Deep Dive: 26 Stock Ideas for 2026

Where expectations are low and outcomes don’t have to be perfect – a global mix across sectors, sizes, and narratives

Every year, a handful of institutions publish their “stocks to buy” lists. Barron’s has its “Stocks to Buy for 2026,” Boyar sells its “Forgotten Forty” report, the Wall Street Journal runs similar roundups, Morningstar puts out conviction lists, and many large banks and brokers follow with their own versions.

These lists (with the exception of Boyar’s reports) provide some entertainment value, but they also tend to look very similar. The same mega-cap U.S. names everyone knows already show up again and again – does anyone really need Barron’s to pitch Amazon? –, often companies that most investors already own, already know well, and already have priced into their expectations.

In my view that does limit the incremental value of reading yet another list that mostly rehashes the S&P 500 with a fresh coat of paint.

Hence, this list is deliberately different. My goal here is not to predict which household names will do “fine” over the next twelve months – predicting 12-month performance is inherently difficult. It’s to build a global idea pool that increases your surface area for opportunity. Opportunities for those with a 12-36 month investing horizon.

That means going where many of the big lists don’t:

outside the U.S. index core,

across smaller market caps,

into unloved or misunderstood situations,

into businesses where the narrative has broken, the stock chart looks broken, but the economics may not have.

If this list does its job, you won’t agree with everything in it. You don’t need to. You only need to find one idea that you may then research further and eventually buy (and then hopefully earn a good multi-year return on), and then this post did its job well and provided value. If you come away from this post with just one idea that’s worth deeper work and an eventual investment, the value can be tremendous. That’s how investing actually compounds – not by owning everything, but by occasionally finding something that really matters and drives portfolio returns.

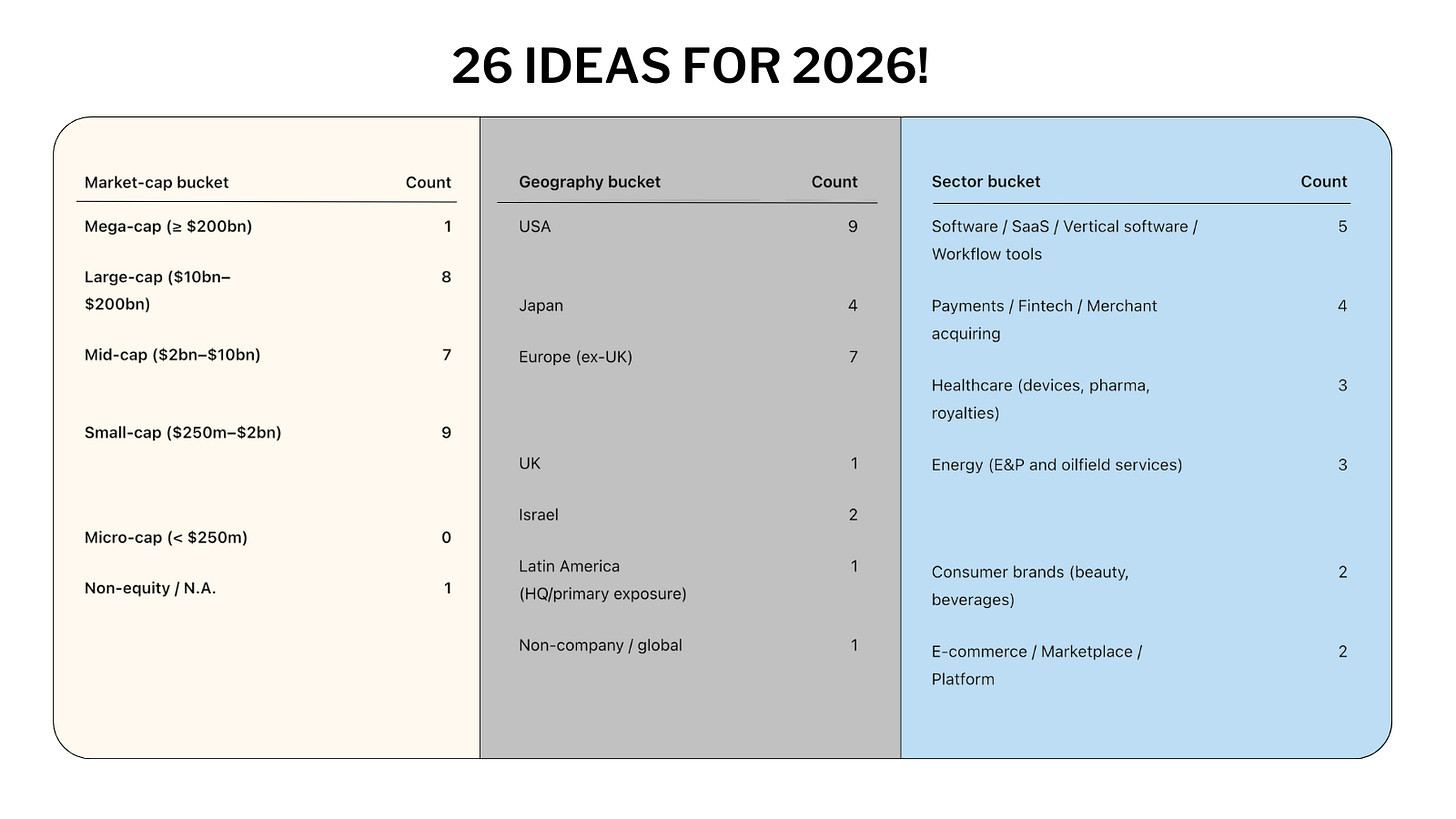

To make that tangible, here’s the breadth this list covers:

Geography: U.S. (9), Europe ex-UK (7), Japan (4), Israel (2), UK (1), Latin America (1)

Sectors: software and SaaS (5), payments and fintech (4), healthcare (3), energy (3), consumer brands (2), e-commerce and marketplaces (2), plus a mix of travel tech, chemicals distribution, food DTC, luxury goods, media

Market-cap range: mega-cap (1), large-cap (8), mid-cap (7), small-cap (8), micro-cap (1), non-equity (1)

One important rule shaped this entire exercise: none of these are stocks I currently own. I strongly believe that your core holdings should always be top of mind when thinking about opportunity cost, and investors generally underestimate how powerful that concept really is. Every new idea competes not just with cash, but with the best ideas already in your portfolio. By excluding my own positions, I forced myself to think more clearly about incremental opportunity rather than confirmation.

I’ll also be honest about expectations. There are almost certainly not 26 truly great ideas at any given moment. I disdain the title Barron’s chose for their idea list (“Stocks to Buy for 2026: Amazon, Visa, and More“) and deliberately went with a different title, stressing the idea part.

Markets don’t work that way. But I do believe every company on this list has a reasonable – and in some cases very likely – shot at outperforming the market in 2026. Think of this less as a “buy everything” list and more as a curated hunting ground. Most of these stocks are unloved, misunderstood, or simply ignored right now – 25 of the 26 names covered underperformed the S&P over the last five years. That’s usually a prerequisite for interesting outcomes.

For each company, I provide a concise overview of the business, what I think constitutes its competitive advantage, relevant charts (around 100 in total), linked resources, and a snapshot of valuation to frame expectations. I’ve also leveraged my network and talked to a lot of investors I’m friends with to get up-to-speed with the core theses. Overall, I ended up putting together 23,000 words.

For context, institutional-style research reports often run into the thousands of dollars – I don’t want to point out specific reports here, but I do know that some of them cost up to $4,999. I’m obviously not trying to replicate that format or audience, and I do believe these institutions provide a lot of value, too, BUT I do want to stress that you get access to my analysis and ideas (plus everything else I covered on this blog in the past) for a fraction of that.

But then again, nothing here is a pitch (read the disclaimer). The list is an invitation to think, to study, and to weigh opportunity cost a little more deliberately.

PS: This was a massive effort, and if you want to support me, sharing this post with others goes a long way – thank you!

Disclaimer:

The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also, double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

1) Azelis Group (AZE BB)

Industry: Specialty chemicals distribution

Headquartered in: Antwerp, Belgium

Market cap: ~€2.2B

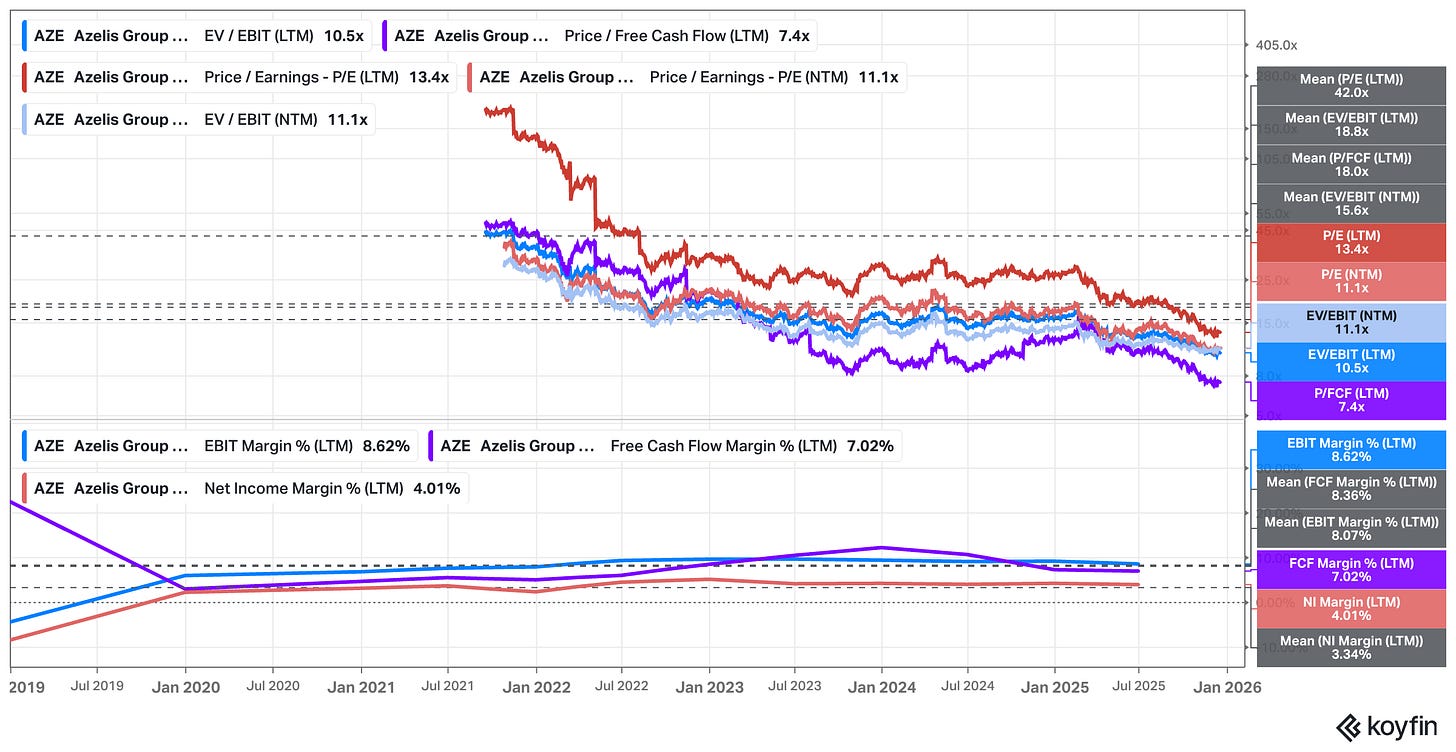

NTM P/E: 11.1x

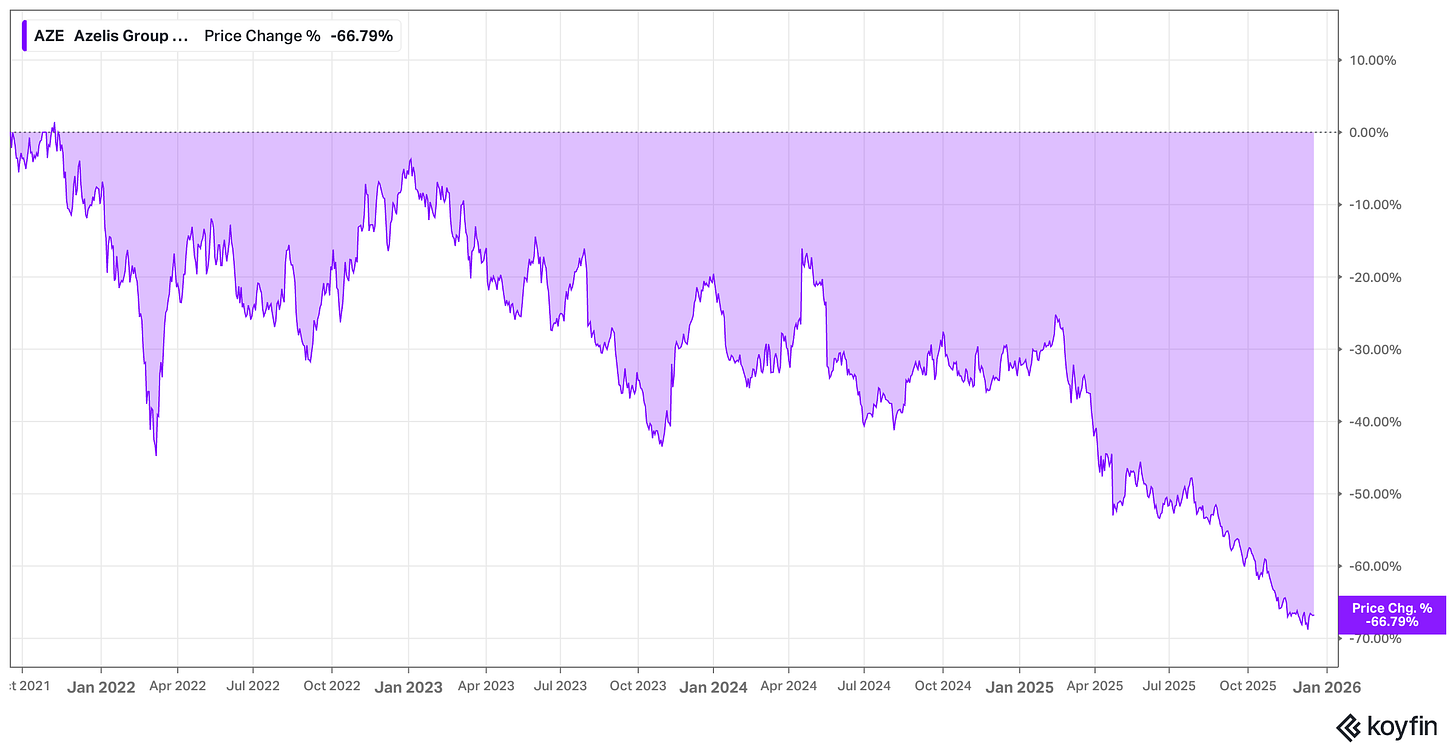

YTD performance: ~–51%

5Y performance: ~-67%

Azelis is a business that won’t excite most investors on first glance, yet it sits at the center of thousands of industrial and consumer formulations worldwide.

With a market cap of roughly €2.2 billion, Azelis operates as a value-added distributor of specialty chemicals and food ingredients, connecting global producers with local customers across life sciences, industrial chemicals, and consumer applications.

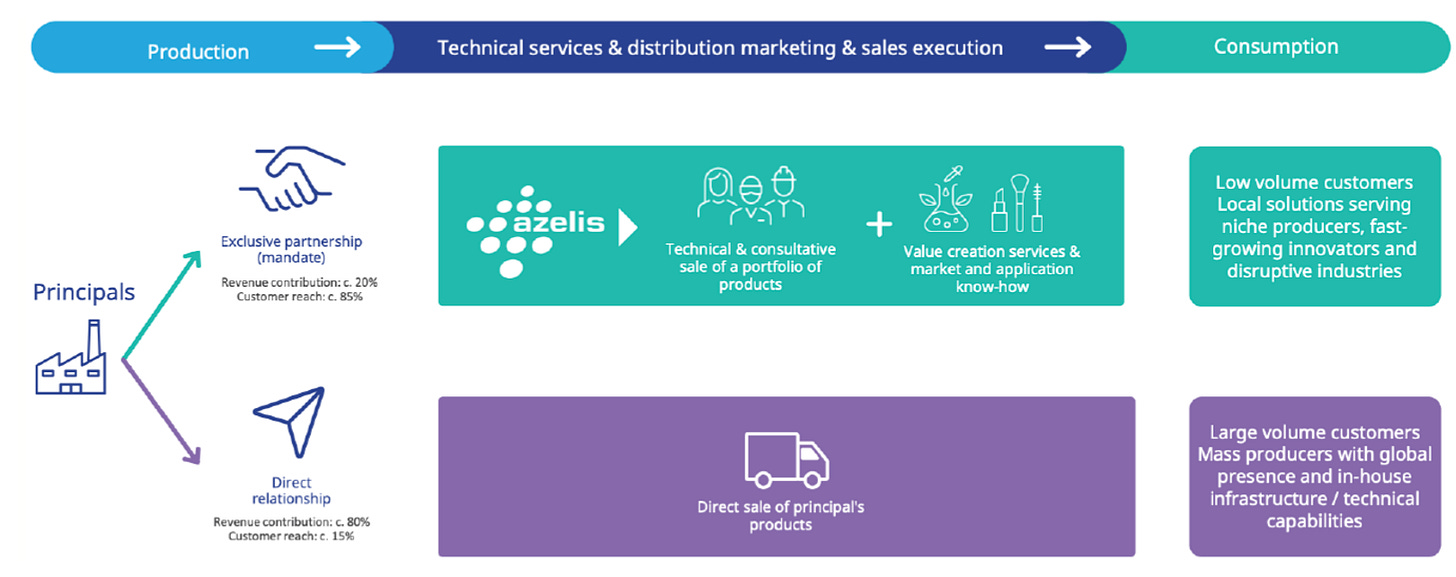

At its core, Azelis is not only a distributor but also a services company embedded in the specialty chemicals value chain. It sources highly specific ingredients from producers such as BASF, DSM-Firmenich, or Croda and combines them with formulation expertise, regulatory know-how, and local market presence to serve tens of thousands of small and mid-sized customers. These customers typically lack the scale or in-house expertise to manage complex chemical inputs themselves. Azelis is thus mission-critical for many of its clients.

What makes this model durable is the structure of the specialty chemicals market itself. Unlike standard chemicals where price competition dominates, specialty chemicals are more differentiated, value-based products. Azelis exemplifies this through its 'Life Sciences' and 'Industrial Chemicals' segments; for instance, providing precision enzymes that maintain the freshness of baked goods or high-performance additives for aerospace coatings. In these cases, the chemical cost is marginal, but its role in ensuring product safety and quality is mission-critical. They typically represent a low-cost, high-consequence component, often accounting for only a small fraction of a customer’s total cost base while having an outsized impact on the final product’s performance and integrity. Because the cost of the chemical is negligible compared to the risk of system failure or brand damage, customers exhibit high loyalty and price insensitivity. This creates significant switching costs and 'sticky' revenue streams, as the incentive to swap a proven formulation for a cheaper, unverified alternative is outweighed by the potential for catastrophic loss in yield or quality.

Switching costs are therefore real. Azelis often operates under exclusive distribution agreements, meaning it is the only distributor allowed to sell a given product in a specific region. In practice, that gives the company quasi-monopolistic positions at the product–region level. Supplier relationships tend to last decades, customer relationships are sticky, and pricing power is far stronger than the term “distribution” would suggest.

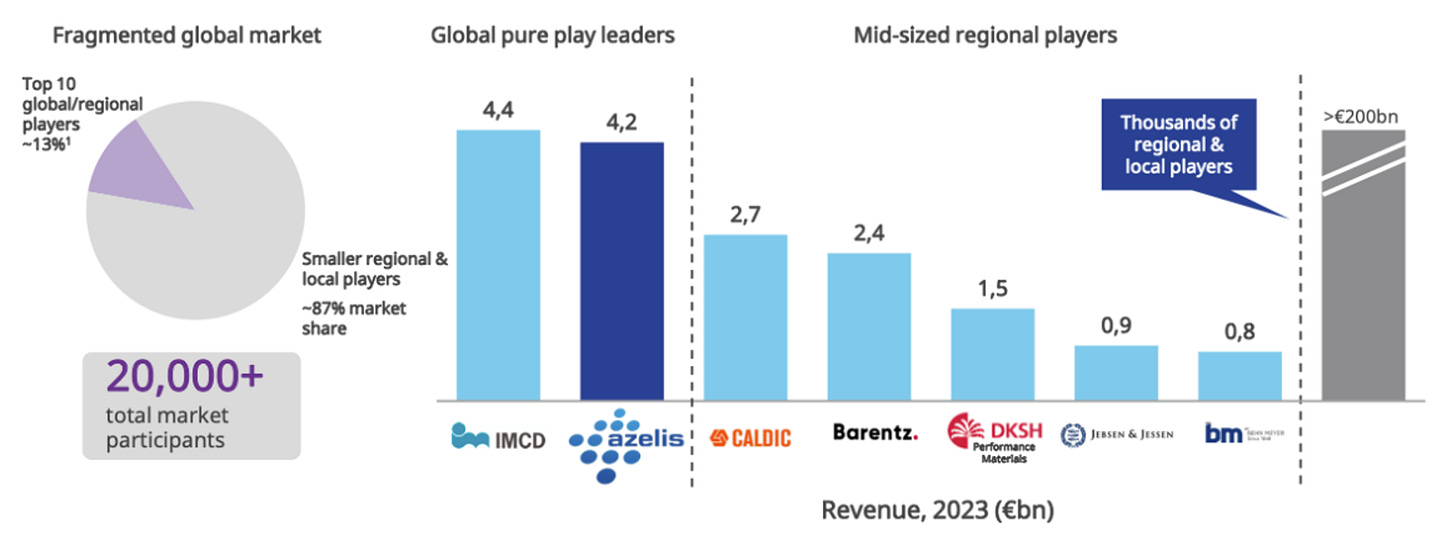

Competition exists, but it remains muted and, crucially, rational. While large full-line distributors operate globally, Azelis and IMCD stand alone as the only truly global pure-play specialty peers. This unique positioning allows them to avoid the hyper-commoditized price wars of the broader market. Furthermore, the vast fragmentation of the industry ensures a disciplined M&A environment; the large players can actively avoid bidding wars, instead focusing on acquiring small, high-quality local distributors at attractive valuations to expand their technical footprint.

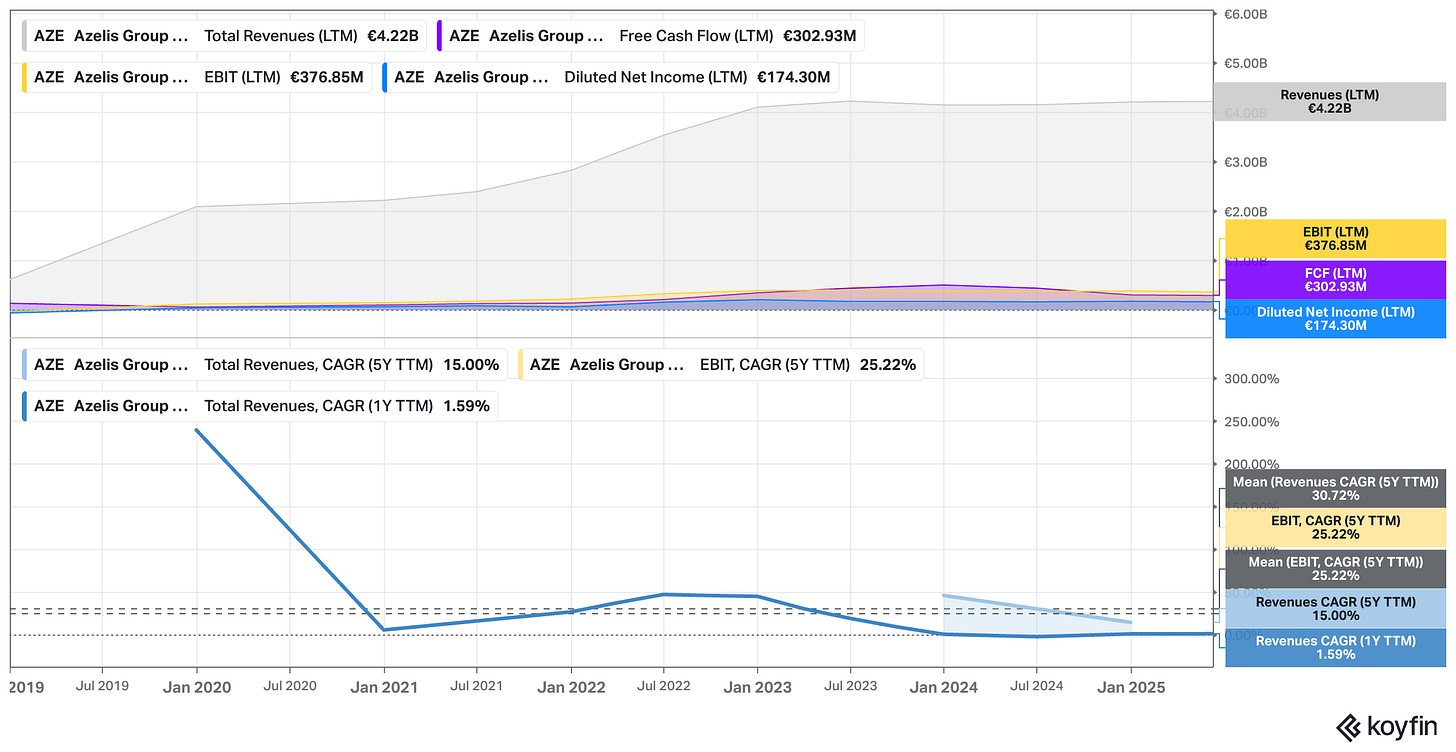

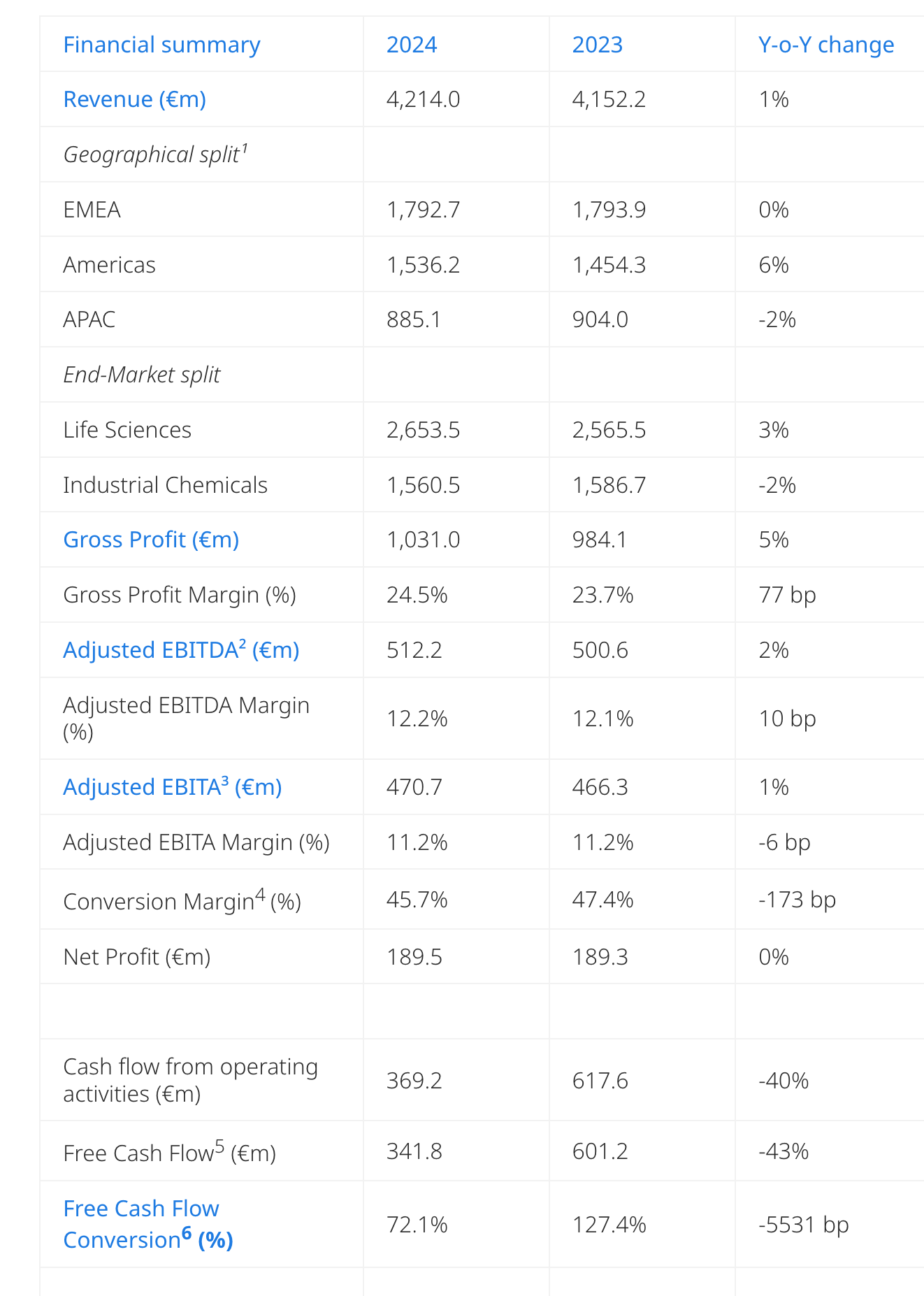

The stock has had a difficult year, down around 50% year-to-date, largely reflecting a combination of post-pandemic destocking, softer end-market demand, and a general derating of distribution models that benefited disproportionately from inflation and supply chain disruptions in prior years. At today’s price, the market seems to be extrapolating a subdued earnings environment well into the future.

The long-term growth story rests on fragmentation and consolidation. The global specialty chemicals distribution market remains extremely fragmented, with the top ten players accounting for only a low-teens percentage of total market share.

Regulatory complexity, sustainability requirements, and digitalization are steadily raising the bar for smaller local distributors, many of which simply cannot keep up. This creates a steady pipeline of acquisition opportunities for Azelis, which has built a disciplined, repeatable M&A playbook supported by a unified global ERP system. It allows Azelis to integrate acquisitions quickly, expand product breadth, cross-sell more effectively, and reinvest capital at attractive returns. Over time, scale begets scale, and the competitive advantage quietly compounds.

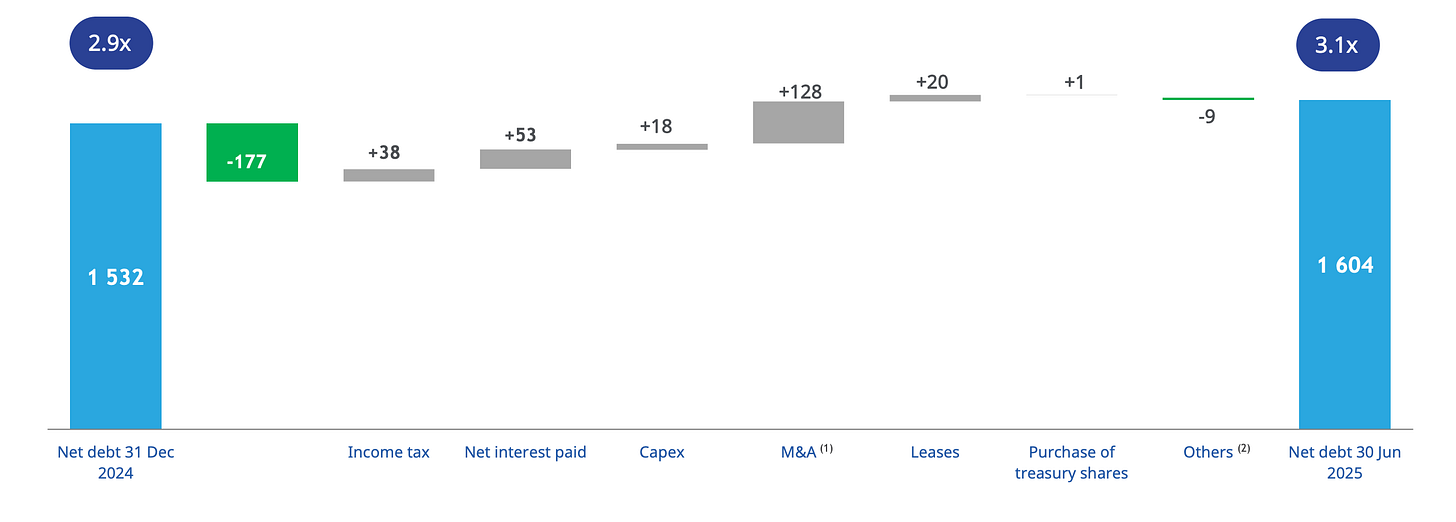

Leverage, while not low and trending higher in recent years, looks manageable given the stability of cash flows, and while acquisition activity may slow temporarily as a result of the current debt load – while IMCD with less debt can still deploy cash –, the long-term runway remains intact.

Recent results look weaker than the underlying business reality. After exceptionally strong organic growth in 2021 and 2022, the company is now cycling back toward its historical organic growth rate of roughly 5–6%. Margins have dipped modestly, sentiment toward the chemicals sector is poor, and the stock has corrected sharply from post-IPO levels (Azelis went public in 2021). On top of that, EQT remains a large shareholder (around 10% after the November announcements; see below) that continues to sell down its position, creating a persistent overhang that continues to weigh on valuation.

“Akita I S. à r. L., an entity indirectly controlled by an affiliate of the funds called EQT VIII (”EQT”) is pleased to announce it has signed a definitive agreement to sell c. 44 million shares in Azelis Group NV (EBR:AZE) (the “Company”) […]. Following the Sale, EQT will hold a c.10% ownership stake in the Company and the remaining stake is subject to customary lock-up terms for 90 days.“ - EQT

The market seems far more focused on these short-term pressures than on the structural quality of the business.

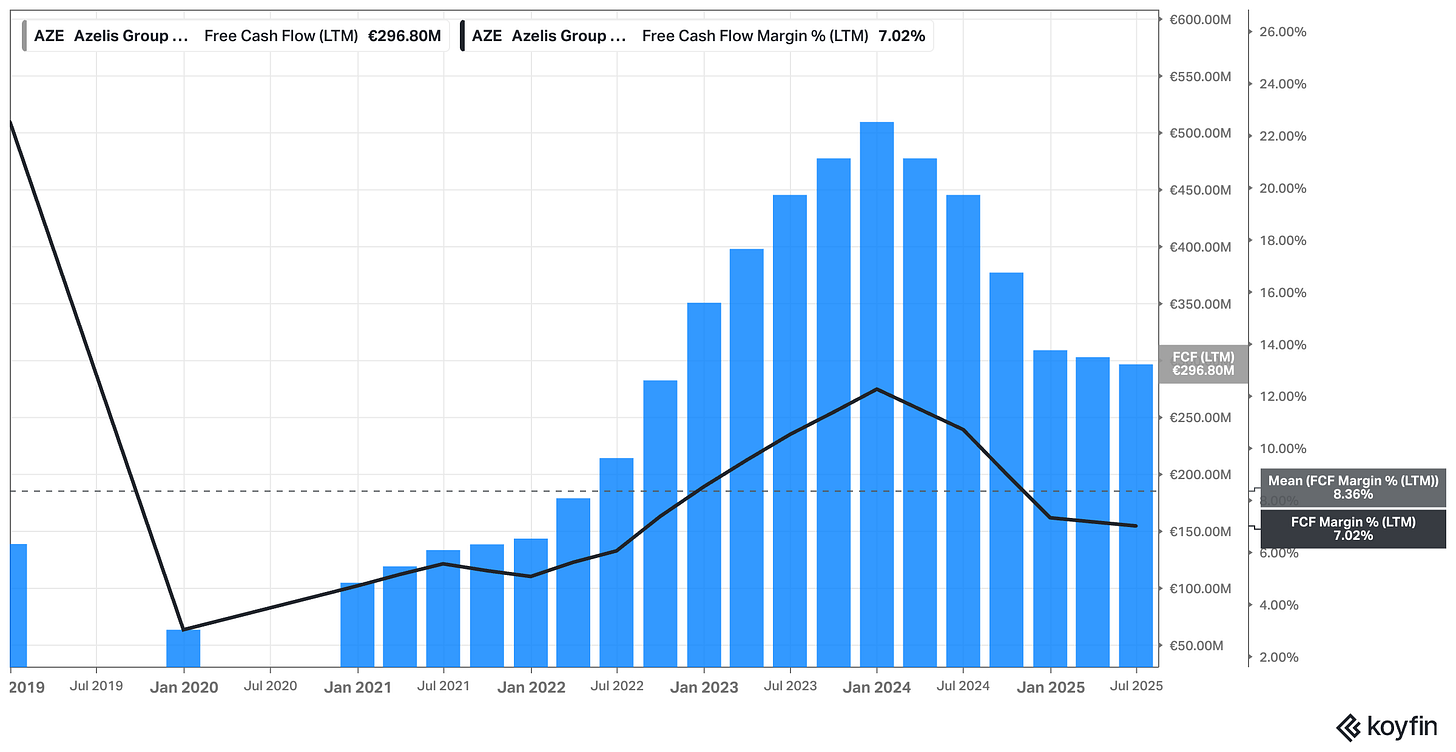

At today’s valuation, that disconnect may be the opportunity. Azelis trades at 6.4x FCF reported by the company (3x 2023 FCF) on a market cap basis, and an EV/FCF yield of 9.4% (15% on 2023 FCF figures, which to be fair are probably representing a cyclical peak). So Azelis trades at a level that implies very little confidence in its ability to compound, despite a business model that has proven resilient across cycles, is capex-light, and converts earnings into cash at a solid rate (72% in FY24).

For patient investors willing to look through near-term noise, Azelis could offer exposure to an exceptional model in a deeply unglamorous corner of the market.

The full analysis starts here:

The rest of this post covers 25 more stock ideas for 2026, covered in roughly 23,000 words – lots of ideas, insights, charts, resources, etc. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more) and powerful investing frameworks. is just a click away. Upgrade your subscription, support my work, and keep learning.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.