Chris Mayer, the mind behind 100 Baggers, shared the secrets to long-term investing success in a recent interview with Quartr.

Here are 10 timeless lessons every investor needs to know!

1. Start small, think long-term

Chris Mayer highlights the power of compounding over time. To achieve a 100-bagger:

Look for businesses with high returns on capital.

Ensure they can reinvest profits effectively for growth.

He explained, "If you start with $10,000 and earn 20% on that in year 1, you have $2,000 in profit. Reinvest it, and after 25 years, you have your 100-bagger."

The formula is simple, but it takes decades of patience.

2. Founder-led companies outperform

Founder-led businesses often thrive because founders are driven by passion and vision, not quarterly earnings. They’re willing to make long-term bets.

Mayer notes: "Founders tend to think long-term and are opportunistic, whereas hired hands often fall for the quarterly earnings game."

He cites examples like Steve Jobs (Apple), Sam Walton (Walmart), and Charles Schwab. Founder involvement is a strong predictor of success.

3. Reinvestment > Dividends

One of the most underappreciated factors for long-term success is reinvestment. Companies that retain and reinvest profits compound wealth faster than those paying large dividends.

“If you are focusing on 100-baggers, then a dividend is, in the words of Thomas Phelps, ‘an expensive luxury.’ It’s a leak in your boat that slows the compounding process.”

Look for businesses that prioritize reinvestment to fuel future growth.

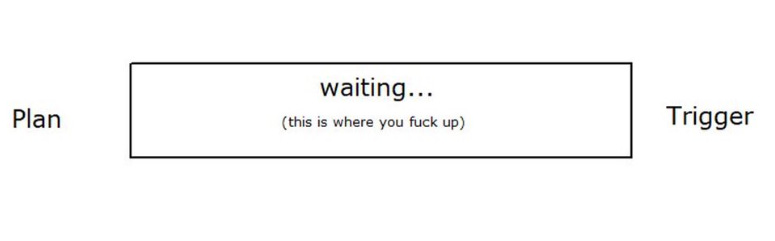

4. Noise is the enemy

One of the biggest mistakes investors make is getting distracted by irrelevant factors like interest rates, politics, or short-term market fluctuations.

Mayer avoids all financial news and economic forecasts. He emphasizes: “All these distractions will make it seem like something important is happening every day, when most of the time, the opposite is true.”

Focus instead on a company’s fundamentals and competitive advantage.

5. Holding beats flipping

Mayer’s biggest regret? Selling great businesses too soon in favor of chasing cheap stocks. His advice:

Hold great companies through thick and thin.

Resist the temptation to “trade up” for short-term gains.

“I wasted time flipping cheap stocks. I'd be richer if I’d held compounding machines like Mastercard, Visa, and Copart for decades.”

The longer you hold, the more compounding works in your favor.

6. Judging quality

Mayer starts with quantitative metrics like high ROIC and strong balance sheets. But he stresses that the qualitative factors—like leadership, culture, and competitive positioning—are what matter most over time.

“I don’t care how good the numbers are if the leadership and culture aren’t right.”

Numbers are just the starting point; the heart of a business lies in its people and vision.

7. Lessons from mistakes

Reflecting on his career, Mayer shares this hard-earned insight: “The power of leaving the stocks of good companies alone is one of the greatest lessons I’ve learned.”

During the 2008 crisis, he chased “net-nets” (stocks trading below liquidation value). But none lasted in his portfolio. He admits, “I’d have been better off just buying Visa and leaving it alone.”

8. His new investment

One example of a 100-bagger in the making? Computer Modelling Group, a Canadian software company. Why Mayer likes it:

High ROIC.

Strong management with “Constellation Software” DNA.

Big market opportunity and smart incentives.

He notes: “They have everything I look for—great incentives, a high-return business, and a valuation that’s a gift for long-term investors.”

9. A mental model for investing

Mayer’s book How Do You Know? applies Alfred Korzybski’s idea that “the map is not the territory.” He warns against labels like “small cap” or “value stock,” which can limit your thinking.

“Market caps and terms like ‘growth stock’ are irrelevant to the art of investing. Focus on the engines of compounding, not categories.”

Forget the labels and focus on business fundamentals.

10. Final advice for investors

To identify long-term winners, Mayer suggests studying great businesses. Learn what makes them tick and look for younger versions of those companies.

“Investing is nuanced—it’s not a checklist of five bullet points. But if you study great businesses deeply, you’ll start to see the patterns that lead to success.”

Patience and persistence are the ultimate superpowers for investors.

TL;DR

Chris Mayer’s philosophy boils down to this: Find extraordinary businesses, focus on reinvestment, and hold through thick and thin. These are the traits of 100-baggers.

Which of these lessons resonated with you most? Let me know below! 👇