Deep Dive: 22 Stock Ideas Too Interesting to Ignore!

A Growing List of Handpicked Companies to Watch

Ideas always seem to arrive faster than I can process them. Some land on my desk through conversations with investing friends, others through obscure filings, podcasts, or the odd research note that sends me down a rabbit hole.

I maintain a note with Substack post ideas: stocks I’d like to analyze, frameworks I’d like to write about, mental models that deserve your attention, valuation approaches that need to be stress-tested, even macro observations or interview notes that could each become their own standalone post. But over the last few months, I noticed that my list of stocks I want to research – and maybe write a deep dive on – has become unmanageably long. The backlog is overflowing, and as much as I’d like to turn every spark into a full-length deep dive, there are only so many hours in the day.

If you’ve read some of my deep dives before, you know how much time and energy goes into them. They’re detailed, often multi-thousand-word explorations, and for good reason – that’s the level of research required to properly understand a business (and then build conviction in the thesis).

But I’ve been toying with a lighter format as well: shorter “shallow dives” (maybe 3,000 words long) that surface an idea, sketch out what the business does, briefly touch on valuation, and outline why it might be interesting – all without pretending the work is finished. Think of them as radar pings. They won’t replace the deep dives, but they could add a useful layer: a way to get names in front of you sooner, before I’ve spent weeks or months turning over every stone. I’d love to know what you think of this idea.

In a way, in an even more stripped-down way, that’s what I’m doing in this post too. I’ve pulled together a collection of companies that I find interesting and may to explore further. Some are well-known, most of them are far more obscure, but all of them strike me as worth at least a closer look.

In this post, you’ll find a short description of each, ordered alphabetically, with ticker symbols included as well as a Koyfin overview screenshot so you can dig in yourself if you’d like. Consider it a menu of sorts – and if you have research, writeups, podcasts, or videos on any of these, I’d love to see them (!), so make sure to share them in the comments section.

This is an experiment, and I’m curious what you think of it. Does a collection of “early-stage” ideas like this add value for you as a reader? Or would you rather I keep my powder dry until a company is fully baked into a deep dive? My hunch is that many of you, like me, enjoy tracing ideas in their earlier, less-polished state. And with that, let’s get into the list.

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

22 Stock Ideas I Can’t Stop Thinking About (But Haven’t Researched Yet)

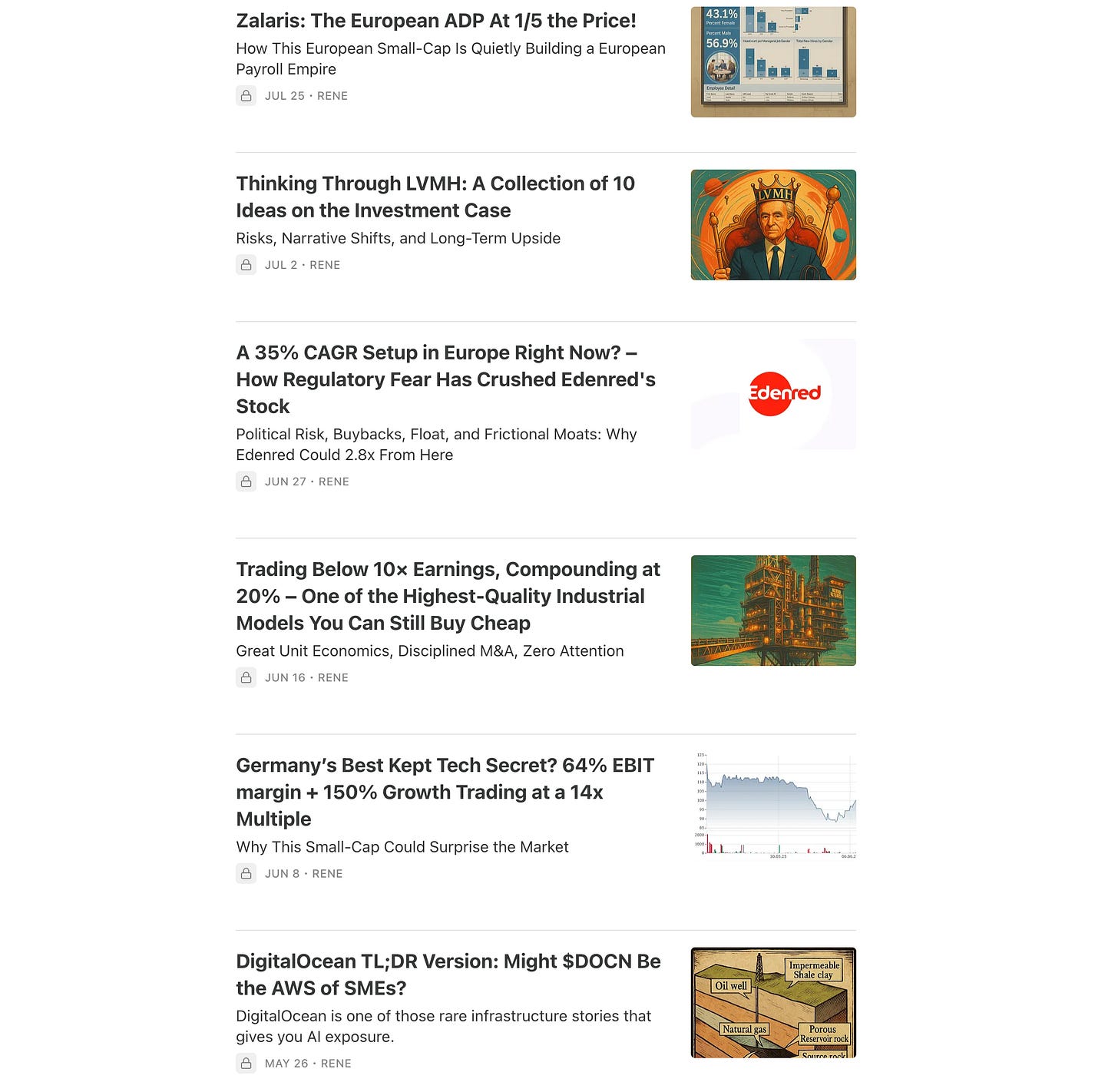

AeroEdge (TYO:7408)

AeroEdge is a Japanese aerospace supplier specializing in precision-machined titanium components, most notably compressor blades used in aircraft engines. The company has carved out a niche as one of only a handful of global suppliers with the technology and quality standards required by leading engine manufacturers. Its fortunes are closely tied to long-cycle aerospace demand – especially as the global fleet transitions to more fuel-efficient engines that use lighter titanium parts. The business benefits from recurring aftermarket demand as blades wear out and are swapped– a classic razor-and-blades dynamic – once its parts are in service, but it also carries the risks that come with customer concentration and exposure to cyclical aircraft production.

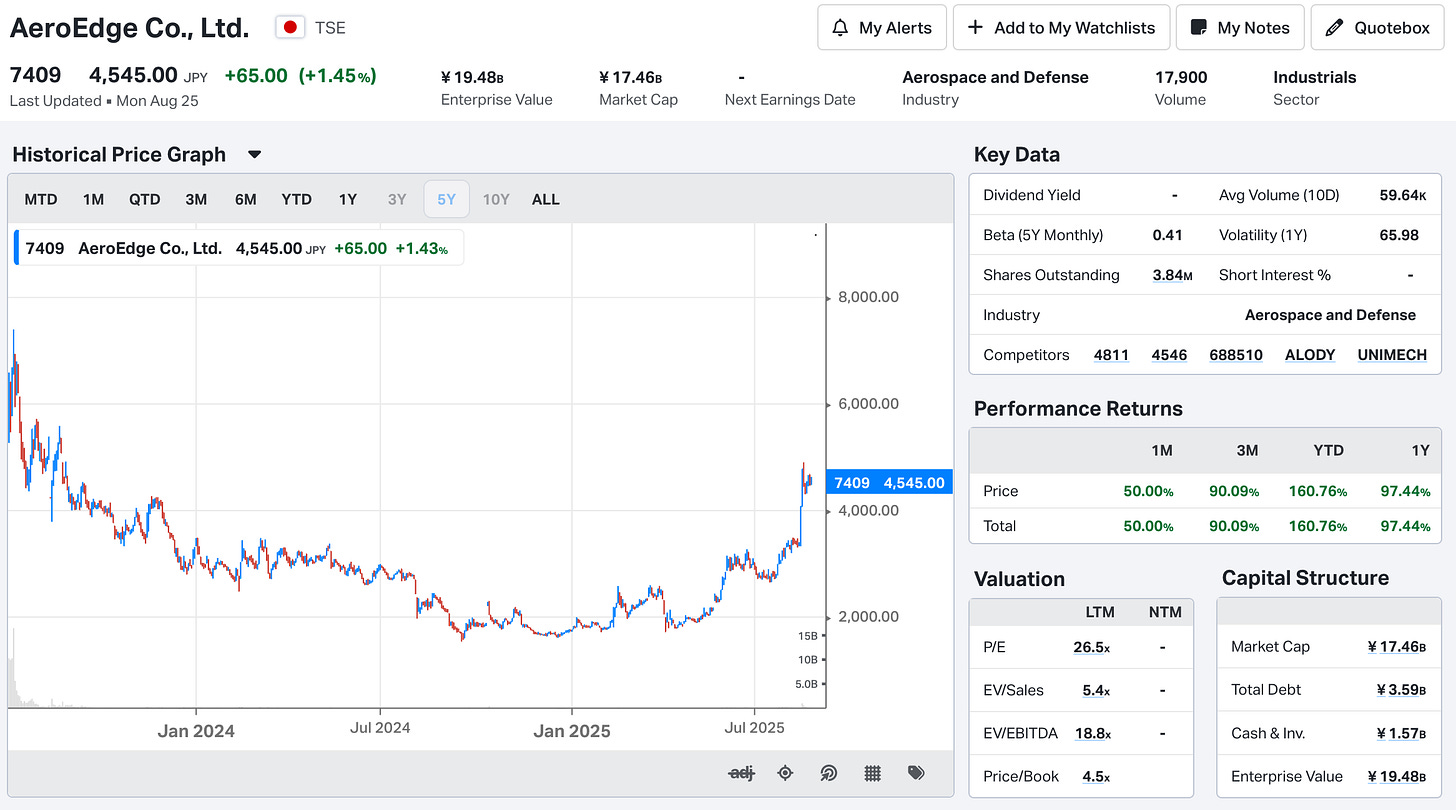

ALK-Abelló A/S (CPH:ALK-B)

Headquartered in Denmark, ALK-Abelló develops and markets allergy immunotherapy products aimed at treating the root causes of allergic diseases rather than just the symptoms. Its portfolio includes tablet-based treatments for common allergens like grass, ragweed, tree pollen, and house dust mites, alongside traditional injections and drops. The company operates in a niche but steadily expanding segment of healthcare, supported by rising allergy prevalence globally and the growing acceptance of immunotherapy as a mainstream option. Investors often watch the scalability of its tablet platform, which could meaningfully improve margins over time compared to older delivery forms.

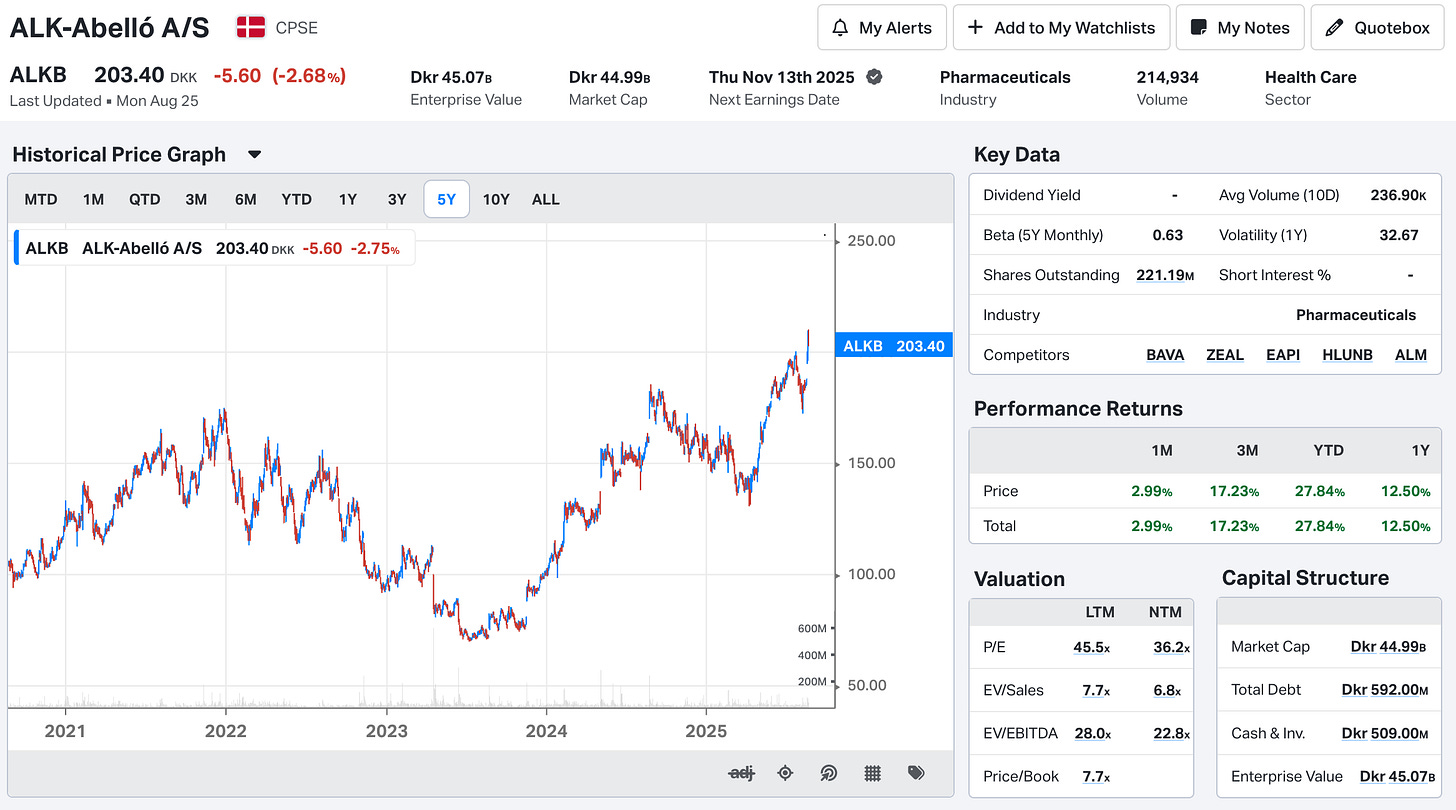

Altus Group (TSX:AIF)

Altus Group is a Canadian software and analytics company serving the commercial real estate industry. Its flagship platform, ARGUS, is widely used for asset and portfolio management, valuation, and risk analysis by institutional investors, asset managers, and appraisers. Beyond software, Altus also provides advisory services and data solutions that help real estate professionals make better capital allocation decisions. The investment case often revolves around its ability to transition more of its business toward recurring, subscription-based revenue and to embed itself deeper in clients’ workflows as real estate markets become increasingly data-driven.

The full story starts here:

The rest of this post covers the remaining 19 ideas. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks) is just a click away. Upgrade your subscription, support my work, and keep learning.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.