In 2022, tennis legend Roger Federer stepped off the court but has remained top of mind for many.

In 2024 he stepped onto the podium to deliver a commencement speech at Dartmouth College. While his inspiring words were directed at graduating students, they offer surprising wisdom for investors too!

Here are five key lessons from Federer’s speech that can help elevate your investing game.

Lesson 1: Manage Your Emotions

Federer’s first piece of advice is a timeless one: keep your emotions in check.

"I spent years whining, swearing – sorry – throwing my rackets before I learned to keep my cool," Federer admitted.

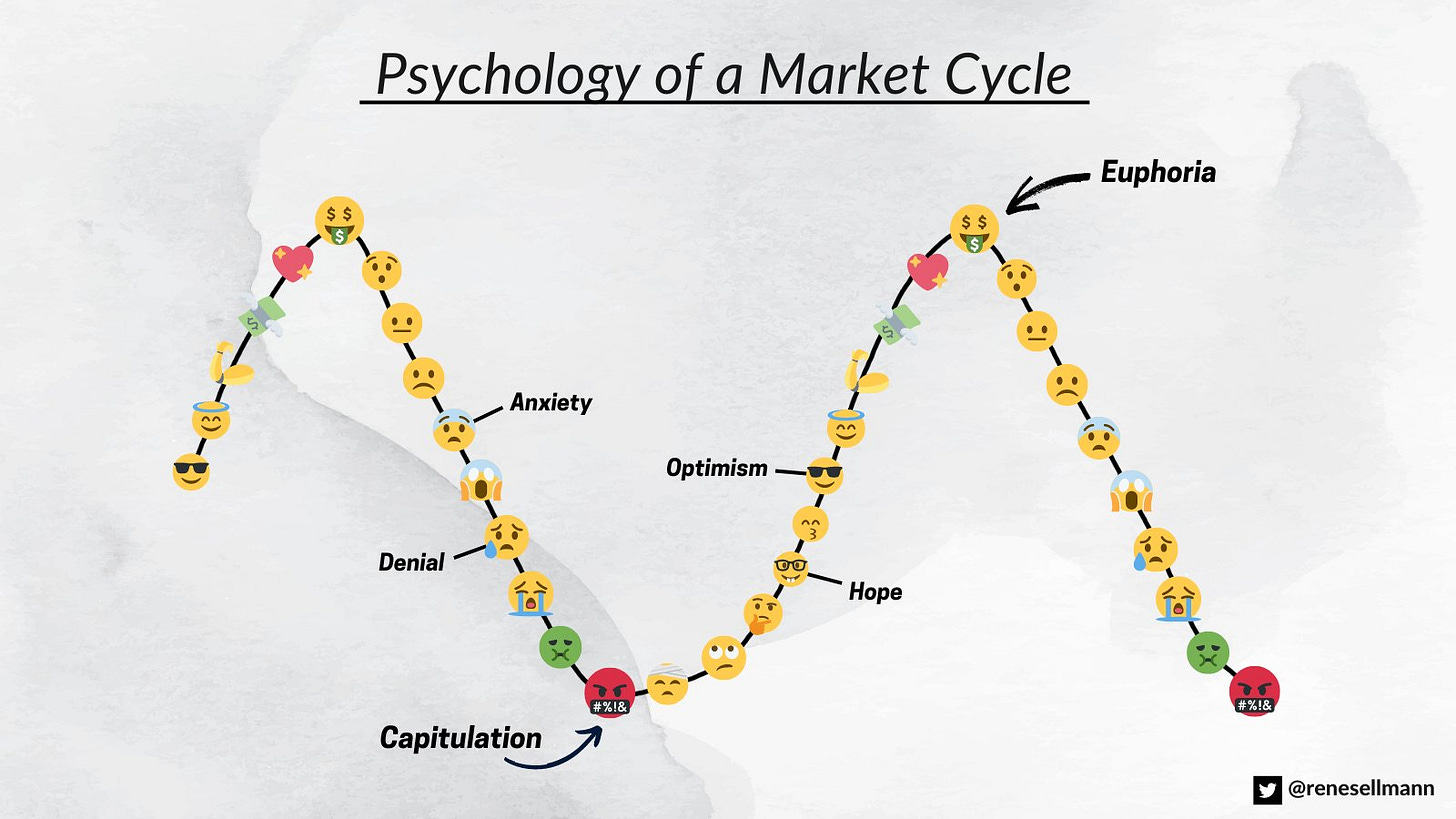

His journey to mastering emotional control on the court is a valuable parallel for investors. Emotional reactions, whether driven by fear or greed, can lead to impulsive decisions that harm long-term performance.

"Negative energy is wasted energy. You want to become a master at overcoming hard moments."

By managing emotions, investors can make decisions based on logic and analysis rather than impulses. Emotional resilience is especially critical during market downturns, when sticking to a well-thought-out plan can mean the difference between success and failure.

Lesson 2: It’s Only a Point!

One of Federer’s most striking revelations was about his win rate:

“In tennis, perfection is impossible. In the 1,526 singles matches I played in my career, I won almost 80% of those matches. Now, I have a question for you. What percentage of points do you think I won in those matches? Only 54%. In other words, even top-ranked tennis players win barely more than half of the points they play.”

The lesson for investors? Don’t dwell on individual losses or mistakes; focus on the bigger picture.

"The truth is, whatever game you play in life, sometimes, you’re going to lose a point, a match, a season, a job."

In investing, even the best decisions won’t always yield a profit. The most successful investors—like Warren Buffett or Charlie Munger—accept occasional losses as part of the process. Their success lies not in avoiding mistakes entirely but in ensuring their winners more than make up for their losses.

As Munger put it:

“We understood more and more of the bad things that could happen… and we avoided them even more – like when we were old than we did when we were young. And it all worked.”

As research by Hendrik Bessembinder highlighted, over a long enough time frame, most stocks perform poorly, underperforming US treasuries. However, “the top-performing 2.4% of firms account for all of the $US 75.7 trillion in net global stock market wealth creation during the thirty-year period. [the period between 1990 and 2020]“

The takeaway? Focus on long-term outcomes rather than short-term setbacks.

Lesson 3: Trust the Process

Federer emphasized the value of discipline, patience, and embracing the grind:

"In tennis, like in life, discipline is also a talent, and so is patience. Trusting yourself is a talent. Embracing the process. Loving the process is a talent."

For investors, this translates to developing and sticking to a well-defined investment process. A solid process involves setting clear goals, conducting thorough research, and adhering to a checklist or strategy—even during volatile markets.

Developing this discipline during calmer periods can prepare investors for emotionally charged moments. With a system in place, they can make decisions based on logic, not panic.

Lesson 4: Success Requires Hard Work and Persistence

One of Federer’s most powerful lines debunks the myth of effortless success:

"The truth is I had to work very hard to make it look easy."

This applies directly to investing. The world’s top investors—Buffett, Druckenmiller, Terry Smith, Nick Sleep—make it seem effortless. But behind the scenes, their success is built on rigorous analysis, continuous learning, and overcoming human biases.

Investors who commit to diligent research and a constant improvement of their strategies can achieve long-term outperformance. Like Federer’s preparation for matches, the effort put into building a strong investment process may not be visible, but it’s what drives results.

Lesson 5: Value Your Team

Federer highlighted the importance of teamwork in his success:

"It’s not an accident that my business partnership with Tony is called TEAM8 – a play on words, 'teammate'."

While investing might seem like a solo endeavor, having a team—or at least intellectual sparring partners—can be invaluable. A trusted network of mentors, advisors, or peers provides diverse perspectives, helps avoid pitfalls, and sharpens decision-making.

As Frederik Gieschen (@neckarvalue) reminds us:

“You should ask yourself who you’d want to spend the last day of your life with, and then figure out how to meet them, like tomorrow.”

(Source: How to Find a Partner like Charlie Munger)

Building a network of like-minded investors or mentors creates opportunities for collaboration, idea-sharing, and mutual growth. Even in investing, you don’t have to do it alone.

Final Thoughts

Roger Federer’s insights from the tennis court resonate far beyond sports. By managing emotions, staying focused on the big picture, trusting the process, committing to hard work, and valuing teamwork, investors can sharpen their skills and achieve greater success.

The next time you’re faced with a tough decision or a setback, remember Federer’s words:

"Tennis, like life, is a team sport. Yes, you stand alone on your side of the net, but your success depends on your team, your coaches, your teammates, even your rivals."

These timeless lessons prove that the strategies for winning on the court can also help you win in the markets.