relationships.

Ultimately, Edenred’s model thrives on volume, network effects, and favorable regulation. As more employers adopt the service, Edenred attracts more merchants, which in turn makes the platform more useful to employees – creating a virtuous cycle that reinforces its position in the market.

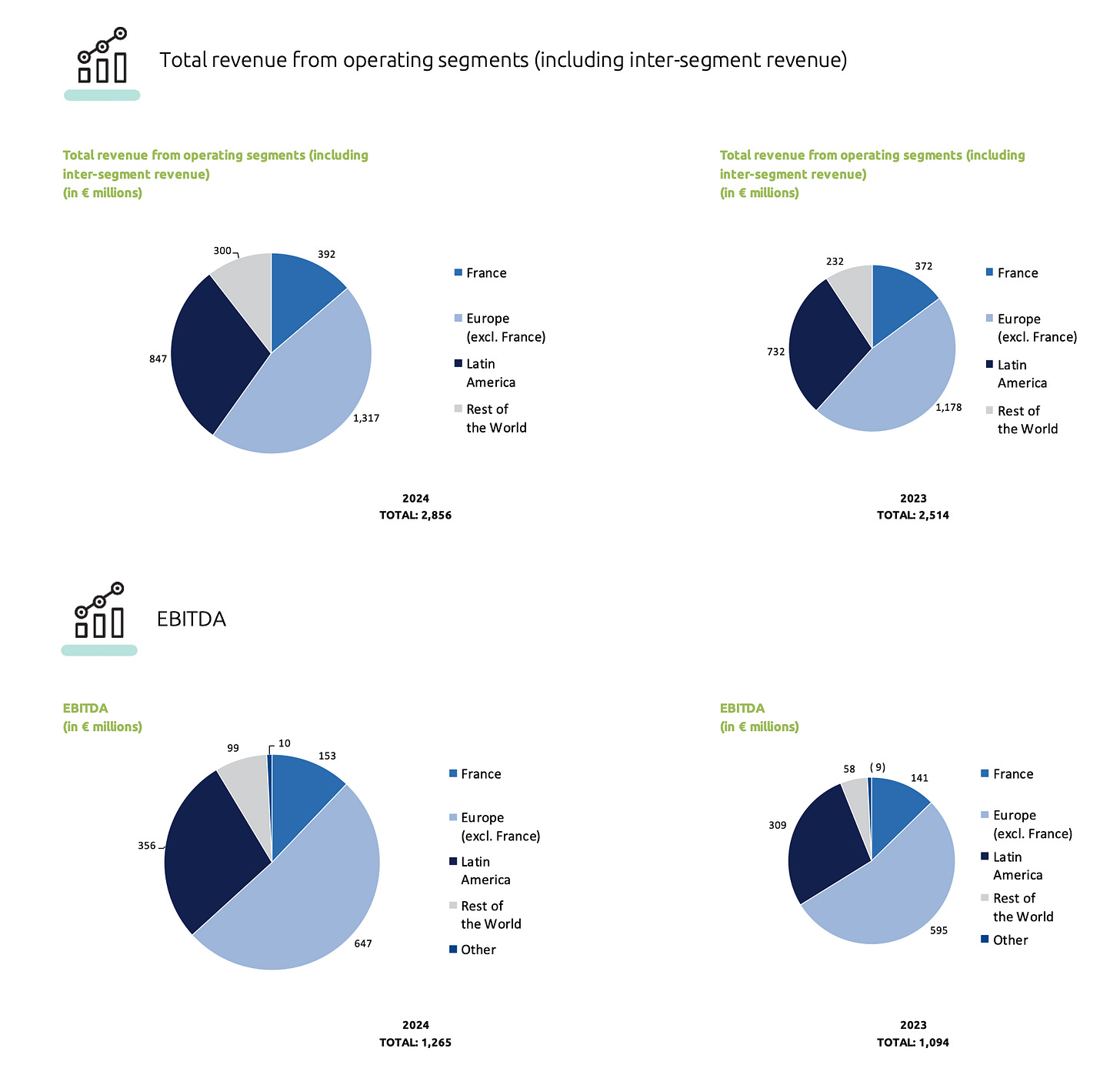

Each of Edenred’s three verticals – Employee Benefits, Fleet & Mobility, and Complementary Solutions – runs on a version of this model. It’s a business that’s asset-light, scalable, and rich in operating leverage. The key unit of analysis here is not the card, but the business volume (BV) processed across Edenred’s platforms. In FY 2024, that figure reached €45 billion, up from €37 billion in 2022. On this base, the company earned €2.86 billion in revenue and €1.27 billion in EBITDA, implying a blended take-rate of ~6.2% and a 44% EBITDA margin. Those are elite economics, especially for a firm that doesn’t hold credit risk and operates with negative working capital.

Most of Edenred’s cost base sits below gross profit, and the company actually doesn’t break down its gross profits separately. The actual delivery of its services – payment processing, app management, API connections – scales efficiently as volumes grow. Its biggest fixed costs are related to R&D, compliance, IT infrastructure, and salesforce support.

Marketing spend is modest, and customer acquisition often comes via tenders or long-term contracts, not paid ads. As a result, incremental margins are high.

Since 2016, Edenred revenue is up 2.6x while slightly expanding EBITDA and EBIT margins.

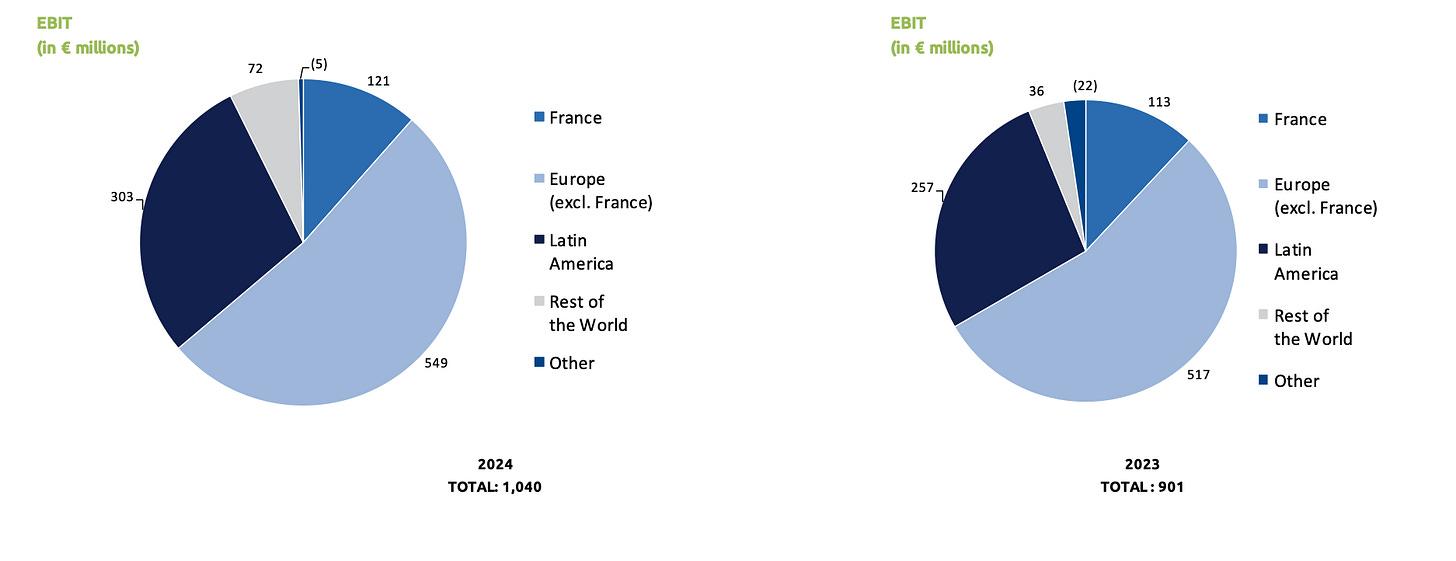

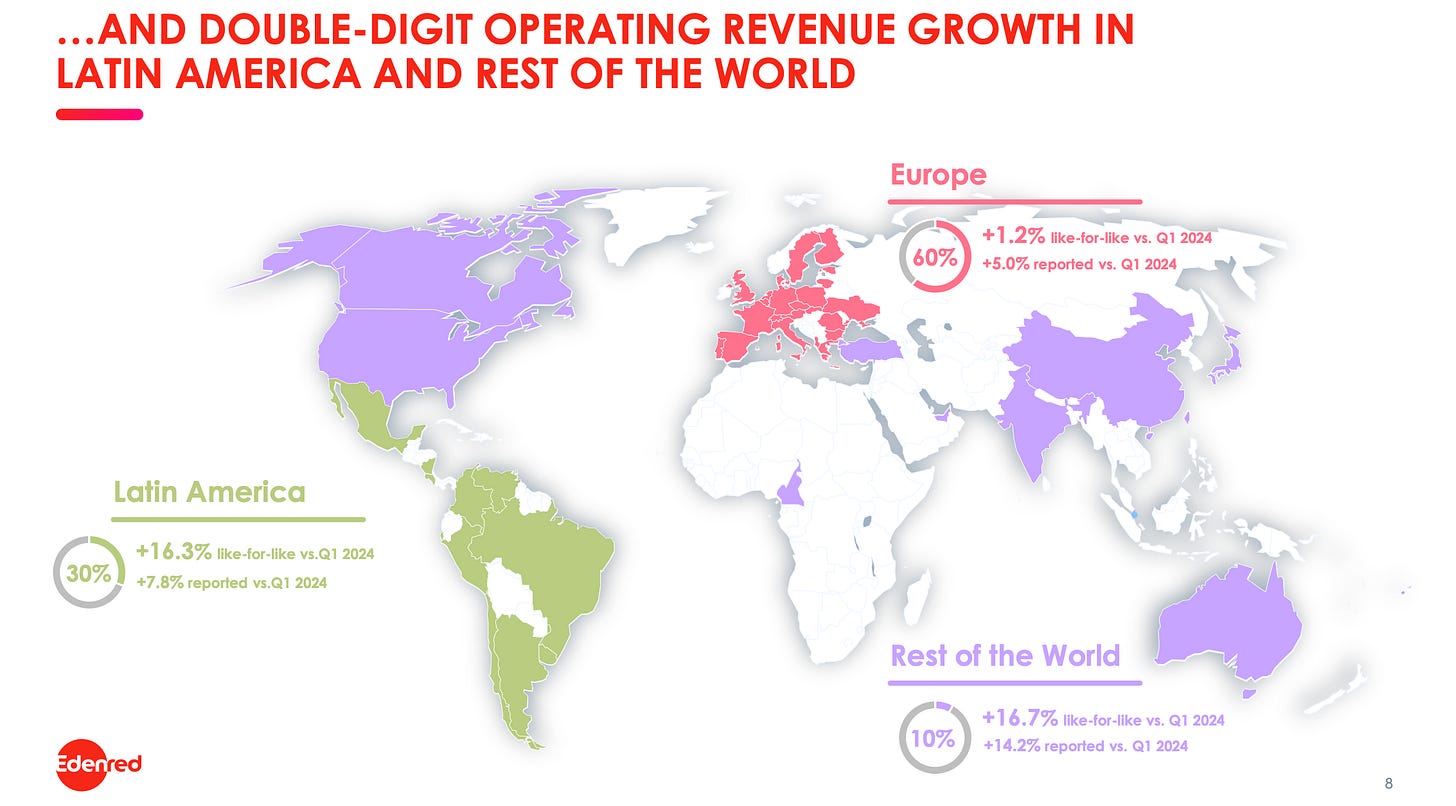

Geographically, Edenred is global, but not equally distributed.

Roughly 60% of revenue comes from Europe, with France, Italy, Germany, and the Iberian Peninsula as key markets. Latin America contributes about 30%, driven largely by Brazil and Mexico.

The remainder comes from North America and Asia-Pacific (Rest of the World; 10% of revenue).

The firm is exposed to FX swings and regulatory change, but it mitigates country risk by maintaining local partnerships, regulatory teams, and technology compliance per jurisdiction. Where possible, it localizes services and payment licenses rather than forcing a one-size-fits-all approach.

If you're wondering how cyclical this business is – look at 2020. Even during a global shutdown, Edenred remained free cash flow positive. Volumes dipped slightly, but as long as people go to work and eat lunch, benefits and fuel cards get used. That stability is key.

Edenred’s revenue base may fluctuate modestly with employment levels or mobility trends, but it doesn’t fall off a cliff. It’s a classic example of a business that might look cyclical on the surface but behaves more like a utility in disguise. And unlike true cyclical businesses, Edenred’s cash flows never entered burn mode. The model flexes without cracking.

Over time, the business has evolved from a mono-product, mono-region voucher firm into a multi-platform, recurring-revenue ecosystem. The corporate payments segment now includes single-use virtual cards and AP automation tools, with a take-rate and rebate structure borrowed from the credit card world. The Reward Gateway acquisition brought in subscription-style pricing, giving Edenred a foothold in the fast-growing employee engagement space. This is an effort to deepen Edenred’s reach into the everyday work experience and add more services per client.

The industry itself benefits from structural tailwinds: digitalization, tax complexity, HR outsourcing, and the need for spend control in large organizations.

Competitors tend to be regional players or legacy banks, few of whom can match Edenred’s product breadth or regulatory expertise.

“Then the competition, the state of the competition. Well, we've known about competition since the very beginning. You may not know this, but there are more than 100 issuers of luncheon vouchers. In Brazil, for instance, there were 15 in France and again, you might not know that. And we're talking here about lunch and vouchers, which account for 44% of our business. In mobility, all sorts of competitors also for commitments, same again. So from the very beginning, Edenred has been very much involved and aware of competition, very competition from one business to the next, and from one country to the next. But still. Then in France, well, according to our computation of the numbers from the so-called […] the National Commission for Luncheon Vouchers, the official figures, therefore, we understand that Edenred has something like 37% or 38% of the market, so we're the leading operator. On that basis and according to our calculation, apparently, in 2024, we increased our market share by 1 percentage point. So that's the dynamic situation we're in. We're the leaders, and we're still acquiring market share.“

“… who are our competitors? There's a competitor that was -- that emerged from the merger of Bimpli and Swile, they merged. And this is now the second largest on the French market. And then there's Up which is cooperative and there's Pluxee, which is in fact the spinoff of Sodexo as concerns employee benefits, and there are all sorts of others. I mentioned there were 15, but these are the 4 leading issuers. All this to say that we're -- we've always experienced competitive. And I think the 12,000 members and staff are innate competitors, I mean they love the competition. They love to be involved in a competition, and they want to win.“ - 2025 AGM

As a result, Edenred enjoys meaningful pricing power, and the ability to introduce cross-sells and new modules on top of its existing rails.

If you had to reduce the business to a few essential metrics/KPIs, they’d be: business volume, take-rate, EBITDA margin, and free cash flow conversion. Everything else – new products, new geographies, M&A – is a lever to enhance those core inputs. And so far, Edenred has done it well.

Despite the headline noise, this remains a business with high returns on capital, stable cash flow, and the kind of model that gets stronger with scale. It’s not sexy, but it’s surprisingly durable.

Who Needs Edenred – and Why They Keep Paying for It

Edenred’s core customers aren’t individuals. They’re corporations, institutions, and public-sector organizations trying to solve a very specific set of problems: how to deliver non-cash benefits to employees in a compliant, tax-advantaged, and administratively simple way. Whether that benefit is a lunch card, a mobility budget, or a virtual payment token, the goal is always the same – distribute money with strings attached.

From the employer’s perspective, Edenred solves four major pain points simultaneously:

cost control,

regulatory compliance,

employee satisfaction, and

administrative burden.

It allows HR teams to issue standardized benefits that can’t be abused, while staying within national tax frameworks and minimizing back-office work. And unlike offering higher salaries – which come with social security charges and no earmarks – Edenred’s platforms help optimize the employer’s cost base. If Edenred vanished tomorrow, many HR departments would be scrambling to re-establish a compliance-safe, tax-optimized, and employee-friendly benefit system. That pain would be very real.

So would the impact on employees. While they don’t pay for Edenred’s services directly, they’re major beneficiaries. The value of prepaid meal cards, for example, often exceeds what the employee would get in cash terms. The perks are tangible, daily, and increasingly integrated into everyday life through mobile wallets, apps, and merchant discounts. Employees who’ve used Edenred services for years come to rely on them – and, crucially, expect them. That expectation creates pressure on employers to keep offering the benefit, especially in competitive hiring markets. It’s a small but powerful form of lock-in.

On the other end of the chain are millions of merchants: restaurants, supermarkets, gas stations, pharmacies. For them, Edenred is a high-frequency, high-certainty source of foot traffic and revenue. Acceptance comes with a fee, but it also brings visibility, volume, and fast payment. In some countries, Edenred processes over 30% of daily lunch transactions, meaning a merchant who doesn’t accept it is essentially invisible to a large chunk of the workforce. That distribution power matters. And once you’ve plugged into Edenred’s ecosystem, there’s little incentive to walk away.

In terms of customer composition, Edenred’s clients skew enterprise and mid-market, mostly in formalized employment sectors with stable payroll systems. These are not cost-sensitive small businesses looking to save every euro – they’re often government agencies, large industrial employers, multinationals, and professional services firms. The underlying end users (employees) span gender, age, and income levels, but the actual purchasing decision lies with organizations that prioritize compliance, retention, and simplicity.

Importantly, Edenred’s products aren’t just convenient – they’re often embedded. In Italy, for example, the public sector widely uses meal vouchers, which then get distributed through multi-year tenders. In France, 100% of CAC 40 companies offer employee benefits like meal cards. And in Brazil, Edenred serves over 2 million companies, most of which rely on vouchers for employee food budgets due to legal and tax frameworks. That’s the key: Edenred isn’t pushing a nice-to-have. It’s enabling a regulated requirement.

Customer retention is correspondingly high (net retention rate of 104% in FY 2024). Contracts are typically signed for multiple years, and churn is low – especially where Edenred operates under long-term frameworks or holds deep merchant acceptance. While the company doesn’t directly disclose exact churn rates (attrition in business volume is < 5% though), recurring revenue accounts for a massive share of the business, and renewal rates are strong even in contested markets. Clients that leave often come back after realizing how complex it is to replicate Edenred’s infrastructure on their own or through smaller providers.

As for CAC and CLV, we don’t have exact figures – but the model is structurally attractive. Customer acquisition often happens via tenders or direct sales to HR departments, not costly consumer marketing. Once acquired, a corporate client might stay for 5–10 years, issuing cards to hundreds or thousands of employees, each generating high-margin transaction revenue. The longer the relationship lasts, the more Edenred can layer on additional services: mobility perks, digital gifting, corporate payments, employee engagement. That’s where the magic of CLV kicks in – because many of the operational and IT costs are front-loaded, while usage-based revenue continues to compound over time.

This is not a cult brand in the consumer sense, but it is a default in the enterprise benefit world. Employers don’t just use Edenred, they structure parts of their compensation systems around it.

Employees expect it, merchants depend on it, and competitors struggle to match its breadth.

It’s not the kind of business that gets praised on social media. But in boardrooms, payroll departments, and procurement teams, Edenred occupies a highly defensible position, precisely because it’s built on regulatory fluency, network density, and operational trust.

The in-depth analysis starts here:

The rest of this post covers the content outlined in the table of contents shared in the introduction. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content) is just a click away. Upgrade your subscription, support my work, and keep learning.